Dow Jones Industrial Average continues to chalk in new records highs despite thin momentum

- The Dow Jones rose into yet another record high, but bidders remain unconfident.

- Consumer confidence surveys show US spenders still fear higher inflation.

- Fedspeak deviations continue, but rate markets price in higher odds of another double cut.

The Dow Jones Industrial Average (DJIA) ground its way into another record bid on Tuesday, but price action remains tepid and intraday momentum is struggling to outpace the 42,000 level. The CB Consumer Confidence Index for September dropped to the bottom end of a familiar two-year range, and Federal Reserve (Fed) Governor Michelle Bowman has leaned into her dissent of the Fed’s recent 50-bps rate cut.

Consumer confidence deteriorated across the board on Tuesday, and consumer expectations of 12-month inflation accelerated to 5.2%. Consumers also reported a general weakening of their six-month family financial situation outlook, and consumer assessments of overall business conditions have turned negative.

As explained by the Conference Board’s chief economist Dana Peterson, “Consumers’ assessments of current business conditions turned negative while views of the current labor market situation softened further. Consumers were also more pessimistic about future labor market conditions and less positive about future business conditions and future income.”

Fed Board of Governors member Michelle Bowman made waves last week as the sole dissenter to the Fed’s nearly unanimous decision to trim interest rates by an outsized 50 bps. Fed Governor Bowman advocated for a smaller 25 bps cut, citing ongoing concerns that the Fed may be moving prematurely before confirming that inflation will continue to ease toward the target 2% band.

While addressing a banking group in Kentucky, Fed Governor Bowman explained that the jumbo rate cut last week “could be interpreted as a premature declaration of victory on our price-stability mandate. Accomplishing our mission of returning to low and stable inflation at our 2 percent goal is necessary to foster a strong labor market and an economy that works for everyone in the longer term.”

Despite Fed Governor Bowman’s concerns, backsliding consumer confidence results sparked a renewed bid in rate markets for a follow-up jumbo cut in November. According to the CME’s FedWatch Tool, rate markets are pricing in nearly 60% odds of a second 50 bps rate cut on November 7, and only 40% odds of a more reasonable 25 bps follow-up rate trim. Rate traders were pricing in roughly even odds of a 50 or 25 bps rate cut at the beginning of the week.

Dow Jones news

Despite an upside tilt to rate cut expectations, a move that would typically see equities lurch into the bid side, the Dow Jones index is roughly on-balance on Tuesday, with around half of the index’s constituent securities trading into the red. Visa (V) is reportedly facing a potential antitrust lawsuit from the US Department of Justice, sending the payment card services company’s stock backsliding -4.5% to $275 per share.

On the high end, Caterpillar (CAT) soared nearly 4% on Tuesday, rising to a new all-time high of $388.44 per share as the construction and mining equipment manufacturer adds to its already-impressive 35% one-year gain in its share price. Despite single-digit declines in Caterpillar’s reported sales, profit margins have been increasing, and the company’s recently announced $20 billion share repurchase authorization is keeping investor confidence pinned to the ceiling.

Dow Jones price forecast

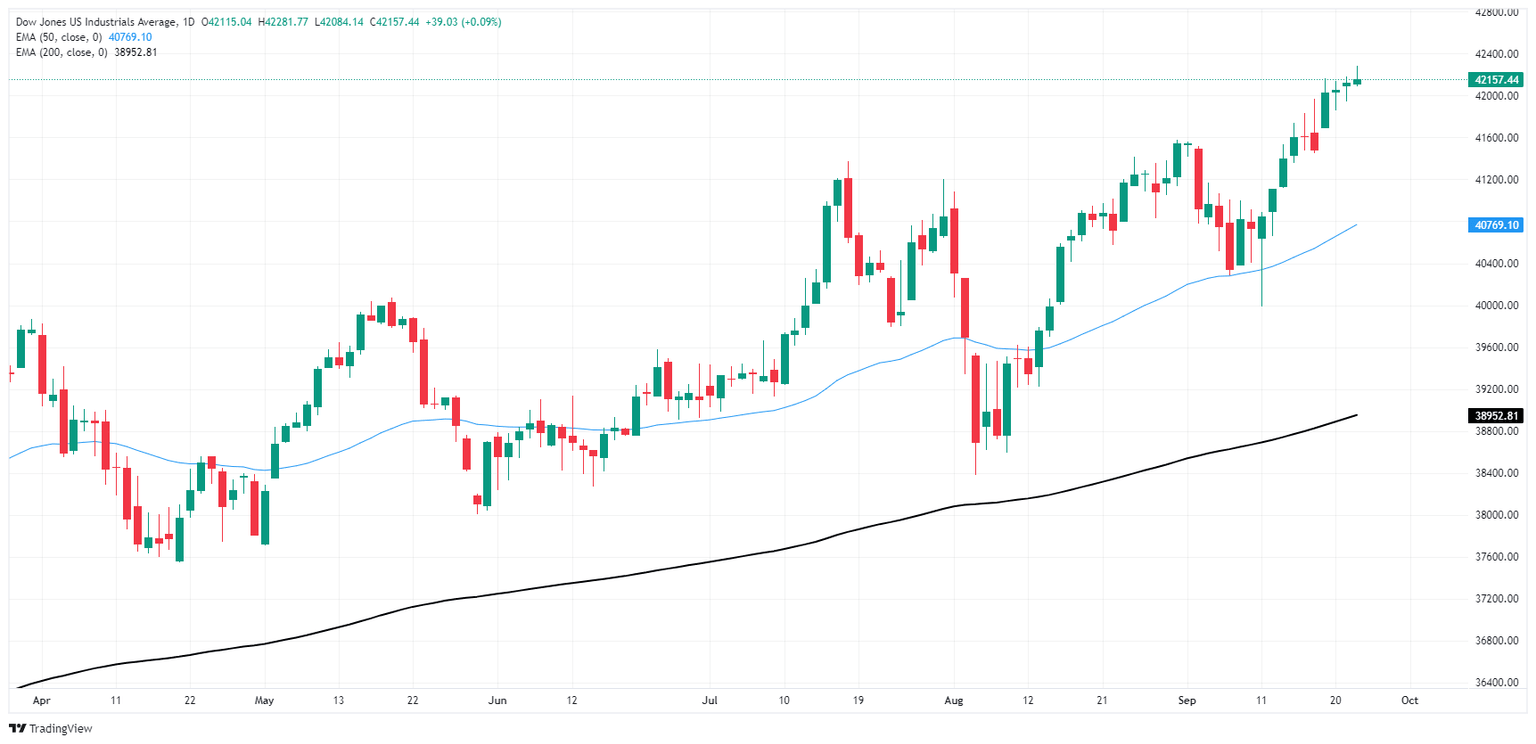

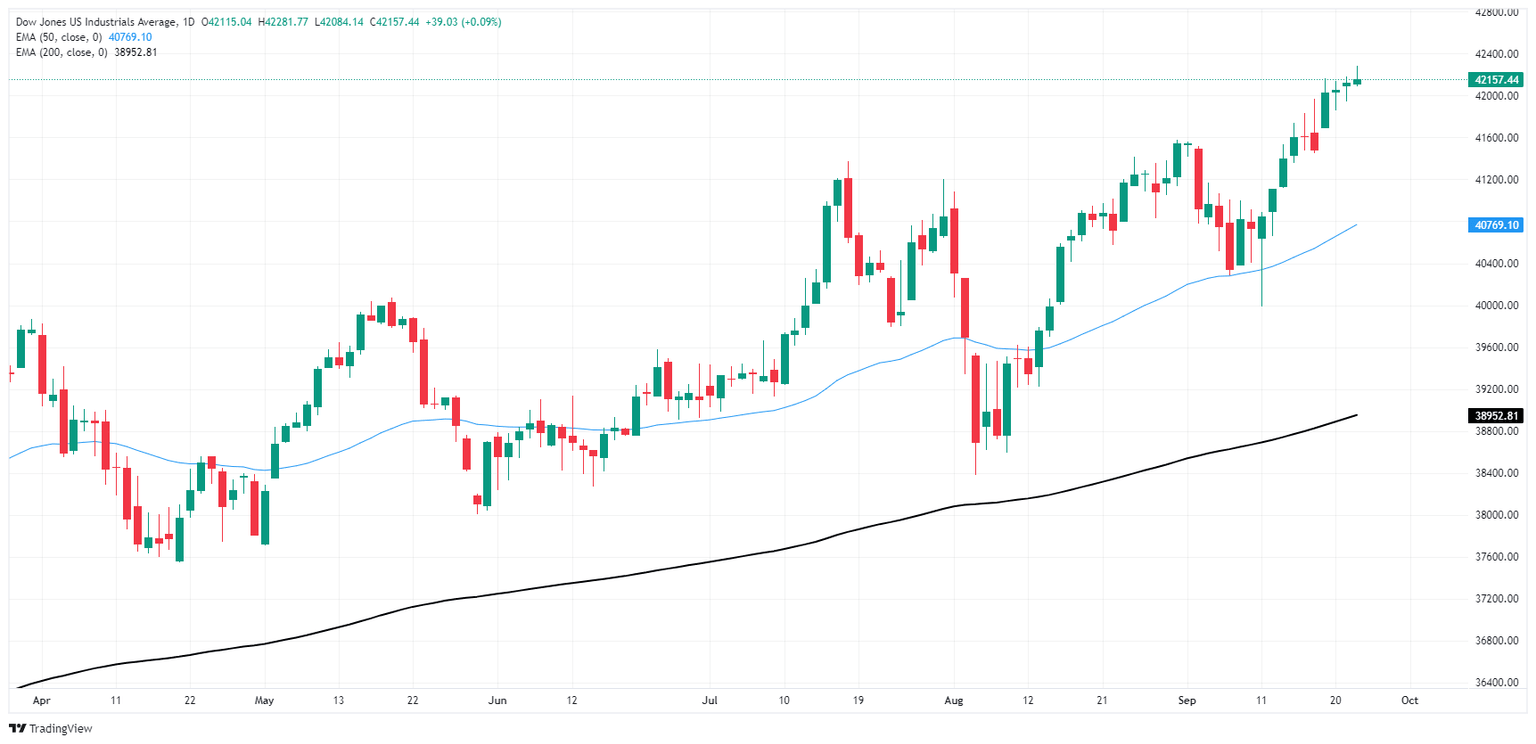

The Dow Jones has pierced into yet another record high on Tuesday as investors continue to bid up the major index, but intraday momentum remains tepid overall and bidders are struggling to hold onto near-term gains. Prices continues to grind back into familiar territory just north of the 42,000 handle.

The DJIA has climbed 5.73% from the last swing low into the 40,000 region, but a lopsided tilt into the bullish side has left price action with little technical footholds, and charts may be primed for a pullback to the 50-day Exponential Moving Average (EMA) near 40,770.

Dow Jones daily chart

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.