Dow Jones Industrial Average churns on middling Wednesday markets

- Dow Jones hung up on the 39,000.00 handle amid quiet midweek markets.

- Fedspeak continues to press down on rate cut hopes.

- Investors buckle down for the wait to key data on Thursday and Friday.

The Dow Jones Industrial Average (DJIA) is churning just above 39,000.00 in tepid Wednesday trading as markets hunker down for the wait to key data in the back half of the trading week. Federal Reserve (Fed) officials have repeatedly noted the need for patience on policy rates. The US central bank continues to look for firmer signs that inflation will continue easing to the Fed’s 2% annual target. A notable lack of economic slowdown and a still-tight labor market leaves the Fed with little need to rush into rate cuts. Several Fed officials have cautioned that there might be no rate cuts in 2024, while the Fed’s median dot plot of rate expectations suggests only a single quarter-point cut for the year.

A notable lack of data on Wednesday leaves investors to fidget in place and wait for a raft of key US datapoints slated for release on Thursday and Friday. US Durable Goods Orders, a revision to first-quarter US Gross Domestic Product (GDP), and Initial Jobless Claims are all due Thursday. Friday will round out the trading week with a fresh print of US Personal Consumption Expenditure Price Index (PCE) inflation figures for May.

Investors with hopes pinned on at least a quarter-point rate cut from the Fed in September will look for soft-but-not-too-soft US economic figures. Too good a print means the Fed will be even less likely to deliver an early rate trim, while too bad of a data calendar will mean the US is headed for a recession, leaving rate-cut-hungry markets to dream of a happy middle ground.

Dow Jones news

The Dow Jones is up a scant 30 points rounding the corner into the final stretch of Wednesday’s US market session. The major equity index is getting propped up by firm gains in market favorites, but most of the Dow Jones’ constituent securities are in the red on Wednesday, with two-thirds of the listed stocks softly in the red.

Amazon.com Inc. (AMZN) surged nearly 4.5% on Wednesday, approaching $195.00 per share, with Apple Inc. (AAPL) struggling to keep pace, rising 2.3% to $214.00 per share. On the downside, Amgen Inc. (AMGN) and Travelers Companies Inc. (TRV) are each down around 1.7% apiece, with Amgen falling below $315.00 per share and Travelers Companies falling to $205.00 per share.

Dow Jones technical outlook

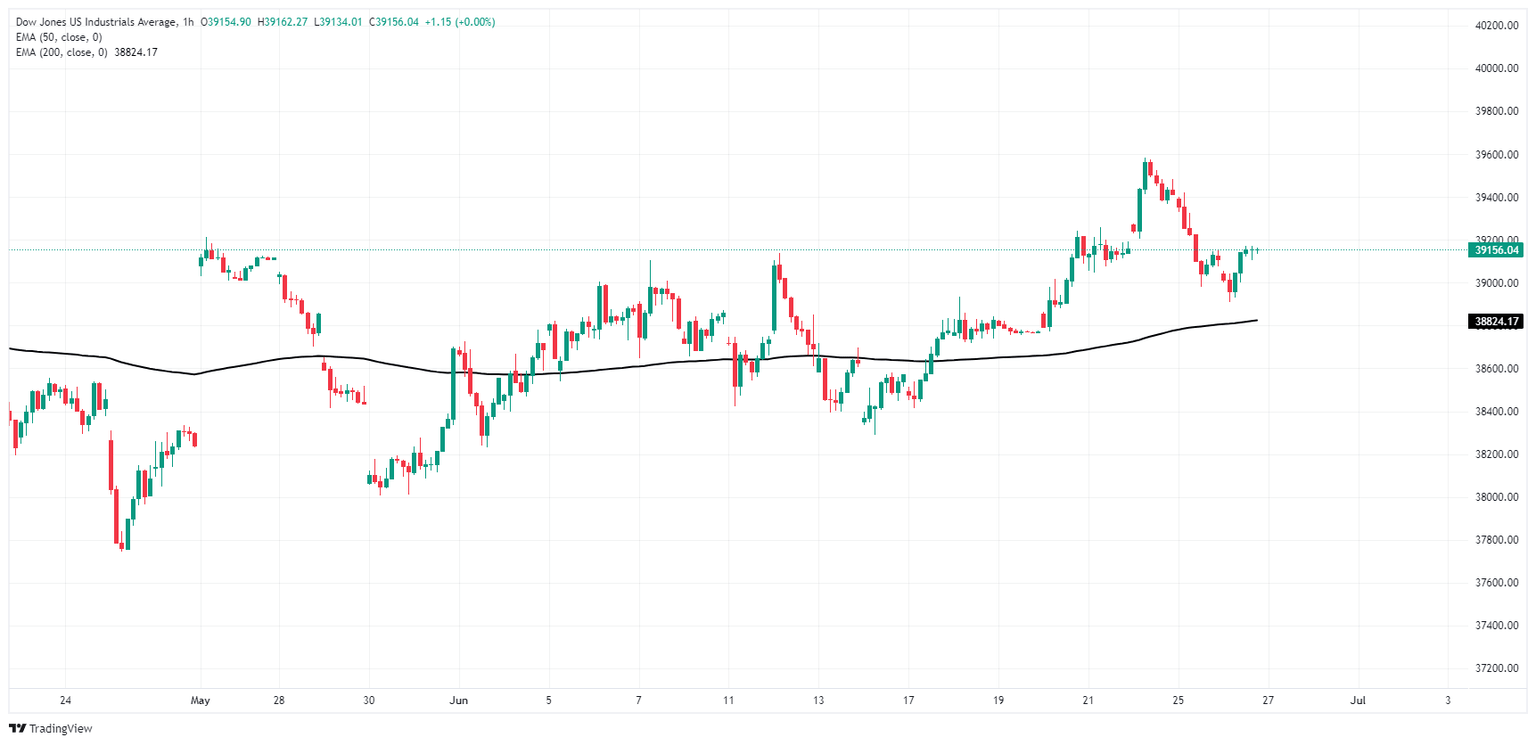

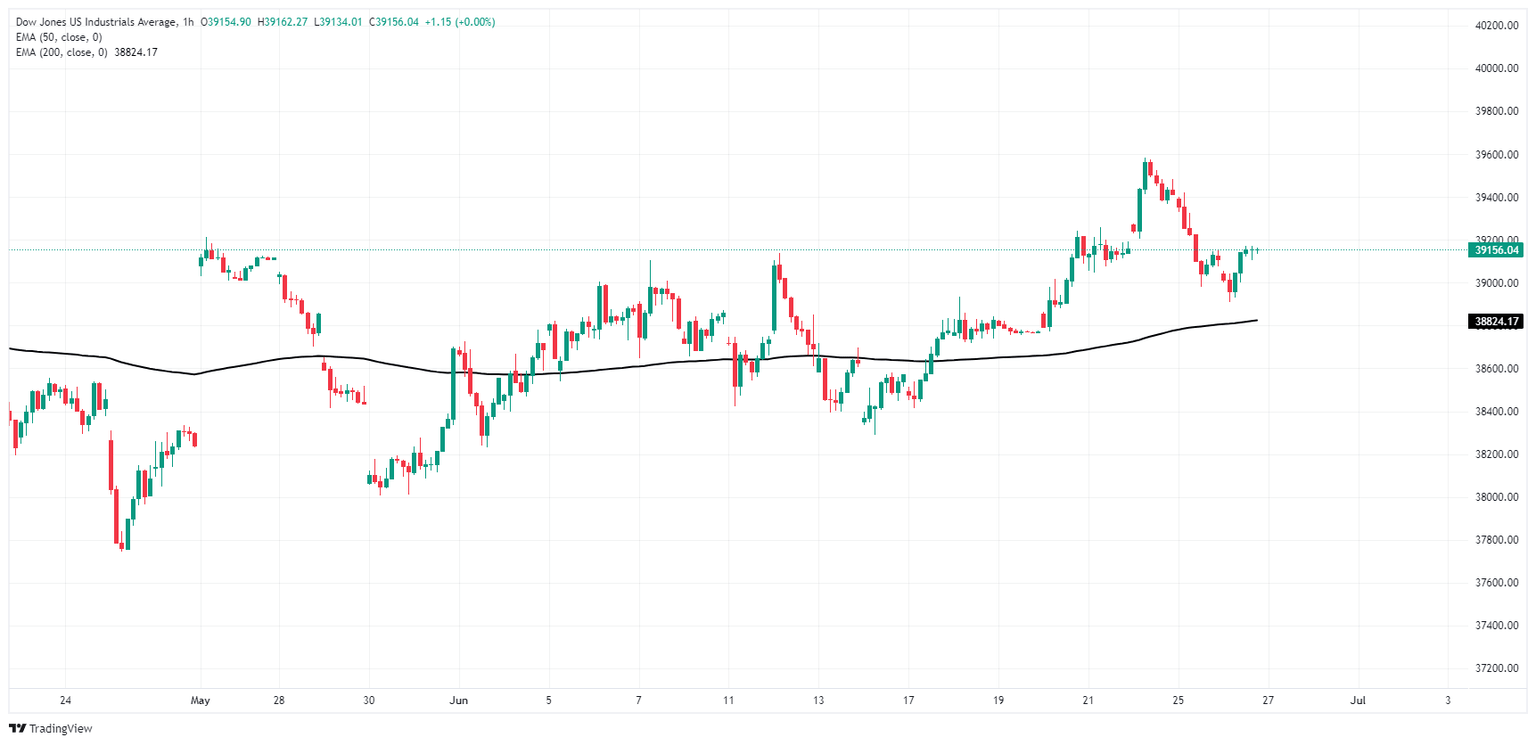

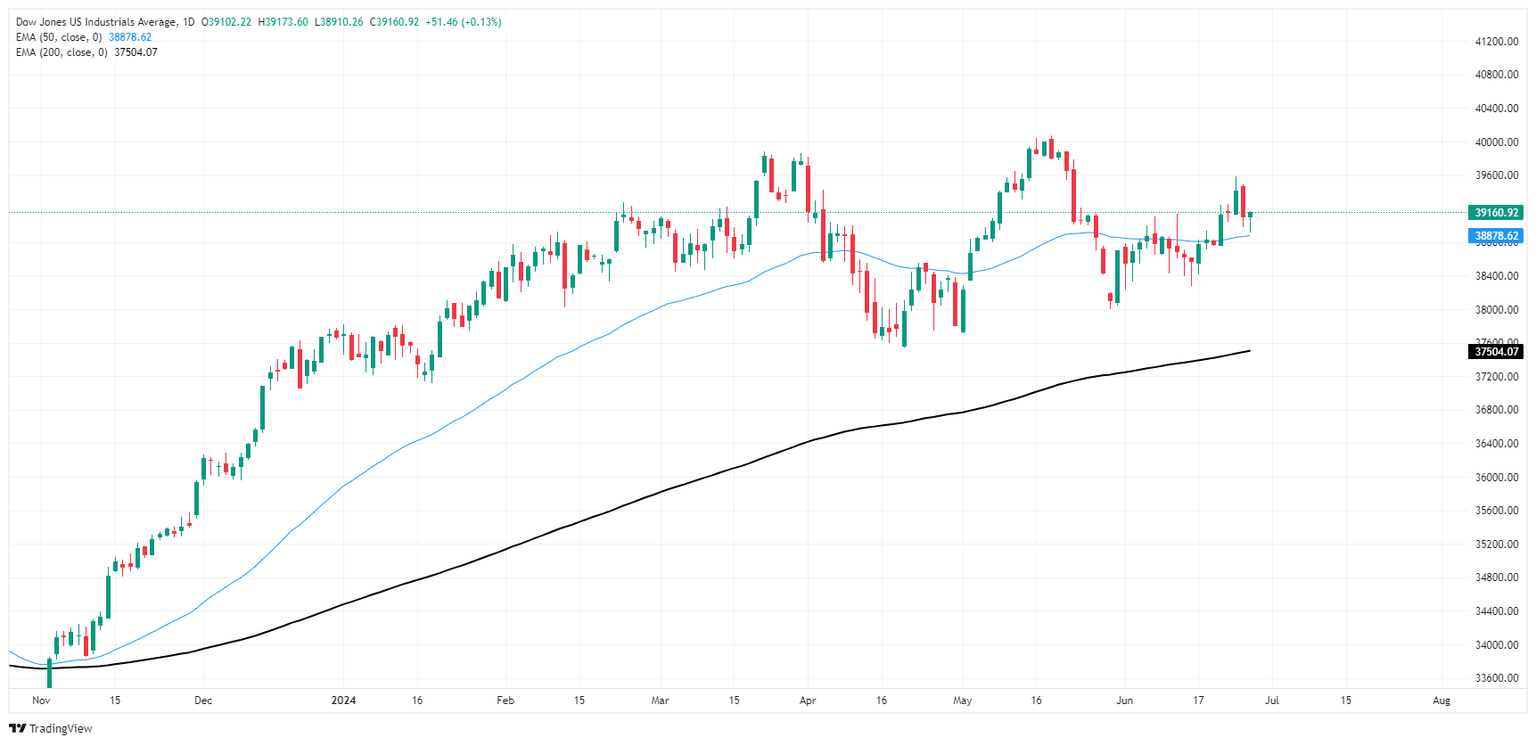

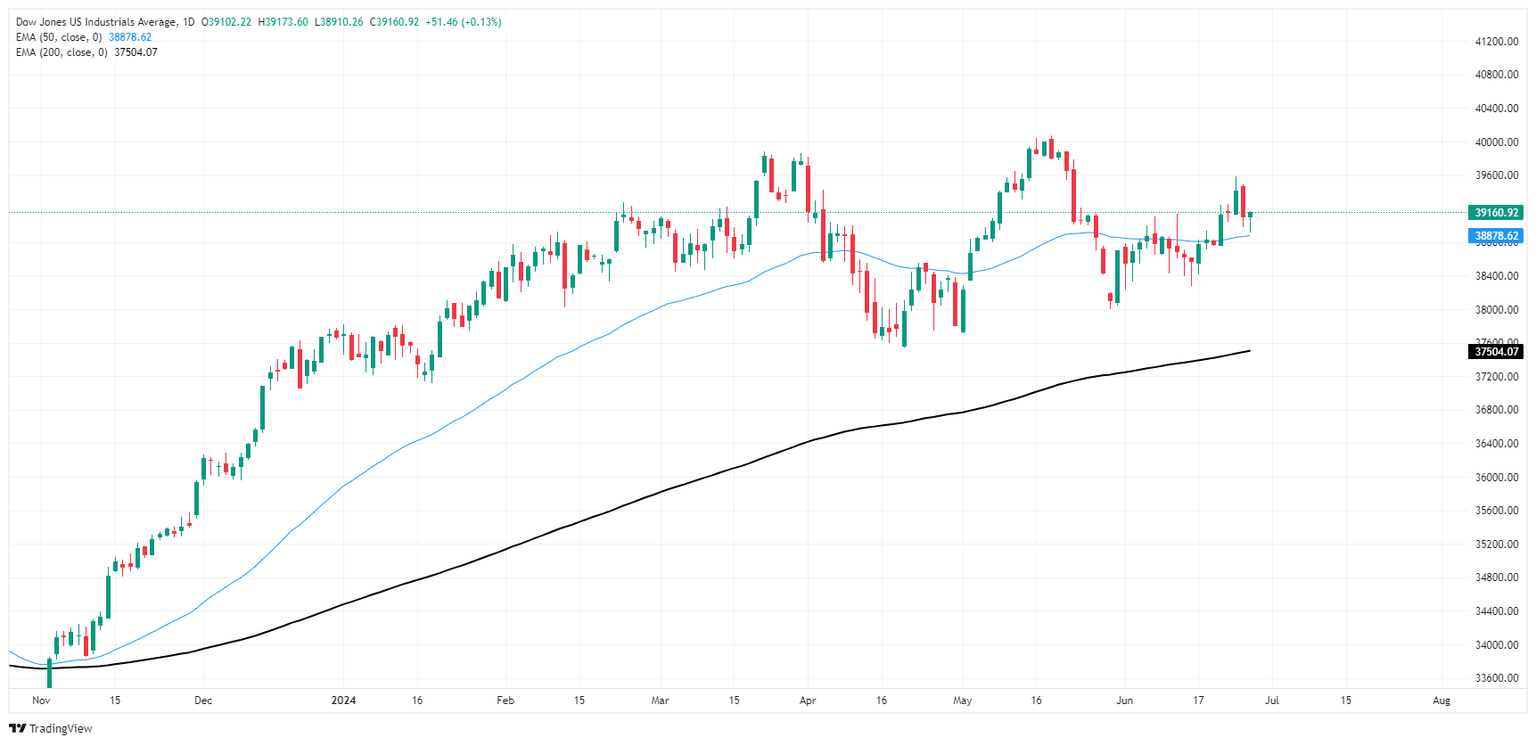

Dow Jones remains within touch range of the previous day’s closing bids near 39,100.00 on Wednesday. The DJIA remains down from last week’s peak near 39,600.00, but a near-term floor is priced in at Wednesday’s early lows just above 38,900.00.

Daily candlesticks continue to hold just above the 50-day Exponential Moving Average (EMA) at 38,878.00 as bidders try to drag the large-cap index back towards all-time highs set in May just north of the 40,000.00 major handle.

Dow Jones five minute chart

Dow Jones daily chart

Economic Indicator

Personal Consumption Expenditures - Price Index (MoM)

The Personal Consumption Expenditures (PCE), released by the US Bureau of Economic Analysis on a monthly basis, measures the changes in the prices of goods and services purchased by consumers in the United States (US).. The MoM figure compares prices in the reference month to the previous month. Price changes may cause consumers to switch from buying one good to another and the PCE Deflator can account for such substitutions. This makes it the preferred measure of inflation for the Federal Reserve. Generally speaking, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.

Read more.Next release: Fri Jun 28, 2024 12:30

Frequency: Monthly

Consensus: 0%

Previous: 0.3%

Source: US Bureau of Economic Analysis

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.