Dow Jones Industrial Average falls further with banks and megacaps leading losses

- Dow Jones index drops for fourth session this week, on track to post nearly 4.5% reversal from late March highs near 40,000.

- JPMorgan leads losses as quarterly earnings failed to meet expectations.

- News that China has told tech firms to phase out foreign chips hammers chipmakers.

The Dow Jones Industrial Average (DJIA) is reversing Thursday’s gains on a negative session opening on Friday. The quarterly earnings of some of the largest US banks have failed to cheer investors, who are already feeling frail sentiment on lower hopes of monetary easing by the Federal Reserve (Fed).

JPMorgan (JPM) and Wells Fargo (WFC) have posted softer-than-expected results in the first quarter, which is weighing on the financial sector. Beyond that, mega-caps and chipmakers are suffering on the back of news reporting that China has told telecom firms to phase out foreign chips.

The NASDAQ is leading losses on Friday, down 1.75% to 16,154 the S&P 500 drops 1.57% to 5,117, and the Dow Jones trades with a 1.4% loss at 37,895 on afternoon trading.

Dow Jones news

All the Wall Street sectors are posting losses on Friday. The Materials sector posts a 1.7% decline, the weakest performance, followed by the Technology sector, 1.62% lower. The Utilities and Consumer Staples sectors are the least affected by the risk -averse sentiment, down 0.57% and 0.74% respectively.

JP Morgan is taking the biggest blow on Friday with a 5,85% decline to $184.04 on the back of downbeat quarterly data, while Intel (INTC), which has been crushed by news about China’s decision, is 4.45% lower to $35.93. On the positive side, Apple (AAPL) advances 0.39% to $175.78, followed by Travelers Companies (TRV), up 0.32% to $221.09.

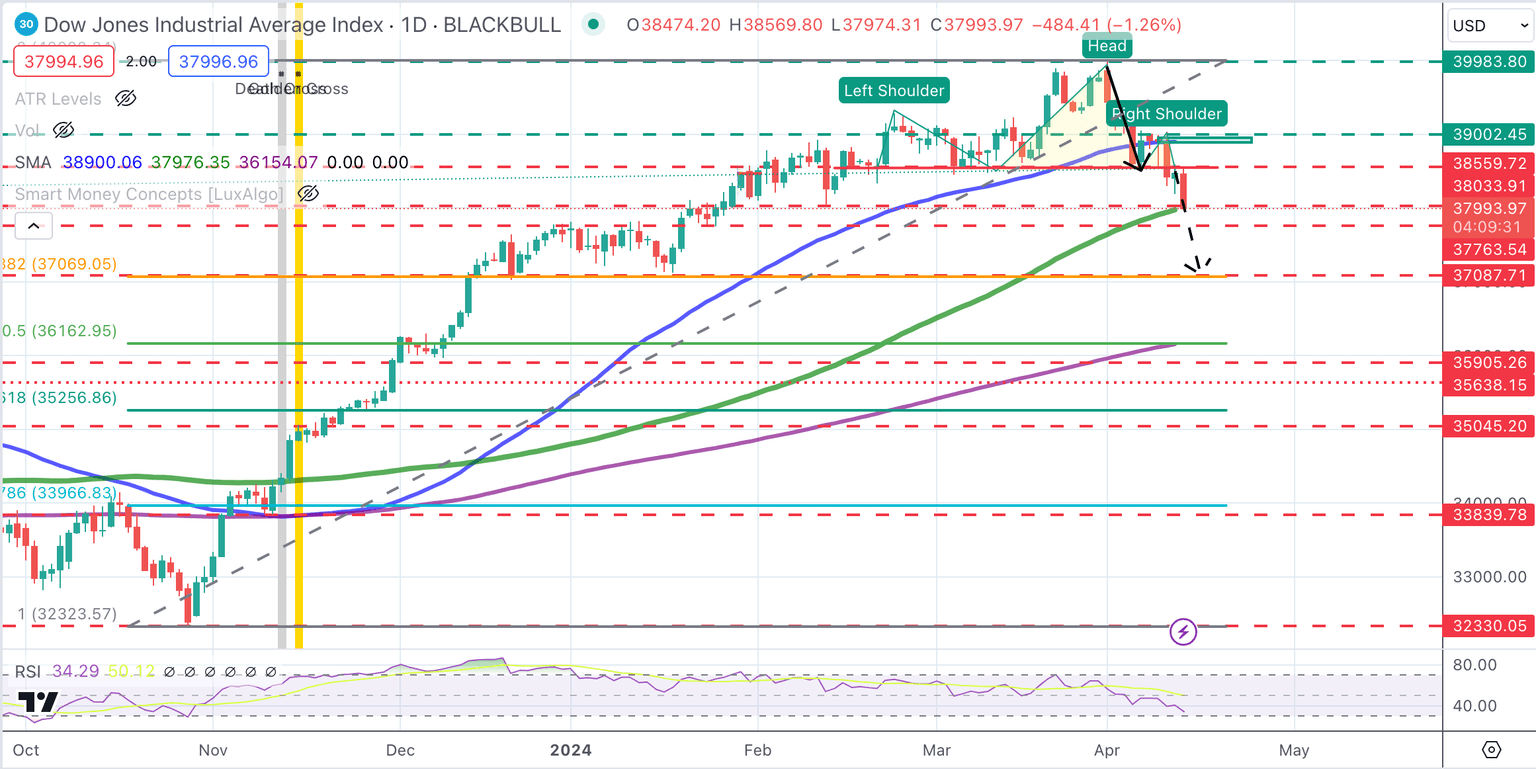

Dow Jones technical outlook

The Dow Jones index keeps drifting away from the historic highs reached in March. The move below 38,560 has activated a bearish Head & Shoulders pattern that might anticipate a sharper decline.

The next bearish targets are 38,000 and 37,750. The measured target of the H&S pattern is the mid-January low and 38.6% Fibonacci retracement at 37,087. A bullish reaction above 38,540 might find some more supply ahead of 39,000 (order block).

Dow Jones Index Daily Chart

S&P 500 FAQs

The S&P 500 is a widely followed stock price index which measures the performance of 500 publicly owned companies, and is seen as a broad measure of the US stock market. Each company’s influence on the computation of the index is weighted based on market capitalization. This is calculated by multiplying the number of publicly traded shares of the company by the share price. The S&P 500 index has achieved impressive returns – $1.00 invested in 1970 would have yielded a return of almost $192.00 in 2022. The average annual return since its inception in 1957 has been 11.9%.

Companies are selected by committee, unlike some other indexes where they are included based on set rules. Still, they must meet certain eligibility criteria, the most important of which is market capitalization, which must be greater than or equal to $12.7 billion. Other criteria include liquidity, domicile, public float, sector, financial viability, length of time publicly traded, and representation of the industries in the economy of the United States. The nine largest companies in the index account for 27.8% of the market capitalization of the index.

There are a number of ways to trade the S&P 500. Most retail brokers and spread betting platforms allow traders to use Contracts for Difference (CFD) to place bets on the direction of the price. In addition, that can buy into Index, Mutual and Exchange Traded Funds (ETF) that track the price of the S&P 500. The most liquid of the ETFs is State Street Corporation’s SPY. The Chicago Mercantile Exchange (CME) offers futures contracts in the index and the Chicago Board of Options (CMOE) offers options as well as ETFs, inverse ETFs and leveraged ETFs.

Many different factors drive the S&P 500 but mainly it is the aggregate performance of the component companies revealed in their quarterly and annual company earnings reports. US and global macroeconomic data also contributes as it impacts on investor sentiment, which if positive drives gains. The level of interest rates, set by the Federal Reserve (Fed), also influences the S&P 500 as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.