Dow Jones Industrial Average backslides on fresh economic fears

- The Dow Jones tumbled 500 points on Monday as investor confidence buckles.

- Markets have fallen victim to new recession fears after US ISM figures miss the mark.

- Investors are jostling for position ahead of this week’s bumper NFP jobs report.

The Dow Jones Industrial Average (DJIA) backslid to kick off the new trading week on Tuesday after US markets took the Labor Day holiday off. US traders were greeted by a fresh misprint in US ISM Manufacturing Purchasing Managers Index (PMI) figures that failed to meet expectations of a rebound in the print, sending a fresh round of recession fears rippling through equity markets.

ISM’s Manufacturing PMI for August came in below expectations, printing at 47.2 and missing the median market forecast of 47.5. Despite a soft rebound from July’s multi-month low of 46.8 failed to galvanize markets, giving already flighty investors a perfect excuse to pull back from a recent lopsided tilt into bullish expectations.

Tuesday’s overall decline has kicked off September’s trading with a notable bearish note as markets remain leery of softer US data on a per-release basis. An overall decline in the tech sector extended a broad-market pullback as the AI darling race begins to show cracks, with high-profile semiconductor companies struggling to hit lofty growth metrics.

Friday's US Nonfarm Payrolls (NFP) report looms large on Friday, and represents the last round of key US labor data before the Federal Reserve (Fed) delivers its latest rate call on September 18. Friday's NFP print is widely expected to set the tone for market expectations regarding the depth of a Fed rate cut, with investors fully priced in on the start of a new rate cutting cycle this month.

Dow Jones news

Most of the Dow Jones equity board dipped into the red on Tuesday, with less than a third of the index finding the green. Verizon Communications (VZ) still managed to squeeze out a 2.4% gain on the day, rising to $42.80 per share, while Intel (INTC) plummeted roughly 8.5% to $20.17 per share.

According to market experts, Intel runs the risk of being dropped from the Dow Jones index, due in no small part to reports that the tech company is continuing to weigh slashing even more departments from the company in a bid to appease investors.

Elsewhere, 3M (MMM) is now at the top of the Dow Jones leaderboard, outperforming the rest of the equity index. 3M has climbed nearly 50% YTD, in a stellar recovery after spending half a decade in the dumps.

Dow Jones price forecast

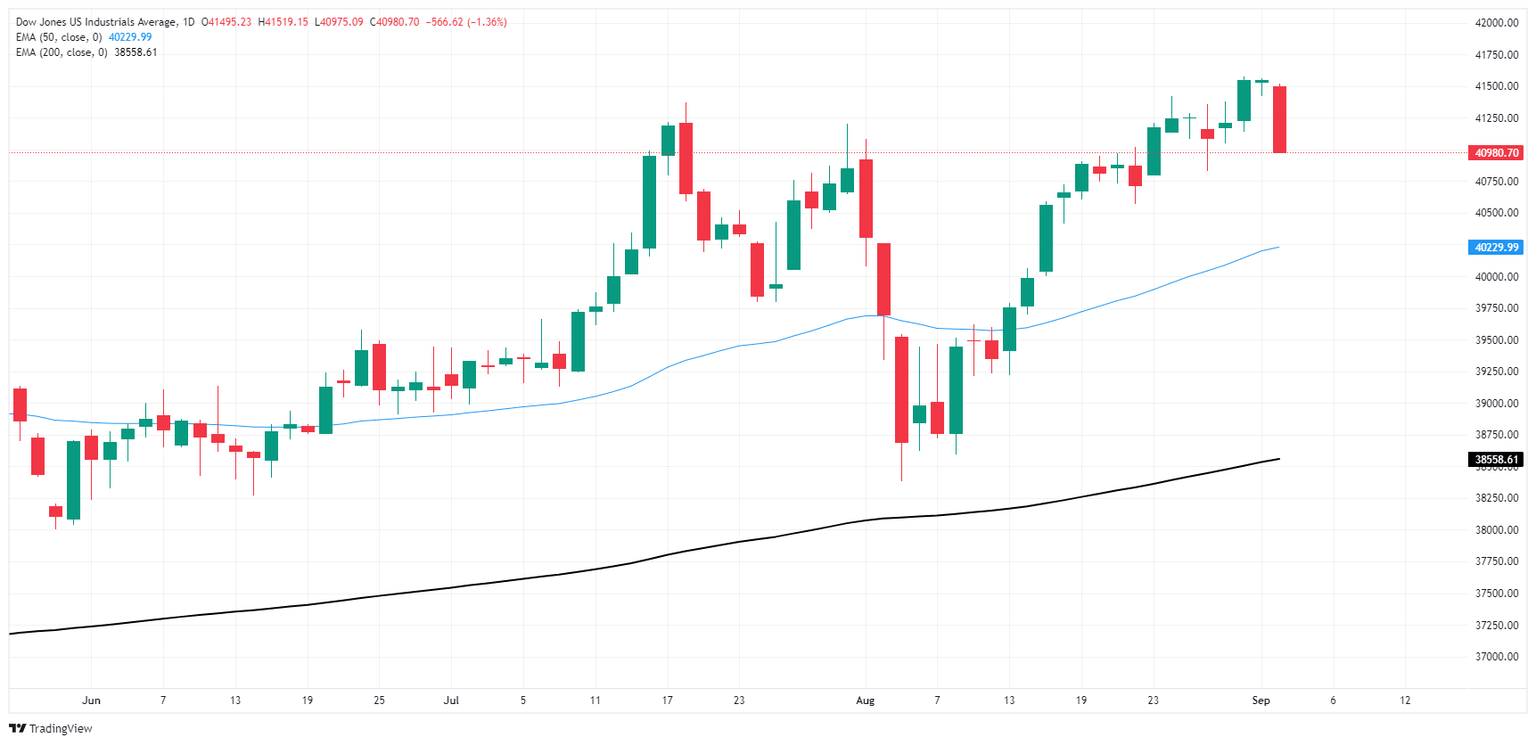

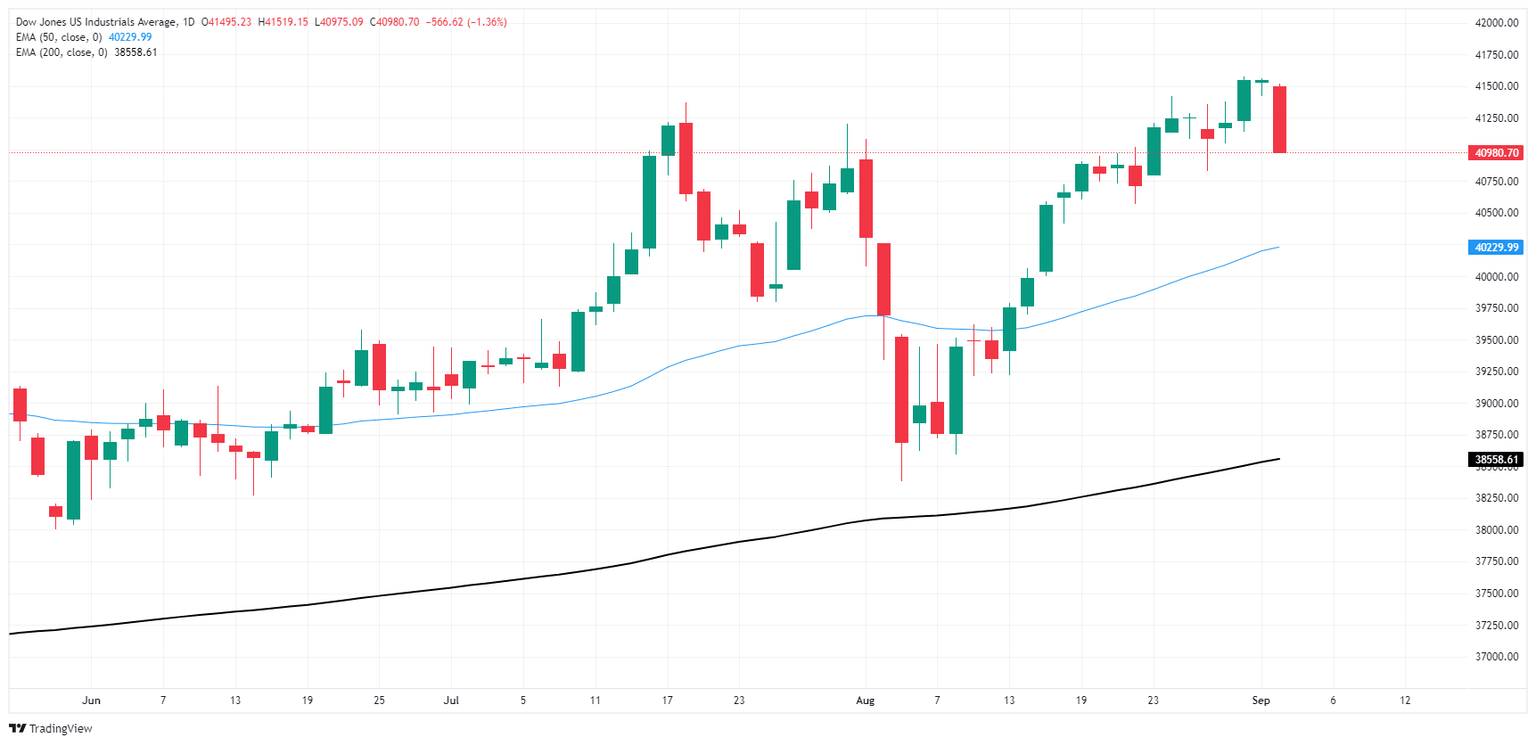

The Dow Jones’ Tuesday plunge has dragged the index back below the 41,000 handle, declining over a full percent from the day’s opening bids and poised for its worst single-day performance in a month. The Dow Jones has tumbled 550 points after chalking in fresh record highs only last week, when DJIA bidders came within a stroke of 41,600.

Despite a near-term pullback, the Dow Jones is still trading deep into bull country, holding well above the 200-day Exponential Moving Average (EMA) at 38,558. The nearest technical barrier for short pressure to take aim at rests at the 50-day EMA near 40,230.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.