Dow Jones Industrial Average softens after PPI uptick

- The Dow Jones is settling back into the 44,000 handle as investors take a pause.

- US PPI inflation accelerated faster than expected in November.

- Analysts increasingly worry that it may take longer to get to 2% inflation.

The Dow Jones Industrial Average (DJIA) held steady on Thursday, drifting into the 44,000 major price handle as investors balked at the latest US Producer Price Index (PPI) inflation figures. This week’s overall US inflation data package has given traders cause for pause, but not enough to fundamentally shift expectations for December’s Federal Reserve (Fed) rate cut.

US PPI inflation bucked to 0.4% in November, while October’s print was retroactively adjusted to 0.3% from 0.2% MoM. Markets were expecting a print no higher than 0.2% MoM. Core PPI inflation accelerated to 3.4% on an annualized basis, over and above the expected uptick to 3.2% from the previous 3.1% YoY.

Investor sentiment froze in its tracks on Thursday post-PPI inflation print, however market expectations for the Fed’s December 18 rate call have hardened around the 25 bps mark. According to the CME’s FedWatch Tool, rate traders are now pricing in over 98% odds of a quarter-point rate cut when the Federal Open Market Committee (FOMC) convenes in December 18.

Dow Jones news

The Dow Jones was roughly on-balance during Thursday’s US market session, with winners equally mixed. Coca-cola (KO) found some room to move higher, climbing 1.45% to land somewhere near $63.50 per share after Deutsche Bank upgraded its stance to bullish on the soft drink manufacturer. Unitedhealth Group (UNH) continued to backslide, falling over 1.75% and approaching $524 per share after video surfaced of the company’s current CEO defending the healthcare company’s claim denial practices, which was filmed the day after Brian Thompson’s assassination. Brian Thompson was the CEO of Unitedhealth’s insurance subsidiary responsible for one of the highest claims denial rates in the US.

Elsewhere in equities, Boeing shares climbed again after the airline manufacturer officially resumed production of its 737 Max project.

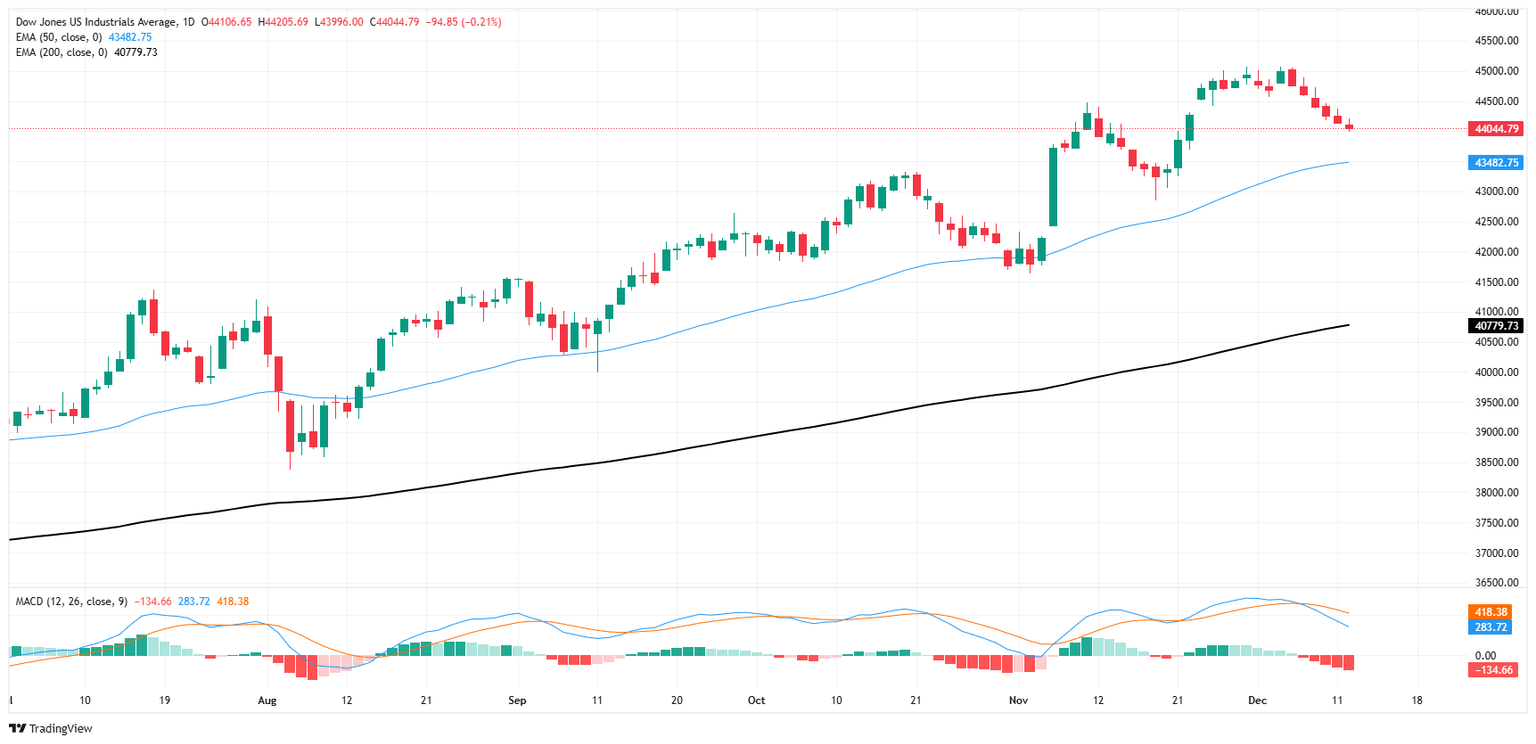

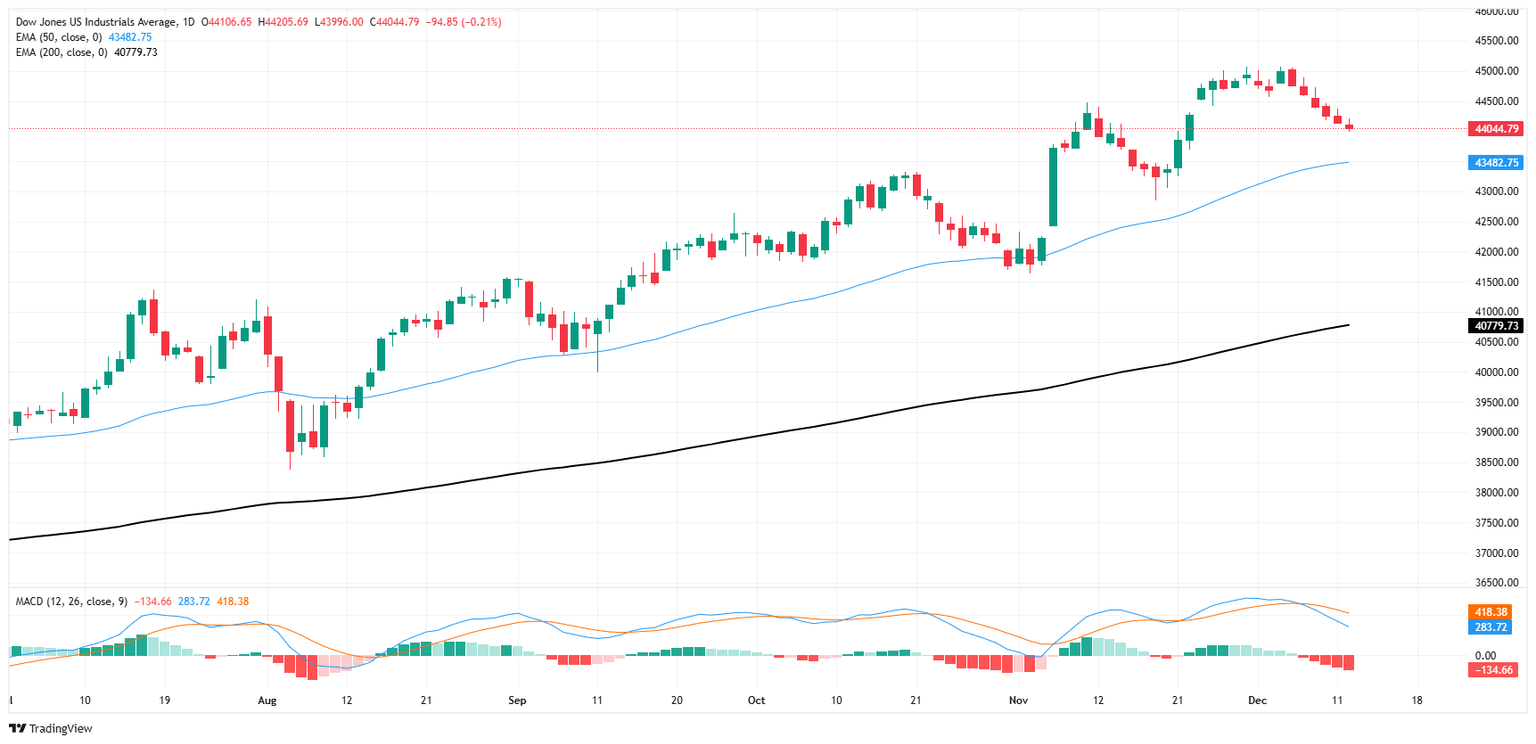

Dow Jones price forecast

The Dow Jones continues to grind lower in the runup to the December market slowdown. Price action has turned tepid, sending bids drifting back toward the 50-day Exponential Moving Average (EMA) near 43,480. With a lack of key bullish momentum, the DJIA is poised to close slightly lower for a sixth consecutive trading day.

Despite bulls appearing to run out of gas in the near term, the long-term trend remains decidedly bullish. The major equity index may be down 2% in December, but that takes only a small bite out of November’s stellar 7.6% return, and the Dow Jones remains up nearly 17% YTD in 2024.

Dow Jones daily chart

Economic Indicator

Producer Price Index (YoY)

The Producer Price Index released by the Bureau of Labor statistics, Department of Labor measures the average changes in prices in primary markets of the US by producers of commodities in all states of processing. Changes in the PPI are widely followed as an indicator of commodity inflation. Generally speaking, a high reading is seen as positive (or bullish) for the USD, whereas a low reading is seen as negative (or bearish).

Read more.Last release: Thu Dec 12, 2024 13:30

Frequency: Monthly

Actual: 3%

Consensus: 2.6%

Previous: 2.4%

Source: US Bureau of Labor Statistics

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.