Crude Oil sees headline risk fade alongside with its price action this Wednesday

- The recent correction in Crude Oil is starting to loose traction, but losses are still more than 6% this week so far.

- Headline risk after harsh rhetoric from Israel’s opposition party to bomb Iranian Oil fields is putting a floor under Crude Oil for now.

- The US Dollar Index has pushed through strong resistance on its way to 104.00.

Crude Oil is off this week's low on Wednesday on the back of harsh rhetoric from Israel’s opposition party. The comments were published in the Jerusalem Post on Tuesday and came from the Yest Atid Party head, Yair Lapid, who called for an immediate attack on Iranian Oil fields. Such an attack would defy the request from the US administration not to do so, contributing to the escalatory spiral between the two countries and increasing the potential of a wider conflict.

The US Dollar Index (DXY), which tracks the performance of the Greenback against six other currencies, advances to a fresh two-month high to levels not seen since August this year. The additional surge in the Greenback came after former US President Donald Trump interview on Bloomberg, in which he further outlined his economic plans if he were to become President again. Traders are placing more bets on the assumption Trump will win on November 5.

At the time of writing, Crude Oil (WTI) trades at $69.82 and Brent Crude at $73.83

Oil news and market movers: THAAD to be deployed

- The US will deploy its Terminal High Altitude Area Defense (THAAD) air-defense systems in Israel. The Biden administration hopes this will help avoid an escalatory spiral that could result in a full-scale regional war between Israel and Iran, Bloomberg reports

- Libyan crude oil is expected to accelerate its production and export schedule for October to 27.52m bbl per month or 888k barrels per day, according to a loading program seen by Bloomberg News.

- Crude Oil prices are little changed in European trading on Wednesday amid uncertainty about the future of the Middle East conflict and the effects of output cuts being held in place by the Organization of the Petroleum Exporting Countries (OPEC) and allied producers until December, Reuters reports.

- The weekly Crude Oil Stockpile Change numbers from the American Petroleum Institute will be released at 20:30 GMT. Expectations are for a build of 2.3 million barrels, smaller than the 10.9 million build registered a week earlier.

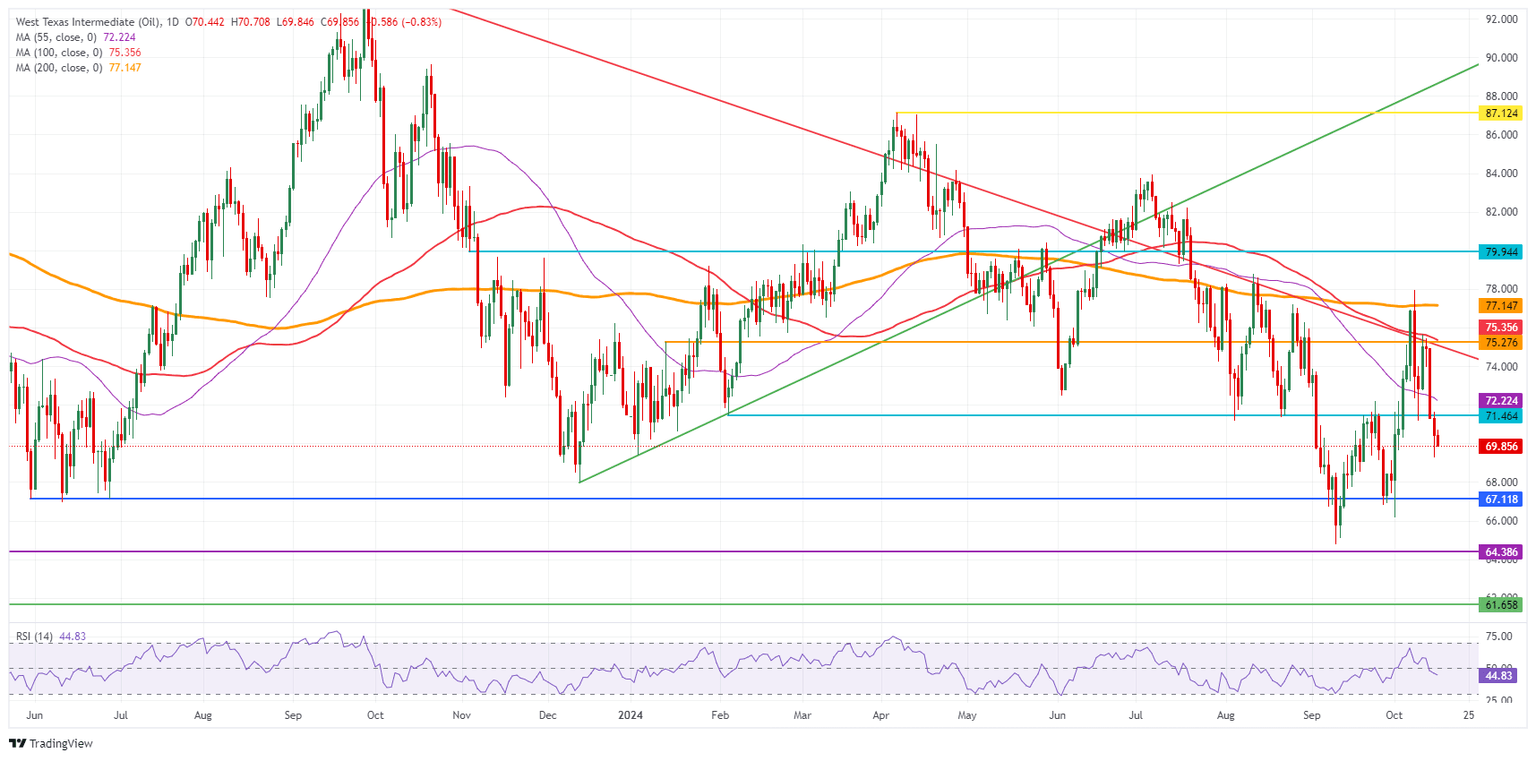

Oil Technical Analysis: Gamechanger needed for another uptick

Crude Oil is trying to hold the $70.00 marker, but it will not be an easy task. With OPEC set to open up the Oil tap soon and supply remaining sluggish, not much upside potential is present. The geopolitical tensions seem to be abating a bit but remain high, not helping out either, so traders are looking for a steady fair value for Oil, which could be further down below $70.00.

There is a challenging path to recovery for Crude Oil. First, the pivotal level at $71.46, which was strong enough to catch the falling knife on Monday, must be regained again with a daily close above it. Once from there, the hefty technical level at $75.35, with the 100-day Simple Moving Average (SMA) and a few pivotal lines, is possibly the first big hurdle ahead.

On the downside, that previously mentioned $71.46 pivotal level has now turned into resistance and no longer has any value as support. Instead, traders need to look much lower, at $67.11, a level that supported the price in May-June 2023. In case that level breaks, the 2024 year-to-date low emerges at $64.75 followed by $64.38, the low of 2023.

US WTI Crude Oil: Daily Chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 12 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.