Crude Oil snaps support after OPEC sources confirm gradual reopening of production

- Crude Oil sinks near 3% after OPEC headlines on output hikes.

- The Libyan outage could still cause concerns about supply in the short term.

- The US Dollar Index trades above 101.00 ahead of July’s PCE inflation release.

Crude Oil prices are slaughtering the $75.00 level and are sinking below it after headlines came out on Reuters that quoted several OPEC sources who confirmed OPEC will increase its supply starting October. The news takes out the possibility of possibly delaying the suggested production cuts that were set to be rolled back as of October. This means the supply outlook grows again with more supply online than demand for it.

The US Dollar Index (DXY), which tracks the performance of the US Dollar against a bucket of currencies, is popping back above 101.00. The release of the Personal Consumption Expenditures (PCE) Price Index release for July did not reveal any new elements and rather confirms a soft landing. The core PCE element is the Fed’s favourite gauge to measure how inflation is behaving and under current conditions gives a green light for a rate cut in September.

At the time of writing, Crude Oil (WTI) trades at $73.54 and Brent Crude at $77.14

Oil news and market movers: OPEC September meeting already a non-event

- Reuters comes with a headline just minutes ahead of the US Opening Bell that sees several sources confirm that OPEC will be going ahead with its committed production reopening. Although the report mentions it will be gradual, it takes out the possibility for OPEC in September to first assess and possibly decide to lengthen a few months current production cuts until its next meeting.

- Bloomberg reports that the sudden supply disruption from Libya could result in a shortage of 1 million barrels a day, according to consultants Rapidan Energy Group. That would account for roughly 1% of global supply.

- Indonesia’s state-owned Pertamina is trying to buy Russian Oil for November delivery to Cilacap, Balikpapan and Balongan. The total amount would be around 5 million barrels, Reuters reports.

- The Greek-flagged crude Oil tanker Sounion is still burning and might be leaking oil in the Red Sea. Yemen’s Houthi rebels have agreed to allow tugboats and rescue ships to reach the damaged tanker, CNBC reports.

- Near 17:00 GMT, the weekly Baker Hughes US Oil Rig Count will be released. The previous release was a steady 483.

Economic Indicator

Baker Hughes US Oil Rig Count

The Baker Hughes Rig Counts are an important business barometer for the drilling industry and its suppliers. When drilling rigs are active they consume products and services produced by the oil service industry. The active rig count acts as a leading indicator of demand for products used in drilling, completing, producing and processing hydrocarbons. This particular case represents the number of rigs drilling exclusively for oil.

Read more.Next release: Fri Aug 30, 2024 17:00

Frequency: Irregular

Consensus: -

Previous: 483

Source: Baker Hughes

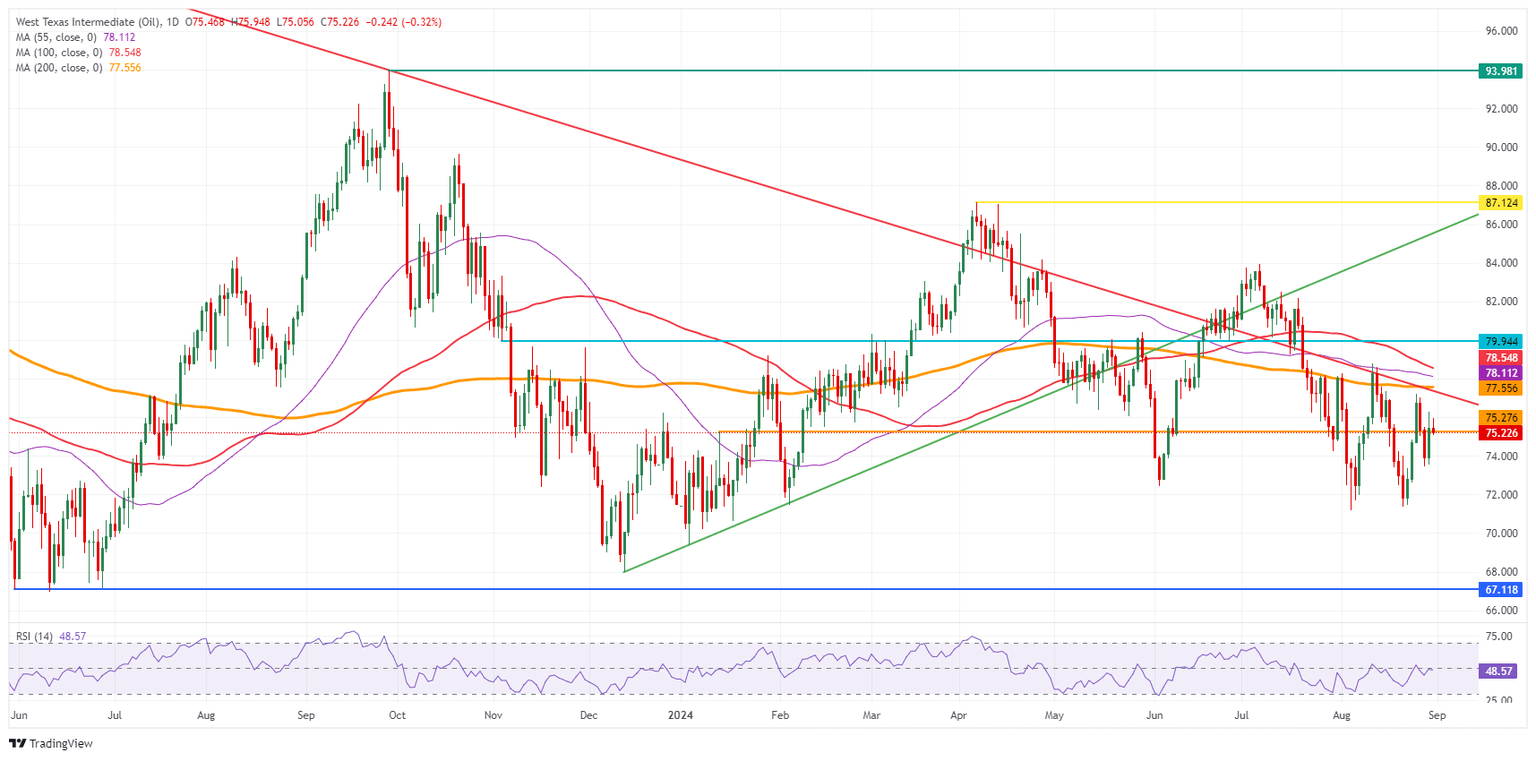

Oil Technical Analysis: OPEC delivered a blow

Crude Oil is set to make a pivotal choice in this Friday’s close. Its fate seems to be going hand in hand with that of the US Dollar Index, with technical elements that result in either a recovery or more downturn to come. For Crude, the key level to hold is $75.50 in order to still be able to retest upside levels.

On that upside, the double level at $77.55 aligns with both a descending trendline and the 200-day Simple Moving Average (SMA). In case bulls are able to break above it, the 100-day SMA at $78.54 could trigger a rejection.

On the downside, the low from August 5 at $71.17 emerges as the first support. Under $70.00, the $68.00 big figure is the first level to watch followed by $67.11, which is the lowest point from the triple bottom seen back in June 2023.

US WTI Crude Oil: Daily Chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 13 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.