Crude Oil hovers around $71.00 after US Continuing Jobless Claims hit a three-year high

- Crude Oil struggles to hold gains this Thursday, attempting to move away from $70.00 and looking for more upside.

- Markets are pricing in a new escalation in geopolitical tensions after failed attempts from US Secretary of State Blinken in the Middle East.

- The US Dollar Index fades after its steep rally earlier this week, focus on the US PMI on Thursday.

Crude Oil prices are stuck around $71.00 after US data threw a spanner in the works for more upside in Crude Oil prices. Earlier gains were pared back when the uprising came after US Secretary of State Antony Blinken failed to broker a diplomatic deal between Israel and Iran and even failed to convince Israel to allow humanitarian aid in the region. Markets are writing off his visit and attempts as a failed one, opening room for further escalations in the region.

The US Dollar Index (DXY), which tracks the performance of the Greenback against six other currencies, starts to dive lower when the weekly US Continuing Claims number beated estimates and printed a fresh three-year high. Next up the preliminary US Purchase Managers Index (PMI) reading for October. The rally in the DXY was steep this week, with quite a few important pivotal levels being breached on its way up above 104.00. Less than 14 days before the US presidential election on November 5, expectations are that the Greenback will remain under pressure, primed for more upside.

At the time of writing, Crude Oil (WTI) trades at $71.42 and Brent Crude at $75.37

Oil news and market movers: Middle East in focus

- Saudi Arabia sees its revenue from Oil exports slump to the lowest in over three years. The main reason is sluggish demand growth, which weighs on Crude prices, according to Bloomberg.

- ExxonMobil has sold its onshore Oil and Gas assets in Nigeria to Seplat Plc for around $1.3 billion after approval from the Nigerian government, Reuters reports.

- Mexican state-owned Oil company Pemex is said to have boosted its Gas and Oil reserves during President Claudia Sheinbaum’s term, several official documents showed, Reuters reports.

- In terms of positioning and hedging, traders have bought more short-dated protection via options to hedge their exposure to higher Oil prices for short-term spikes on the back of geopolitical tensions erupting, according to Bloomberg.

Oil Technical Analysis: All or nothing

Crude Oil price is picking up and recovering further on Thursday, gaining ground and heading back to $75.00. The move comes after markets were too dialled in on the US presidential election and briefly forgot about the geopolitical card from the Middle East. The uneventful visit from Antony Blinken has pulled traders' attention back to the region, making clear that the tensions are far from over and can only escalate further.

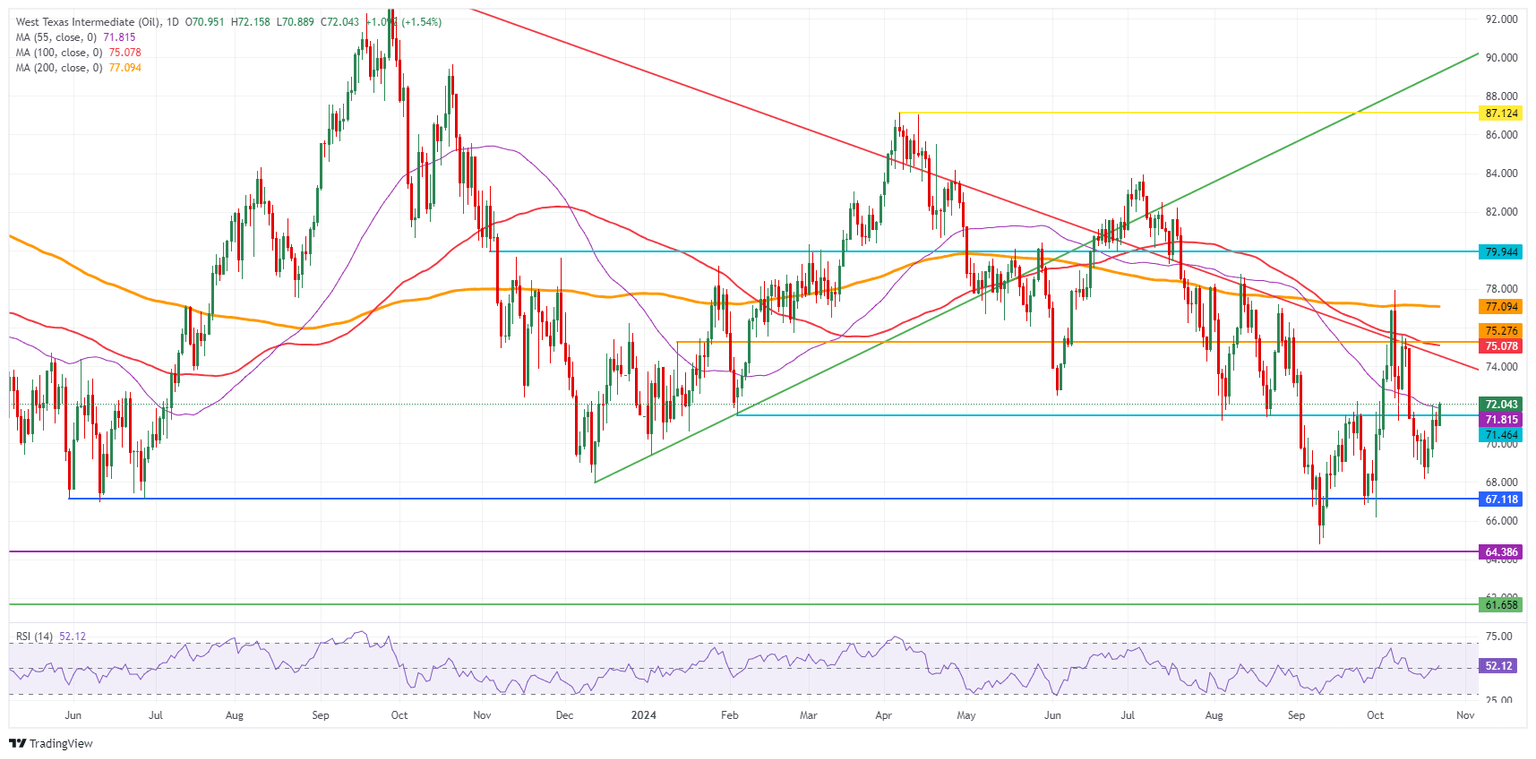

At the time of writing, Crude Oil price has risen above the 55-day Simple Moving Average (SMA) at $71.81, and needs to see preferably a daily close above it to confirm a breakout. Next up, the hefty technical level at $75.08, with the 100-day Simple Moving Average (SMA) and a few pivotal lines, is possibly the first big hurdle ahead.

On the downside, traders need to look much lower, at $67.12, a level that supported the price in May and June 2023. In case that level breaks, the 2024 year-to-date low emerges at $64.75 followed by $64.38, the low from 2023.

US WTI Crude Oil: Daily Chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 12 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.