Coronavirus cases spike in Australia, vaccines to the rescue

Victoria’s daily coronavirus numbers arrived earlier which shows that the state has recorded 246 new, locally acquired cases of coronavirus and zero in hotel quarantine.

''That figure is up from yesterday’s 183 local cases and the highest number of daily cases in more than a year.

The Department of Health says of today’s 246 cases, 121 are linked to existing outbreaks. This means there are, at this stage, 125 mystery cases,'' The Sydney Morning Herald wrote.

''Authorities have not yet said how many cases were in isolation for their entire infectious period. We’re expected to learn more at this morning’s coronavirus update.

There are now 1619 active cases of COVID-19 across Victoria.

Today’s numbers are off the back of yesterday’s 42,248 coronavirus tests.''

New South Wales has reported new local cases 1281 just today, down from 1485 the prior day.

The good news is that Australia is moving forward towards vaccination targets in the region with 75% of the population already vaccinated with their first doses and on target to 80% of double does by October.

Meanwhile, as a potential boost to the Aussie despite the spread, Prime Minister Scott Morrison last week announced the deal would add 4 million Pfizer doses to Australia's supplies, doubling the nation's Pfizer supply this month.

The first flight from London was carrying 164,970 doses landed on Sunday evening while the second, carrying 292,500 doses, arrived a few hours later.

Deputy Chief Medical Officer Sonya Bennett said the extra vaccines had bolstered the vaccine rollout which should be reassuring for financial markets in APAC this week.

This is especially key on a week when the Reserve Bank of Australia is set to meet on 7 Sep.

See the FXStreet calendar

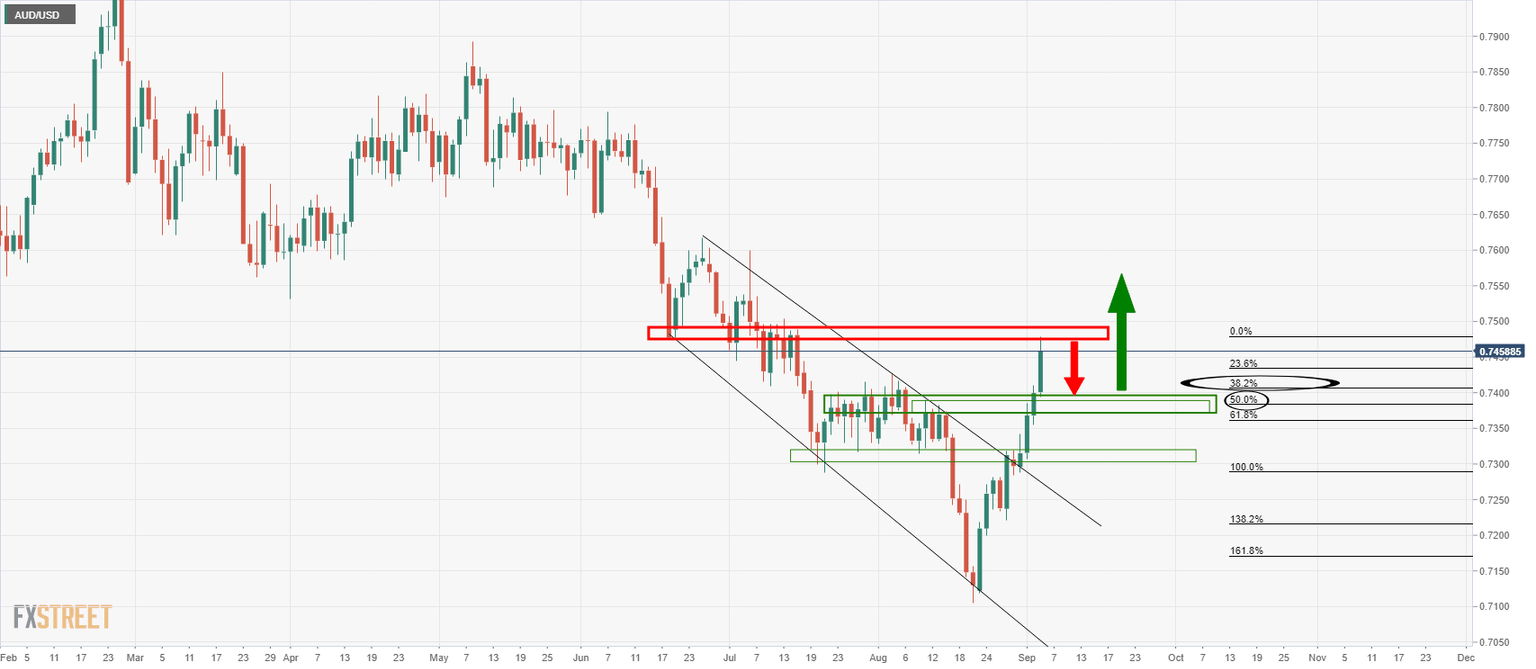

Meanwhile, AUD/USD is capped at 0.7480s and now faces pressures back to test the old resistance block as a fresh support structure.

The support comes in near the 38.2% Fibonacci and 50% mean reversion slightly below between 0.7380 and 0.74 the figure.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.