Cisco stock gains over 4% on Buy rating from Citi

- Citi upgraded Cisco stock to Buy on Wednesday.

- Analyst Atif Malik raised his price target from $52 to $62 on CSCO stock.

- Meta Platforms, which owns Facebook, is order more hardware for use in its AI systems.

- Cisco reports quarterly results in less than a month on November 20.

Cisco Systems (CSCO) got a needed upgrade from Wall Street on Wednesday, which helped it gain 4.25%, its best showing in some time.

The Dow Jones Industrial Average (DJIA), of which it is a constituent member, advanced 0.79%. This performance led both the NASDAQ and S&P 500.

Cisco stock news

Analyst Atif Malik from Citi said that the artificial intelligence (AI) revolution would pivot to future investment in networking equipment makers such as Cisco. At the moment, most of the capex is going toward Nvidia’s (NVDA) new Blackwell GPU that powers AI processes.

Citi raised its price target on CSCO stock by $10 to $62 and moved the company from a Neutral to Buy rating.

"While AI is currently a small piece of the biz (~2% of revs), we see the potential for a stronger contribution," said Malik in his write-up for Citi clients. "With more AI coming, we are incrementally more constructive on the group and expect continued investor rotation out of semis/hardware into networking equipment".

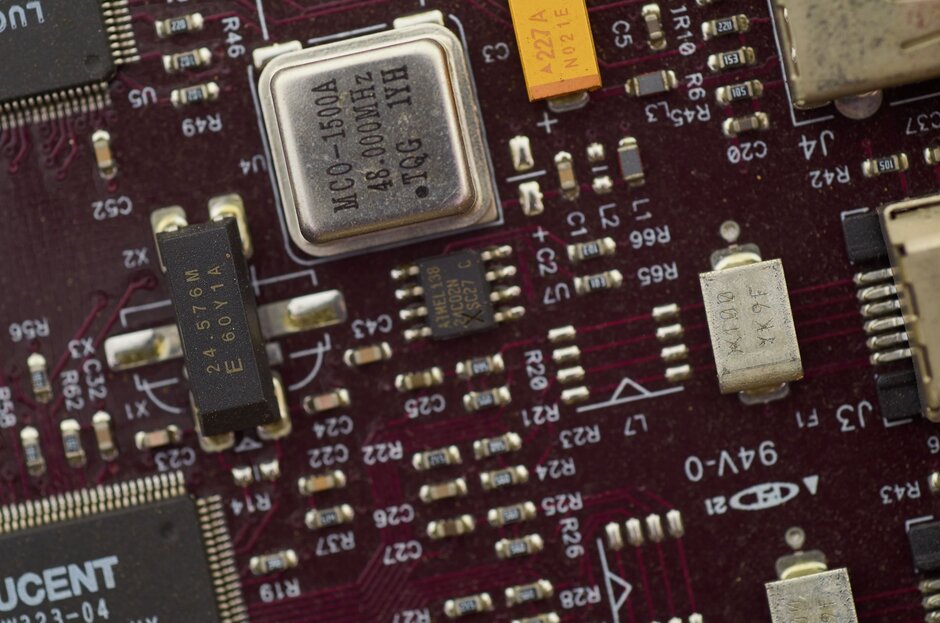

Cisco has additionally become a primary vendor for Meta Platforms (META), which is using Cisco hardware such as networking switches to build out its newest AI network fabric: Disaggregated Scheduled Fabric. Additionally, Malik said that competitor Arista Networks (ANET) would also see increased orders from Meta.

Earlier this month, Citi Research estimated that data centre capex by the hyperscalers will increase 40% YoY in 2025. Much of it will go toward data centre interconnect (DCI) build-outs in which vendors like Cisco connect separate data centres into giant AI clusters that can house more than 300,000 GPUs working in concert on large AI data sets.

Tigress Financial put out a similar note on Monday, arguing that Cisco would not be left behind in the move toward AI-focused investment. The firm slapped an even better $78 price target on CSCO shares.

This news comes ahead of Cisco’s next earnings release on November 20. Wall Street expects Cisco to earn $0.87 per share on $13.77 billion, which is not much of a difference from the prior quarter.

Cisco stock forecast

Cisco stock has broken out of a two-year top trendline that had pushed CSCO into a long-term downtrend. That downtrend may be coming to an end with this week's gains. CSCO shares advanced 2.8% last week and then 3.9% this week through Wednesday.

In late August and early September of 2023, CSCO shares reached resistance near $58. The range high in December 2021 had been near $63 to $64. These two historical levels will be sought for selling price targets, at least by some faction of traders.

CSCO weekly stock chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Clay Webster

FXStreet

Clay Webster grew up in the US outside Buffalo, New York and Lancaster, Pennsylvania. He began investing after college following the 2008 financial crisis.