Breaking: Canadian Core CPI ticked higher in June

Inflation in Canada, as measured by the change in the Consumer Price Index (CPI), declined to 2.7% on a yearly basis in June from 2.9% in the previous month, Statistics Canada reported on Tuesday. This reading came below market expectations.

On a monthly basis, the core CPI, which excludes volatile food and energy prices, contracted by 0.1%, as well as the headline CPI. Meanwhile, the Bank of Canada's Core Consumer Price Index increased by 1.9% from a year earlier, up from the 1.8% growth recorded in May.

Market reaction

USD/CAD advances to multi-day highs and flirts with the 1.3700 barrier in the wake of the release amidst the broad-based recovery in the US Dollar.

Canadian Dollar PRICE Today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.09% | 0.11% | 0.40% | 0.12% | 0.54% | 0.38% | 0.14% | |

| EUR | -0.09% | 0.02% | 0.35% | 0.05% | 0.43% | 0.30% | 0.05% | |

| GBP | -0.11% | -0.02% | 0.31% | 0.02% | 0.42% | 0.28% | 0.05% | |

| JPY | -0.40% | -0.35% | -0.31% | -0.30% | 0.15% | -0.02% | -0.22% | |

| CAD | -0.12% | -0.05% | -0.02% | 0.30% | 0.42% | 0.26% | 0.04% | |

| AUD | -0.54% | -0.43% | -0.42% | -0.15% | -0.42% | -0.16% | -0.40% | |

| NZD | -0.38% | -0.30% | -0.28% | 0.02% | -0.26% | 0.16% | -0.23% | |

| CHF | -0.14% | -0.05% | -0.05% | 0.22% | -0.04% | 0.40% | 0.23% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Canadian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CAD (base)/USD (quote).

This section below was published as a preview of the Canadian Consumer Price Index at 8:00 GMT on July 16.

- The Canadian Consumer Price Index is expected to lose some traction in June.

- The BoC reiterated that inflation is heading towards the target.

- The Canadian Dollar remains stuck within the 1.3600–1.3800 range vs. the US Dollar.

Canada is set to reveal the latest inflation data on Tuesday, with Statistics Canada publishing the Consumer Price Index (CPI) for June. Forecasts predict disinflationary pressures to resume in both the headline CPI and the Core CPI following May’s hiccup.

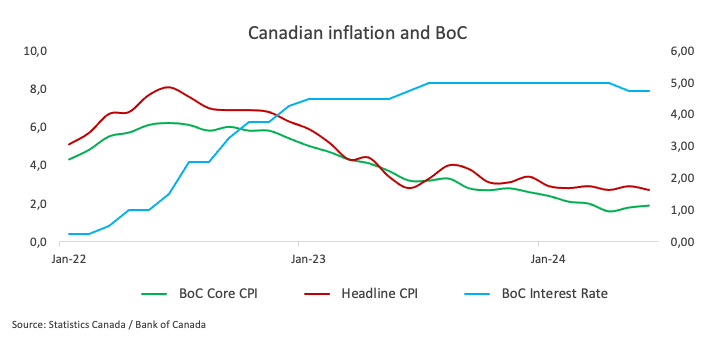

In addition to the CPI data, the Bank of Canada (BoC) will release its core Consumer Price Index, which excludes volatile components such as food and energy. As witnessed, the BoC core CPI showed a 0.6% monthly increase and a 1.8% year-on-year rise in May, while the headline print rose by 2.9% over the last twelve months and 0.6% from the previous month.

These figures are closely monitored as they could influence the Canadian Dollar (CAD) in the short term and affect perceptions of the Bank of Canada's monetary policy, particularly after the central bank reduced its policy rate by 25 bps to 4.75% in June.

Looking at the FX world, the Canadian Dollar keeps navigating the 1.3600-1.3800 range vs. its American counterpart, while the floor of this range still appears propped up by the key 200-day SMA (1.3596).

What can we expect from Canada’s inflation rate?

Analysts expect that price pressures across Canada will ease marginally in June, albeit still well above the bank’s target. That said, consumer prices should mirror the recent performance seen in the US, where lower-than-estimated CPI data have reignited expectations of a sooner-than-anticipated interest rate cut by the Federal Reserve (Fed).

If the upcoming data aligns with these predictions, investors might consider that the BoC could ease its monetary policy further and go for another quarter-point interest rate cut, taking the policy rate to 4.50% at its July gathering.

According to the Minutes of its June meeting, the BoC has expressed concerns that progress on reducing inflation could stall, adding that officials considered the advantages of delaying interest rate cuts by an additional month before ultimately deciding to ease monetary policy on June 5.

Back to inflation, the BoC’s statement following the interest rate cut in June said, “With continued evidence that underlying inflation is easing, the Governing Council agreed that monetary policy no longer needs to be as restrictive and reduced the policy interest rate by 25 basis points. Recent data has increased our confidence that inflation will continue to move towards the 2% target. Nonetheless, risks to the inflation outlook remain. The Governing Council is closely watching the evolution of core inflation and remains particularly focused on the balance between demand and supply in the economy, inflation expectations, wage growth, and corporate pricing behaviour.”

Analysts at TD Securities argued that: “Markets are 70% priced for a cut, and we look for CPI… to add to the case for easing with headline/core CPI pushing 0.20/0.15pp lower (y/y)...”.

When is the Canada CPI data due, and how could it affect USD/CAD?

On Tuesday at 12:30 GMT, Canada is set to release the Consumer Price Index (CPI) for June. The reaction of the Canadian Dollar will largely depend on shifts in monetary policy expectations from the Bank of Canada (BoC). However, unless there are significant surprises in either direction, the BoC is expected to maintain its current cautious monetary policy stance, similar to the approach of other central banks like the Federal Reserve (Fed).

The USD/CAD has started the new trading year with a strong bullish trend, which eventually morphed into yearly highs north of 1.3800 the figure in April. However, that initial uptrend has gradually run out of steam and motivated spot to embark on a consolidative phase between 1.3600 and 1.3800.

According to Pablo Piovano, Senior Analyst at FXStreet, there is a high probability of USD/CAD maintaining its side-line theme for the time being as market participants remain focused on the Fed-BoC policy divergence as the almost exclusive driver of the price action. “This range-bound pattern appears to be underpinned by the always-relevant 200-day Simple Moving Average (SMA) at 1.3596 so far. On the upside, there is immediate resistance at the June top of 1.3791 (June 11) prior to the 2024 peak of 1.3846 (April 16),” Piovano said. “Conversely, if USD/CAD falls below the 200-day SMA, it could face additional losses, potentially dropping to the January 31 low of 1.3358. Beyond this, notable support levels are scarce until the December 2023 bottom of 1.3177, recorded on December 27.”

Pablo emphasizes that significant increases in CAD volatility would require unexpected inflation figures. A CPI below expectations could strengthen the case for another BoC interest rate cut in the upcoming meeting, thereby boosting USD/CAD. On the flip side, a CPI rebound might offer limited support to the Canadian Dollar. A higher-than-anticipated inflation reading would increase pressure on the Bank of Canada to maintain rates for a longer period, potentially posing prolonged challenges for Canadians dealing with higher interest rates.

Author

FXStreet Team

FXStreet