Breaking: Canadian headline CPI rose below consensus in December

The Bank of Canada’s Core CPI, which excludes volatile items like food and energy, showed signs of firming up. It rose 1.8% YoY in the last month of 2024, up from 1.6% in November. On a monthly basis, core inflation dropped by 0.3, adding to the 0.1% decline recorded in the previous month.

Market reaction to Canadian CPI

The Canadian Dollar resumes its offered bias and reverses Monday’s strong advance in the wake of the release of the Canadian inflation figures, prompting USD/CAD to climb beyond 1.4500 and reach new yearly peaks on Tuesday.

Canadian Dollar PRICE Today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.45% | 0.51% | -0.05% | 0.83% | 0.59% | 0.65% | 0.32% | |

| EUR | -0.45% | 0.07% | -0.45% | 0.39% | 0.16% | 0.22% | -0.12% | |

| GBP | -0.51% | -0.07% | -0.55% | 0.32% | 0.08% | 0.14% | -0.21% | |

| JPY | 0.05% | 0.45% | 0.55% | 0.86% | 0.62% | 0.67% | 0.34% | |

| CAD | -0.83% | -0.39% | -0.32% | -0.86% | -0.24% | -0.18% | -0.53% | |

| AUD | -0.59% | -0.16% | -0.08% | -0.62% | 0.24% | 0.06% | -0.28% | |

| NZD | -0.65% | -0.22% | -0.14% | -0.67% | 0.18% | -0.06% | -0.35% | |

| CHF | -0.32% | 0.12% | 0.21% | -0.34% | 0.53% | 0.28% | 0.35% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Canadian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CAD (base)/USD (quote).

(This story was corrected on January 21 at 13:47 GMT to say that Canadian CPI climbed 1.8% compared to last year, slightly below the 1.9% rise analysts were expecting, not above.)

This section below was published as a preview of the Canadian inflation report for December at 09:00 GMT.

- The Canadian Consumer Price Index is seen advancing by 1.8% YoY in December.

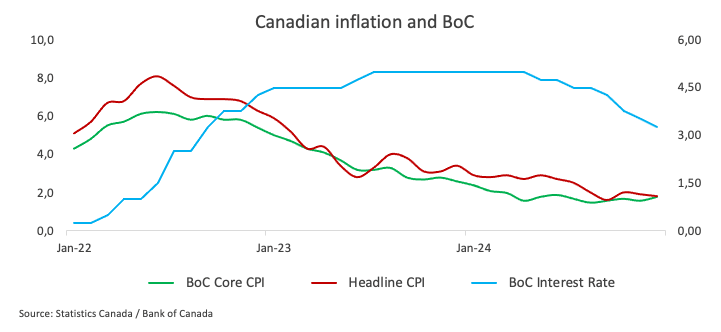

- The Bank of Canada has lowered its interest rate by 175 basis points in 2024.

- The Canadian Dollar navigates multi-year lows against its American peer.

Statistics Canada is set to release its latest inflation report for December, based on the Consumer Price Index (CPI), this Tuesday. Early forecasts suggest headline inflation may have risen by 1.8% compared to the same month of the previous year.

In addition to the headline figures, the Bank of Canada (BoC) will publish its core CPI data, which excludes more unpredictable items like food and energy. For context, November’s core CPI showed a 0.1% contraction compared to the previous month but showed a 1.6% increase from a year earlier. Meanwhile, headline inflation for November rose just 1.9% annually and actually came in flat on a monthly basis.

These inflation numbers are under a microscope, particularly because of their potential impact on the Canadian Dollar (CAD). The BoC’s approach to interest rates plays a critical role here. The central bank has already reduced its policy rate by 175 basis points since it began easing in June 2024, bringing it down to 3.25% on December 11.

On the currency front, the CAD has faced significant challenges, losing value steadily. This has pushed the USD/CAD exchange rate to its highest levels since May 2020, breaching the 1.4400 mark. Markets will be paying close attention to Tuesday’s data to gauge what might come next for the Canadian economy and its currency.

What can we expect from Canada’s inflation rate?

The Bank of Canada’s decision to cut rates by 50 basis points on December 11 to 3.25% was a close call, according to the meeting Minutes published on December 23. Some council members favoured a smaller 25 basis point reduction, leading to significant debate. Governor Tiff Macklem signalled that future cuts would likely be more gradual, marking a shift from earlier messaging about the need for steady easing. Proponents of the larger cut cited concerns about weaker growth and downside inflation risks, though not all recent data supported such an aggressive move. The decision highlights the central bank’s careful navigation of economic uncertainties.

Previewing the data release, analysts at TD Securities note: “We look for CPI to edge higher to 2.0% YoY as prices fall by 0.2% MoM. Seasonal headwinds to core goods will weigh heavily on a MoM basis, while food prices and a softer Loonie provide a source of strength. Core inflation should slow by 0.2pp to 2.45% YoY on average as CPI-trim/median overshoot BoC projections for Q4, but we expect the BoC to look through this in January.”

When is the Canada CPI data due, and how could it affect USD/CAD?

Canada's inflation report for December is set to be released on Tuesday at 13:30 GMT, but the Canadian Dollar's reaction will likely depend on whether the data delivers any major surprises. If the figures align with expectations, they are unlikely to influence the Bank of Canada’s current rate outlook.

Meanwhile, USD/CAD has been navigating a consolidative range since mid-December, reaching multi-year highs just beyond the 1.4500 hurdle. This rise has been primarily driven by a robust rebound in the US Dollar (USD), largely attributed to the so-called “Trump trade,” which continues to exert significant pressure on risk-sensitive currencies like the Canadian Dollar.

Pablo Piovano, Senior Analyst at FXStreet, suggests that given the current scenario of persistent gains in the Greenback and heightened volatility in crude oil prices, further weakness in the Canadian Dollar should remain in the pipeline for the time being.

“Bullish attempts should lead USD/CAD to another potential visit to the 2024 peak of 1.4485 (January 20), ahead of the highest level reached in 2020 at 1.4667 (March 19),” Piovano adds.

On the downside, there is an initial support zone at the 2025 low of 1.4278 (January 6), prior to the provisional 55-day SMA at 1.4177 and the psychological 1.4000 threshold. Down from here comes the November low of 1.3823 (November 6), closely followed by the more significant 200-day SMA at 1.3816. Should USD/CAD break below this level, it could trigger additional selling pressure, initially targeting the September low of 1.3418 (September 25), Piovano notes.

Economic Indicator

Consumer Price Index (YoY)

The Consumer Price Index (CPI), released by Statistics Canada on a monthly basis, represents changes in prices for Canadian consumers by comparing the cost of a fixed basket of goods and services. The YoY reading compares prices in the reference month to the same month a year earlier. Generally, a high reading is seen as bullish for the Canadian Dollar (CAD), while a low reading is seen as bearish.

Read more.Next release: Tue Jan 21, 2025 13:30

Frequency: Monthly

Consensus: 1.9%

Previous: 1.9%

Source: Statistics Canada

Bank of Canada FAQs

The Bank of Canada (BoC), based in Ottawa, is the institution that sets interest rates and manages monetary policy for Canada. It does so at eight scheduled meetings a year and ad hoc emergency meetings that are held as required. The BoC primary mandate is to maintain price stability, which means keeping inflation at between 1-3%. Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Canadian Dollar (CAD) and vice versa. Other tools used include quantitative easing and tightening.

In extreme situations, the Bank of Canada can enact a policy tool called Quantitative Easing. QE is the process by which the BoC prints Canadian Dollars for the purpose of buying assets – usually government or corporate bonds – from financial institutions. QE usually results in a weaker CAD. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The Bank of Canada used the measure during the Great Financial Crisis of 2009-11 when credit froze after banks lost faith in each other’s ability to repay debts.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Bank of Canada purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the BoC stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Canadian Dollar.

Author

FXStreet Team

FXStreet