Breaking: S&P 500 index pierces weekly lows (24 Jan 4,222.62)

The S&P 500 index has pierced the weekly lows (24 Jan 4,222.62), printing a low of 4,221.51.

As per the prior analysis, If Russia does invade Ukraine, this could finally spark off the crash 'puts' have been telegraphing, the Ukraine crisis has started to play out as warned:

Amid Ukraine/Russia tensions and the potential for slowing growth, markets have been trading far more defensively on Wednesday, tipping the stock markets over the edge of the abyss, almost:

SPX weekly chart

In the above analysis, the index has been shown to form a topping head & shoulders on the weekly chart with the price just having broken the prior weekly lows of Jan 24 2022. This is a significant development for financial markets during a pivotal milestone in the Ukraine crisis that just turned up a notch.

So, what has happened?

A lot!

Following news that Russian President Vladimir Putin had sent troops into separatist regions of Ukraine, the prospects of a deeper infiltration into the country was announced just after the Wall Street open by the United States of America. According to US intelligence, Russia will invade within 48hrs.

Further reports enhanced the risk-off moves on Wednesday that cited convoys of military equipment moving towards Donetsk in eastern Ukraine from the direction of the Russian Frontier. Consequently, Ukraine has planned to declare a state of emergency.

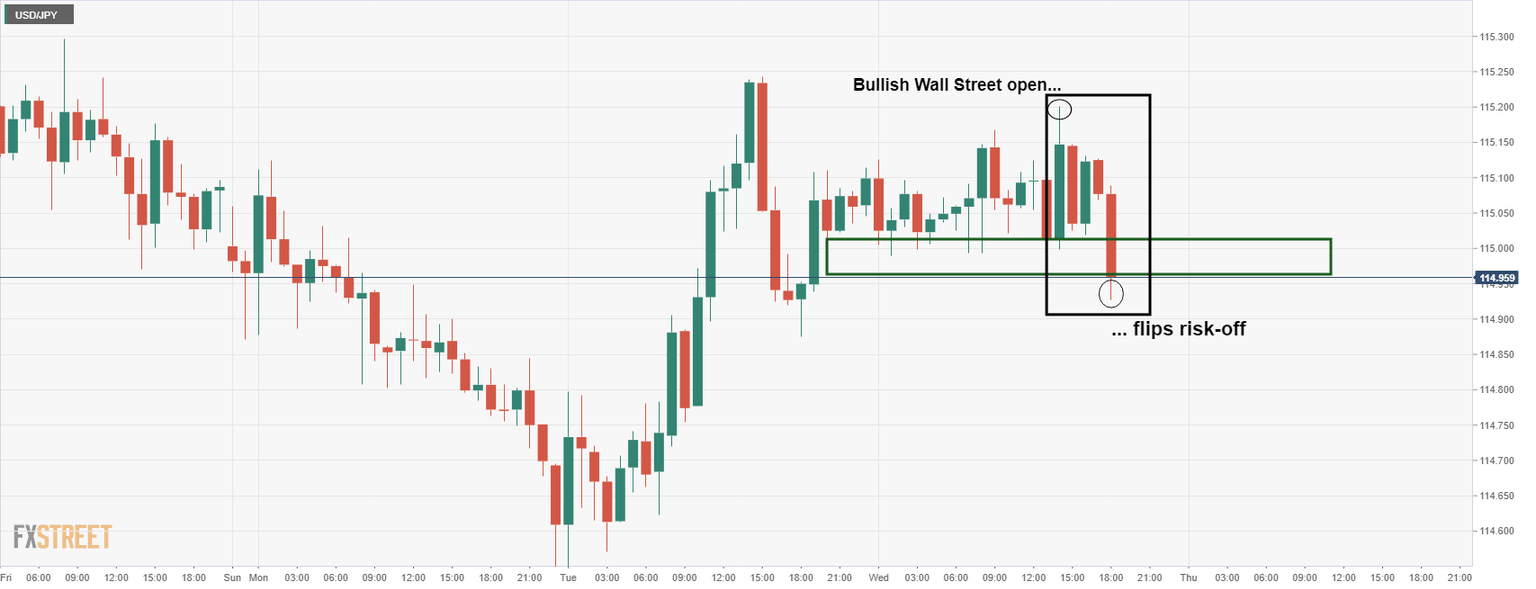

This gave rise to bullish respects for the yen, as shown in the following analysis from earlier in the US session:

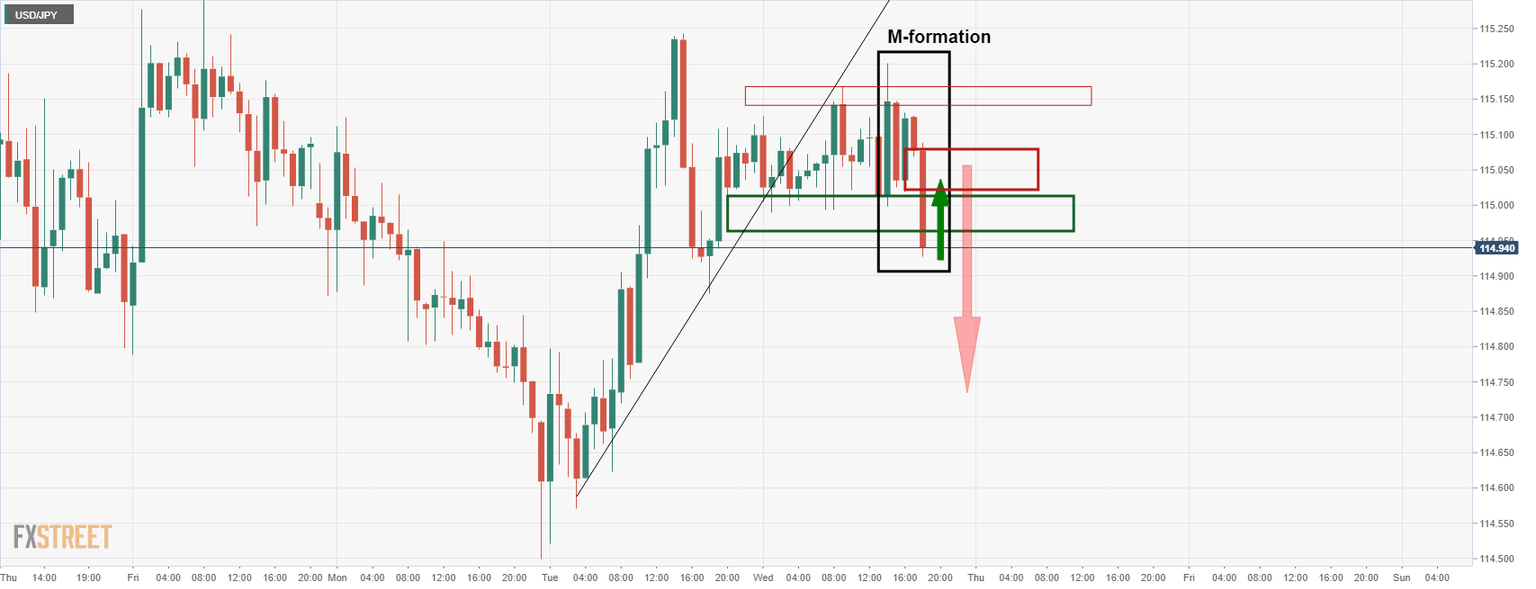

The price action on the hourly time frame was making for a bearish structure, confirming the bearish bias:

the anticipated trajectory of the price is illustrated in the prior analysis on the chart above.

USD/JPY live market

As illustrated here, the price is now adhering to the expected trajectory as we draw to a close on wall Street.

The latest news wires out of the Ukraine crisis are most likely going to support the bearish thesis for the sessions ahead. Leaders of the two separatist regions in eastern Ukraine, Donetsk and Luhansk, have asked Russia for military assistance to 'repel Ukraine's aggression.

USD/JPY, weekly and daily chart outlooks

Considering the dire outlook for equities, the yen would be expected to pick up the flows and the weekly and daily charts are aligned bearishly as follows:

Meanwhile, AUD/JPY, the forex market's risk barometer is also being tipped over the edge as follows:

Author

FXStreet Team

FXStreet