AUD/JPY Price Analysis: Bears take up arms to challenge the bulls at critical levels

- AUD/JPY bears sink in their teeth and are plenty hungry.

- The Ukraine crisis has been turned up a notch and the cracks in risk sentiment and flowing through to the yen.

As per the prior analysis of AUD/JPY, as illustrated in the following article that warned of prospects of a turn in risk appetite due to blatant prospects of escalated tensions surrounding, the Ukraine crisis has started to play out as warned:

AUD/JPY structure and a blueprint for potential price trajectory were drawn out on the daily chart with a bearish bias as follows:

AUD/JPY, daily chart, prior analysis

''If there is going to be a meaningful move in sentiment, the forex markets risk barometer, AUD/JPY, that is retesting the daily counter-trendline, could be shaken out of its tree in the coming days. Eyes will be on whether it can take out the recent lows of 82.12: ''

AUD/JPY live market analysis

Meanwhile, although we saw a secondary breach of the resistance in Asia and European sessions amidst a market that continued to price more benign outcomes of the crisis, the price has indeed succumbed to the growing angst:

Given the latest escalation of the Ukraine crisis, it would only be fair to forecast a more extreme outcome in price action that might be representative of the grave troubles that lie ahead for the global economy. After all, the volatility on the pair today has seen the price move between a range of 80 pips, most of which occurs in the first half of the New York session.

What is key to acknowledge on the daily chart is the prospect of today's close leaving an accompanying double top wick, similar in length to that of 10 Feb. If the price is to react to the news feeds just as it did on Feb 10, when UK Foreign Secretary Liz Truss and Russian FM Sergey Lavrov held fruitless talks, in the first signs that diplomacy was never going to be an option, then it wouldn't be too ambitious to expect a similar 2% follow through to the downside in the coming days.

If there risk sentiment continues to be beaten down into the end of the week, taking into consideration the bearish market structure in USD/JPY as well, along with a less hawkish outlook for the Reserve Bank of Australia, then we could see the makings of a bearish structure below the counter trendline once again resulting in a bearish M-formation, as illustrated on the drawings above. The key levels in this respect are 83.05, 82.50 and 82.12 with 81.50 as the longer-term, target.

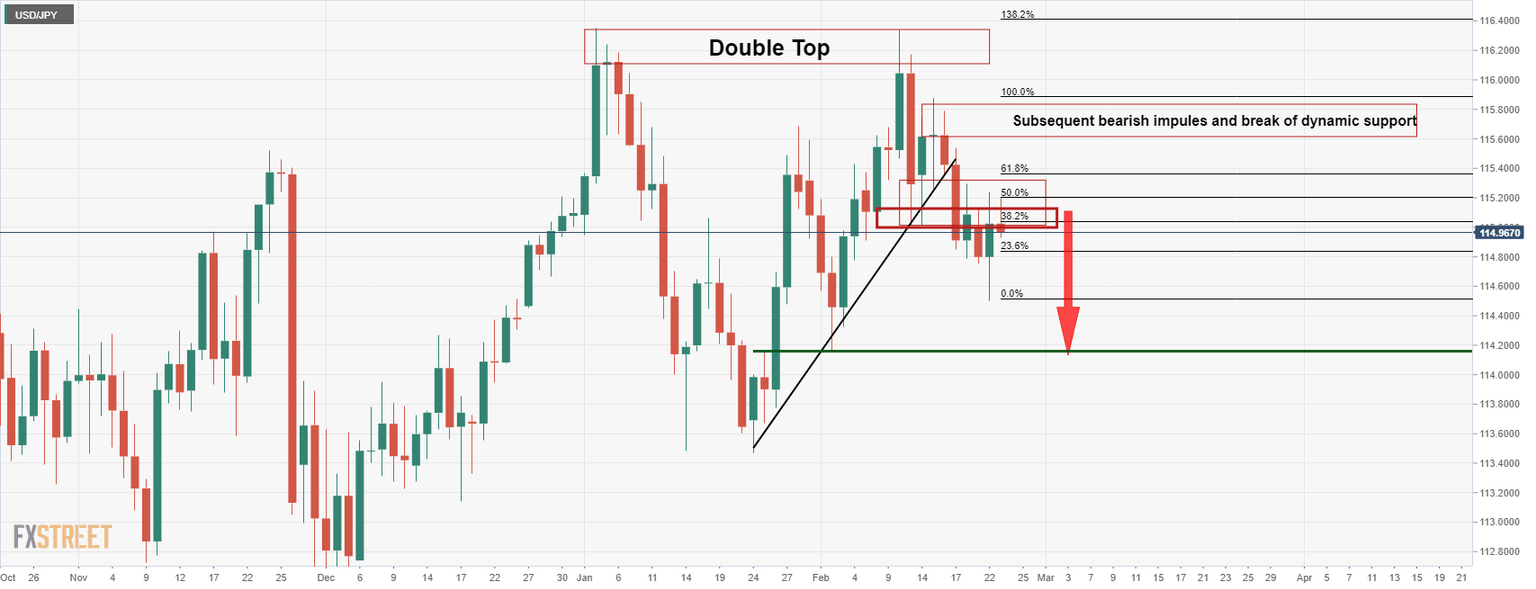

USD/JPY daily chart

''The above analysis, as per USD/JPY's Price Analysis: Weekly and daily pin bars are highly bearish, illustrates the bearish bias given the series of bearish events in price action since the double top was accompanied by a bearish engulfing close on Feb. 11. We have since seen a break of the trendline support and retests back into the cluster of offers below 115.30.

The price is failing there and near a 50% mean reversion of the bearish impulse that broke the dynamic support. This leaves the attention on the downside towards 114.20 for the days ahead as the last defence for much lower levels.''

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.