Australian Dollar holds gains ahead of the US NFP

- The Australian Dollar extends gains as persistently high inflation prompts the RBA to delay rate cuts.

- RBA’s Meeting Minutes suggest an upside risk for May's Consumer Price Index (CPI).

- The US Dollar struggles as the softer US data raise expectations of the Fed reducing rates in 2024.

The Australian Dollar (AUD) extends its gains for the fourth successive day on Friday. This upside could be attributed to persistently high inflation is prompting the Reserve Bank of Australia (RBA) to delay potential rate cuts.

RBA’s June Meeting Minutes indicated that the "board judged the case for holding rates steady stronger than hiking." The board emphasized the need to remain vigilant regarding upside risks to inflation, noting that data suggested an upside risk for May's Consumer Price Index (CPI).

The AUD/USD pair also receives support from a weaker US Dollar (USD). The Greenback struggles due to the softer economic data from the United States (US) raising speculations of the Federal Reserve (Fed) reducing interest rates in 2024. The recovery in US Treasury yields could hold the downside of the US Dollar.

Traders await the US employment reports on Friday, which are expected to show a slowdown in employment growth in June. The US Nonfarm Payrolls (NFP) are expected to show an increase of 190,000 new jobs, down from the previous reading of 272,000. US Average Hourly Earnings are anticipated to moderate slightly, projected to decrease to 3.9% year-over-year from the prior 4.1% reading.

Daily Digest Market Movers: Australian Dollar appreciates due to hawkish RBA

- According to the Australian Bureau of Statistics on Thursday, Australia's trade surplus for May was A$5,773 million ($3,868 million), lower than the expected A$6,678 million and down from the previous reading of A$6,548 million.

- Australia's Retail Sales, a measure of the country's consumer spending, increased by 0.6% MoM in May, up from the previous month's 0.1% rise. This figure exceeded market expectations of a 0.2% increase.

- Judo Bank's Australia Services PMI increased to 51.2 MoM, up from the previous month's 51.0, surpassing the forecasted drop to 50.6. Meanwhile, the Composite PMI rose to 50.7 MoM, compared to 50.6 in the previous month.

- China's Services Purchasing Managers' Index (PMI) fell from 54.0 in May to 51.2 in June, according to the latest data released by Caixin on Wednesday. The market forecast was for a 53.4 figure in the reported period.

- US ISM Services PMI fell sharply to 48.8 in June, marking the steepest decline since April 2020. This figure was well below market expectations of 52.5, following a reading of 53.8 in May.

- ADP Employment report showed that US private businesses added 150,000 workers to their payrolls in June, the lowest increase in five months. This figure fell short of the expected 160,000 and was below the downwardly revised 157,000 in May.

- Federal Reserve Bank of Chicago President Austan Goolsbee stated on BBC Radio on Wednesday that bringing inflation back to 2% will take time and that more economic data are needed. However, on Tuesday, Fed Chair Jerome Powell said that the central bank is getting back on the disinflationary path, per Reuters.

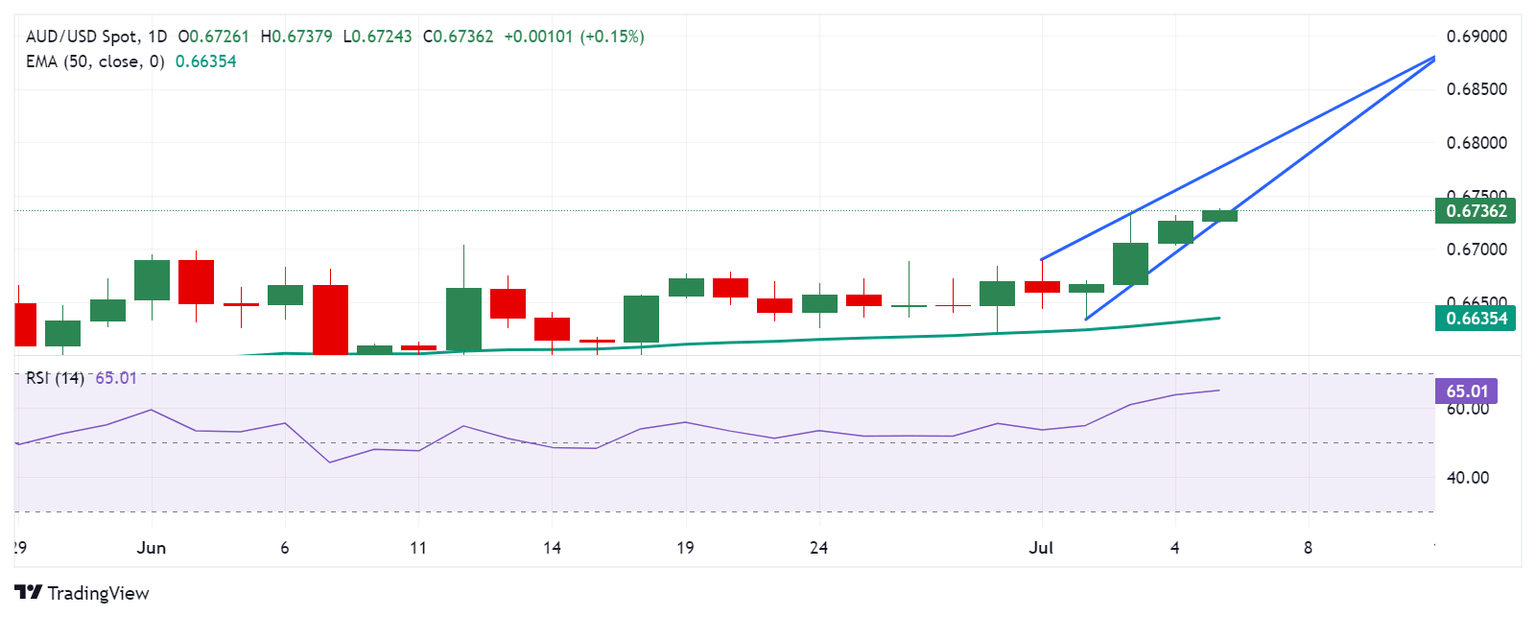

Technical Analysis: Australian Dollar hovers around 0.6750

The Australian Dollar trades around 0.6730 on Friday. The analysis of the daily chart shows a rising wedge, which suggests a potential bearish reversal. Additionally, the 14-day Relative Strength Index (RSI) is slightly below the 70 level. If the RSI breaks above this level, it would suggest the asset is overbought and may experience a short-term correction.

The AUD/USD pair is likely to test the upper boundary of the rising wedge at around 0.6780, followed by the psychological level of 0.6800.

On the downside, the AUD/USD pair tests the lower boundary of the rising wedge at 0.6730, followed by the 50-day Exponential Moving Average (EMA) at 0.6635.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.08% | -0.08% | -0.29% | -0.02% | -0.03% | 0.03% | -0.12% | |

| EUR | 0.08% | -0.01% | -0.23% | 0.07% | 0.05% | 0.11% | -0.06% | |

| GBP | 0.08% | 0.00% | -0.21% | 0.07% | 0.06% | 0.12% | -0.07% | |

| JPY | 0.29% | 0.23% | 0.21% | 0.27% | 0.27% | 0.31% | 0.16% | |

| CAD | 0.02% | -0.07% | -0.07% | -0.27% | -0.03% | 0.05% | -0.14% | |

| AUD | 0.03% | -0.05% | -0.06% | -0.27% | 0.03% | 0.07% | -0.10% | |

| NZD | -0.03% | -0.11% | -0.12% | -0.31% | -0.05% | -0.07% | -0.19% | |

| CHF | 0.12% | 0.06% | 0.07% | -0.16% | 0.14% | 0.10% | 0.19% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.