Australian Dollar declines due to increased likelihood of RBA rate cuts, Fed decision eyed

- The Australian Dollar depreciates following the release of softer CPI data on Wednesday.

- Australia’s Monthly CPI for December 2024 increased by 2.5% YoY, remaining within the RBA target range of 2-3%.

- Traders expect the Fed to maintain its policy rate within the target range of 4.25%-4.50%.

The Australian Dollar (AUD) extends its losses for the third consecutive day against the US Dollar (USD), driven by lower-than-expected Consumer Price Index (CPI) data from Australia released on Wednesday.

Australia’s CPI rose by 0.2% quarter-on-quarter in the fourth quarter of 2024, matching the growth seen in the previous quarter but falling short of the market expectation of 0.3%. On an annual basis, CPI inflation eased to 2.4% in Q4 from 2.8% in Q3, also below the consensus forecast of 2.5%.

Australia’s Monthly CPI for December 2024 increased by 2.5% year-over-year, in line with forecasts and up from November’s 2.3%. This marked the highest reading since August but remained within the Reserve Bank of Australia’s (RBA) target range of 2% to 3% for the fourth consecutive month. The RBA’s Trimmed Mean CPI rose by 3.2% YoY, the slowest pace in three years, slightly under the expected 3.3% but still above the central bank’s target range.

Australian Treasurer Jim Chalmers stated on Wednesday that "the worst of the inflation challenge is well and truly behind us." Chalmers further emphasized that "the soft landing we have been planning and preparing for is looking more and more likely," according to Reuters.

The easing inflationary pressures at the end of 2024 have strengthened the case for a potential interest rate cut by the RBA in February. The central bank has held the Official Cash Rate (OCR) steady at 4.35% since November 2023, emphasizing that inflation must “sustainably” return to its 2%-3% target range before any rate cut can be considered.

The AUD also faced challenges amid increased risk aversion due to tariff threats made by US President Donald Trump. President Trump announced plans on Monday evening to impose tariffs on imports of computer chips, pharmaceuticals, steel, aluminum, and copper. The goal is to shift production to the United States (US) and bolster domestic manufacturing.

Australian Dollar depreciates as US Dollar remains stronger amid cautious Fed

- The US Dollar Index (DXY), which measures the US Dollar’s value against six major currencies, remains steady around 108.00 at the time of writing. Investors are focused on the upcoming US Federal Reserve (Fed) interest rate decision, which is set to take center stage later in the North American session. The Fed’s cautious policy stance continues to provide support for the Greenback.

- According to the CME FedWatch tool, market expectations indicate nearly 100% certainty that the Fed will maintain its policy rate within the target range of 4.25%-4.50%. However, traders will be closely monitoring Fed Chair Jerome Powell’s press conference for any hints regarding the future direction of monetary policy.

- “Nobody knows what to expect from the White House. The policy moves are still very unclear, but we do know that a number of those proposals that have been talked about in the White House are a bit inflationary, and I think that’s going to keep the Fed in check,” said US Bank chief economist Beth Ann Bovino.

- Scott Bessent, the Treasury Secretary under Trump, stated that he aims to introduce new universal tariffs on US imports, starting at 2.5%. These tariffs could rise to as much as 20%, reflecting Trump’s aggressive stance on trade policies, consistent with his campaign rhetoric last year.

- Speaking with reporters aboard Air Force One early Tuesday, US President Donald Trump stated that he “wants tariffs ‘much bigger’ than 2.5%,” as Treasury Secretary Scott Bessent proposed. However, Trump has not yet decided on the specific tariff levels.

- Traders expect the Fed to keep its benchmark overnight rate steady in the 4.25%-4.50% range at its January meeting. Moreover, Trump’s policies could drive inflationary pressures, potentially limiting the Fed to one more rate cut.

- China's NBS Manufacturing PMI fell to 49.1 in January, down from 50.1 in December, missing the market expectation of 50.1. Similarly, the NBS Non-Manufacturing PMI declined to 50.2 in January compared to December's 52.2 reading. As close trade partners, China's economic performance significantly impacts the Australian economy.

- The Australian Dollar also failed to gain support from China’s fresh stimulus measures to promote its development of index investment products, its latest effort to revive the ailing equity market. The China Securities Regulatory Commission (CSRC) has approved a second round of long-term stock investment pilot programs valued at 52 billion Yuan ($7.25 billion).

- China’s Industrial Profits declined by 3.3% year-over-year to CNY 7,431.05 billion in 2024, easing from the 4.7% drop recorded in the first 11 months of the year. This marks the third consecutive year of contraction, following a 2.3% decline in 2023. The continued downturn reflects ongoing economic challenges, including weak demand, rising deflationary pressures, and a prolonged slump in the property sector.

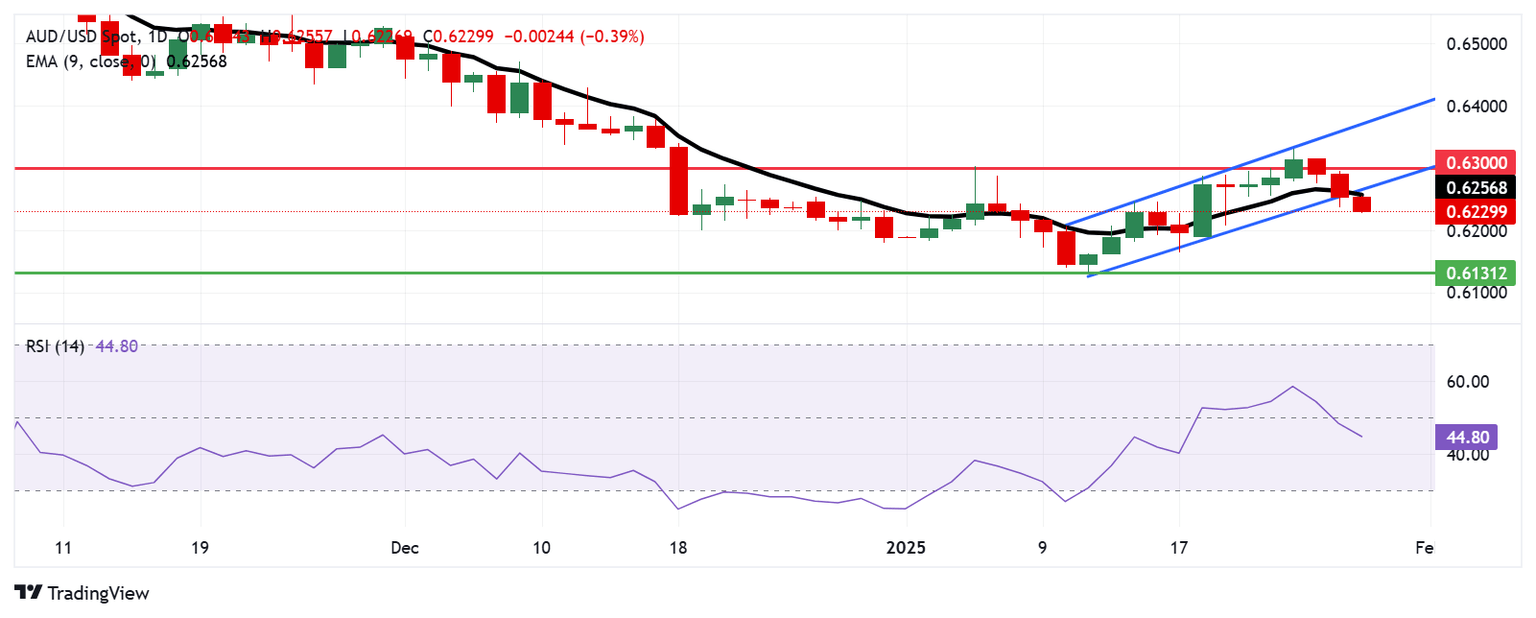

Australian Dollar moves below 0.6250 after breaking below ascending channel

The AUD/USD pair trades near 0.6230 on Wednesday, having broken below the ascending channel on the daily chart, signaling a shift toward a bearish bias. Additionally, the 14-day Relative Strength Index (RSI) has dropped below the 50 level, reinforcing the bearish sentiment in the market.

A decisive break below the key support zone at the lower boundary of the ascending channel has further strengthened the bearish outlook. This could push the AUD/USD pair toward the 0.6131 level, its lowest since April 2020, recorded on January 13.

On the upside, immediate resistance lies at the nine-day Exponential Moving Average (EMA) at 0.6256, which aligns with the channel’s lower boundary. A rebound above this level and a return into the ascending channel could shift the bias back to bullish, with the pair potentially targeting the upper boundary near 0.6360.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.07% | -0.10% | -0.19% | -0.01% | 0.24% | 0.10% | -0.08% | |

| EUR | 0.07% | -0.02% | -0.10% | 0.06% | 0.31% | 0.19% | -0.01% | |

| GBP | 0.10% | 0.02% | -0.08% | 0.08% | 0.34% | 0.20% | 0.02% | |

| JPY | 0.19% | 0.10% | 0.08% | 0.17% | 0.42% | 0.27% | 0.10% | |

| CAD | 0.00% | -0.06% | -0.08% | -0.17% | 0.25% | 0.11% | -0.07% | |

| AUD | -0.24% | -0.31% | -0.34% | -0.42% | -0.25% | -0.14% | -0.32% | |

| NZD | -0.10% | -0.19% | -0.20% | -0.27% | -0.11% | 0.14% | -0.18% | |

| CHF | 0.08% | 0.00% | -0.02% | -0.10% | 0.07% | 0.32% | 0.18% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Read more.Next release: Wed Jan 29, 2025 19:00

Frequency: Irregular

Consensus: 4.5%

Previous: 4.5%

Source: Federal Reserve

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.