Australian Dollar remains weak as US Dollar improves due to risk-on mood

- The Australian Dollar depreciates for the fifth consecutive session on Friday.

- China's Third Plenum concluded on Thursday without concrete measures to revitalize the faltering economy.

- The US Dollar may struggle as soft labor data strengthens expectations of a Fed rate cut in September.

The Australian Dollar (AUD) extends its losing streak for the fifth successive session on Friday. This decline in the AUD/USD pair can be attributed to the strengthening of the US Dollar (USD) due to increased risk aversion. However, the downside for the AUD may be limited by higher-than-expected Employment Change figures, which indicate tight labor market conditions and raise concerns about a potential interest rate hike from the Reserve Bank of Australia (RBA).

Australian Bureau of Statistics on Thursday showed that Employment Change increased by 50,200 in June from May, surpassing market forecasts of 20,000. This data slightly shifted investors' expectations toward a potential rate hike from the Reserve Bank of Australia in August, with swaps implying a 20% probability, up from 12% previously, according to Reuters. However, the Unemployment Rate increased to 4.1% from 4.0%, contrary to forecasts of a steady outcome.

The US Dollar is supported by an increase in US Treasury yields. However, the upside for the greenback may be limited due to soft labor data, which strengthens market expectations of a rate cut decision by the Federal Reserve (Fed) in September.

According to CME Group’s FedWatch Tool, markets now indicate a 93.5% probability of a 25-basis point rate cut at the September Fed meeting, up from 85.1% a week earlier.

Daily Digest Market Movers: Australian Dollar declines due to increased risk aversion

- The Third Plenum of the Chinese Communist Party's 20th National Congress concluded on Thursday with a lack of concrete measures to revitalize the faltering economy. A senior Chinese official for economic affairs noted that China's economic recovery is not robust enough and emphasized the need for more effective implementation of macroeconomic policies, according to Reuters.

- Reuters cited Sean Langcake, head of macroeconomic forecasting for Oxford Economics Australia, saying, "The current pace of employment growth suggests demand is resilient and cost pressures will remain. We think the RBA will stay the course and keep rates on hold, but August is certainly a live meeting."

- Westpac's summary of a note on inflation in Australia and the RBA indicates that Australia is expected to follow the same broad disinflation trend as other countries, given that they face largely similar economic shocks.

- US Initial Jobless Claims increased more than expected, data showed on Thursday, adding 243K new unemployment benefits seekers for the week ended July 12 compared to the expected 230K, and rising above the previous week’s revised 223K.

- On Wednesday, Fed Governor Christopher Waller said that the US central bank is ‘getting closer’ to an interest rate cut. Meanwhile, Richmond Fed President Thomas Barkin stated that easing in inflation had begun to broaden and he would like to see it continue,” per Reuters.

- During an interview with Bloomberg News on Tuesday, Donald Trump cautioned Fed Chair Jerome Powell against cutting US interest rates before November’s presidential vote. However, Trump also indicated that if re-elected, he would allow Powell to complete his term if he continued to "do the right thing" at the Federal Reserve.

- On Monday, Fed Chair Powell stated that the three US inflation readings from this year "add somewhat to confidence" that inflation is on track to meet the Fed’s target sustainably, suggesting that a shift to interest rate cuts may be imminent.

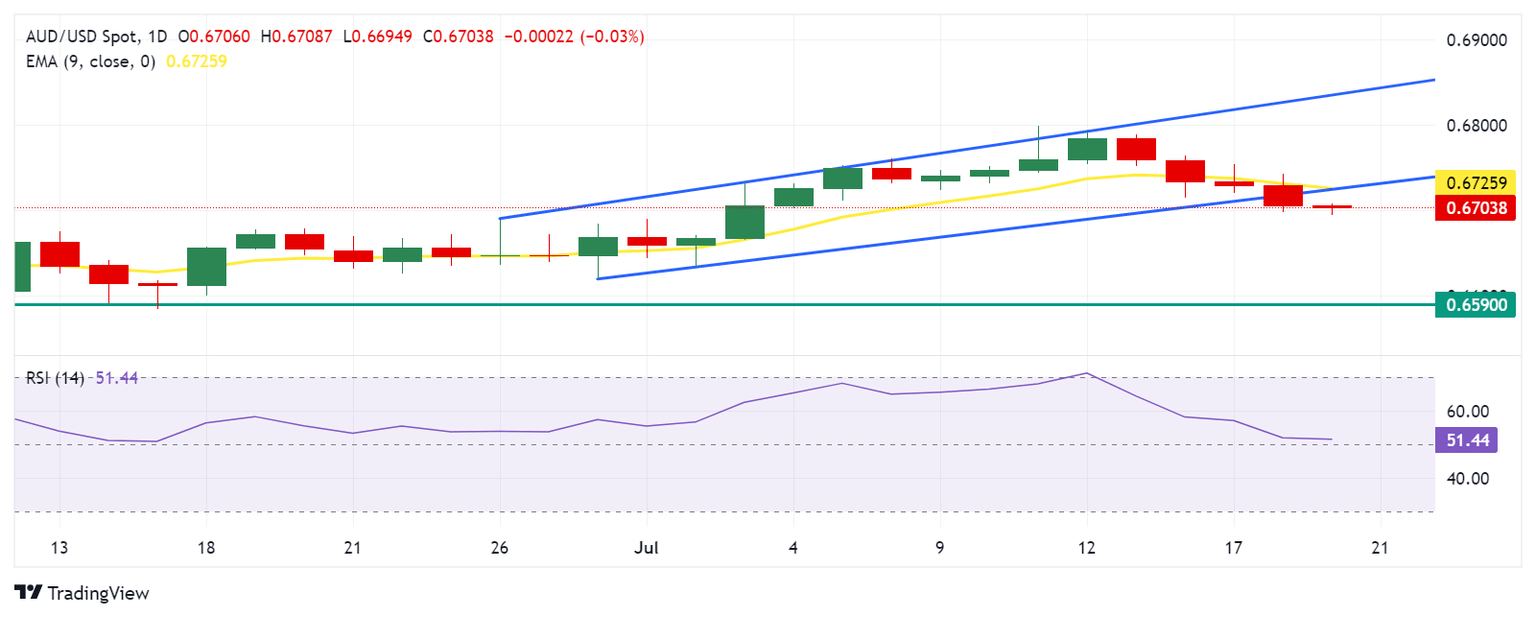

Technical Analysis: Australian Dollar hovers around 0.6700

The Australian Dollar trades around 0.6710 on Friday. The daily chart analysis shows that the AUD/USD pair has fallen below an ascending channel, signaling a weakening bullish bias. Although the 14-day Relative Strength Index (RSI) is slightly above the 50 level, a drop below this level would indicate the onset of bearish momentum.

Immediate support for the AUD/USD pair is seen at the psychological level of 0.6700. A decline below this level could put pressure on the pair to explore the throwback support around 0.6590.

On the upside, the AUD/USD pair might test the lower boundary of the ascending channel near the nine-day Exponential Moving Average (EMA) at 0.6726. A return into the ascending channel could bolster the bullish bias and potentially drive the pair to 0.6800 before the upper boundary of the channel at 0.6840.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the weakest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.10% | 0.11% | 0.27% | 0.02% | 0.09% | 0.21% | 0.21% | |

| EUR | -0.10% | 0.01% | 0.17% | -0.11% | -0.01% | 0.11% | 0.11% | |

| GBP | -0.11% | -0.01% | 0.02% | -0.12% | -0.02% | 0.11% | 0.08% | |

| JPY | -0.27% | -0.17% | -0.02% | -0.25% | -0.16% | -0.05% | -0.07% | |

| CAD | -0.02% | 0.11% | 0.12% | 0.25% | 0.08% | 0.20% | 0.17% | |

| AUD | -0.09% | 0.00% | 0.02% | 0.16% | -0.08% | 0.12% | 0.09% | |

| NZD | -0.21% | -0.11% | -0.11% | 0.05% | -0.20% | -0.12% | -0.03% | |

| CHF | -0.21% | -0.11% | -0.08% | 0.07% | -0.17% | -0.09% | 0.03% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.