Australian Dollar holds gains due to hawkish RBA Bullock, focus shift to US election

- The Australian Dollar held its ground as the RBA decided to keep interest rates unchanged in November.

- Australia's Judo Bank Services and Composite PMIs improved to 51.0 and 50.2, respectively, in October.

- The US Dollar faced challenges amid uncertainty surrounding the US presidential election.

The Australian Dollar (AUD) maintains its position after registering gains in the previous session following improved Purchasing Managers Index (PMI) data released on Tuesday. The Reserve Bank of Australia (RBA) decided to keep the Official Cash Rate (OCR) steady at 4.35%, marking an eighth consecutive pause in November. The central bank is expected to hold current rates following its policy meeting.

Reserve Bank of Australia (RBA) Governor Michele Bullock emphasizes the need to maintain restrictive interest rates for the time being due to ongoing inflationary risks. Despite a tight labor market, wage growth is showing signs of easing.

Australia's Judo Bank Services PMI improved to 51.0 in October from 50.6 in the previous reading. This figure was above the market consensus of 50.6. The Composite PMI climbed to 50.2 in October versus 49.8 prior. Additionally, Caixin China Services PMI rose to 52.0 in October from 50.3 in September.

Investors will closely monitor the outcome of the US presidential election. Former President Donald Trump and Vice President Kamala Harris both predicted victory as they campaigned across Pennsylvania on Monday in the final, frantic day of an exceptionally close US presidential election.

Daily Digest Market Movers: Australian Dollar holds ground after RBA policy decision

- The opinion polls show that Trump and Harris are virtually even. The final winner may not be known for days after Tuesday’s vote. Trump has already indicated he may challenge any unfavorable result, as he did in 2020.

- The US dollar (USD) struggled amid the election-related uncertainty, with strategists linking the currency’s weakness to a Des Moines Register/Mediacom poll showing Democratic nominee Kamala Harris leading Republican candidate Donald Trump 47% to 44% in Iowa.

- The US Federal Reserve’s (Fed) policy decision on Thursday will also be closely watched. Markets expect a modest 25 basis point rate cut this week. The CME FedWatch Tool shows a 99.5% probability of a quarter-point rate cut by the Fed in November.

- The TD-MI Inflation Gauge rose by 0.3% month-over-month in October, up from a 0.1% increase in the prior month, marking the highest reading since July and preceding the RBA's November policy meeting. Annually, the gauge climbed by 3.0%, compared to the previous 2.6% reading.

- ANZ Australia Job Advertisements increased by 0.3% month-over-month in October, a notable slowdown from the upwardly revised 2.3% gain in September. Despite the weaker growth, this marks the second consecutive month of increases.

- China’s Commerce Minister Wang Wentao met with Australia’s Trade Minister Don Farrell on Sunday. China expressed hopes that Australia will continue enhancing its business environment and ensure fair and equitable treatment for Chinese companies.

- US Bureau of Labor Statistics (BLS) indicated that October’s Nonfarm Payrolls increased by only 12,000, following a revised September gain of 223,000 (down from 254,000), which fell well short of market expectations of 113,000. Meanwhile, the Unemployment Rate remained steady at 4.1% in October, matching the consensus forecast.

- Australia's Producer Price Index rose by 0.9% quarter-on-quarter in Q3, following a 1.0% increase in the prior period and surpassing market forecasts of a 0.7% rise. This marks the 17th consecutive period of producer inflation. On an annual basis, the PPI growth slowed to 3.9% in Q3, down from the previous quarter’s 4.8% increase.

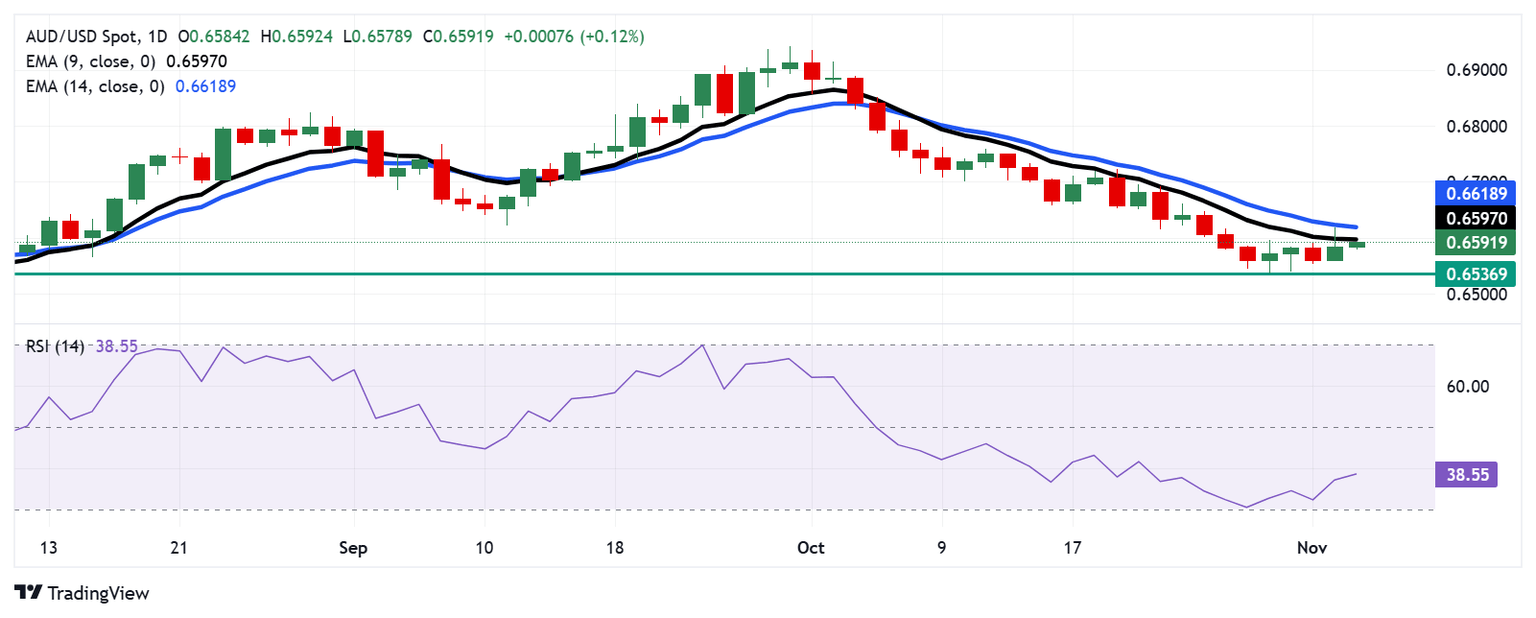

Technical Analysis: Australian Dollar remains below 0.6600, nine-day EMA

AUD/USD trades near 0.6590 on Tuesday, with the daily chart hinting at a potential easing of the bearish trend as the pair tests the nine-day Exponential Moving Average (EMA). However, the 14-day Relative Strength Index (RSI) remains below 50, indicating that the bearish outlook persists.

On the resistance side, AUD/USD faces the nine-day EMA at 0.6596, with further resistance at the 14-day EMA at 0.6618. A break above these levels could strengthen the pair, possibly aiming for a psychological level of 0.6700.

In terms of support, immediate support is around the three-month low at 0.6536. A drop below this level could drive the pair toward the key psychological support at 0.6500.

AUD/USD: Daily Chart

Australian Dollar PRICE Today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.12% | -0.19% | 0.11% | -0.13% | -0.43% | -0.41% | -0.03% | |

| EUR | 0.12% | -0.08% | 0.22% | -0.02% | -0.32% | -0.29% | 0.09% | |

| GBP | 0.19% | 0.08% | 0.28% | 0.05% | -0.25% | -0.22% | 0.17% | |

| JPY | -0.11% | -0.22% | -0.28% | -0.23% | -0.53% | -0.53% | -0.13% | |

| CAD | 0.13% | 0.02% | -0.05% | 0.23% | -0.30% | -0.28% | 0.11% | |

| AUD | 0.43% | 0.32% | 0.25% | 0.53% | 0.30% | 0.00% | 0.40% | |

| NZD | 0.41% | 0.29% | 0.22% | 0.53% | 0.28% | -0.01% | 0.38% | |

| CHF | 0.03% | -0.09% | -0.17% | 0.13% | -0.11% | -0.40% | -0.38% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Australian Dollar from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent AUD (base)/USD (quote).

Economic Indicator

Presidential Election

The U.S. Presidential Election released by the USA.gov is the consecutive quadrennial United States presidential election and decides the President and the Vice President of the United States. It is a significant event to determine the appropriate stance of monetary policy and assesses the risks to its long-run goals of price stability and sustainable economic growth. Also holding congressional elections: voters will elect all 435 members to the US House of Representatives and 33 members to the Senate. The election might affect the USD volatility.

Read more.Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.