AUD/USD Price Analysis: Retraces from wall of resistance around 0.6750

- AUD/USD retreats after refreshing one-week high, mildly bid of late.

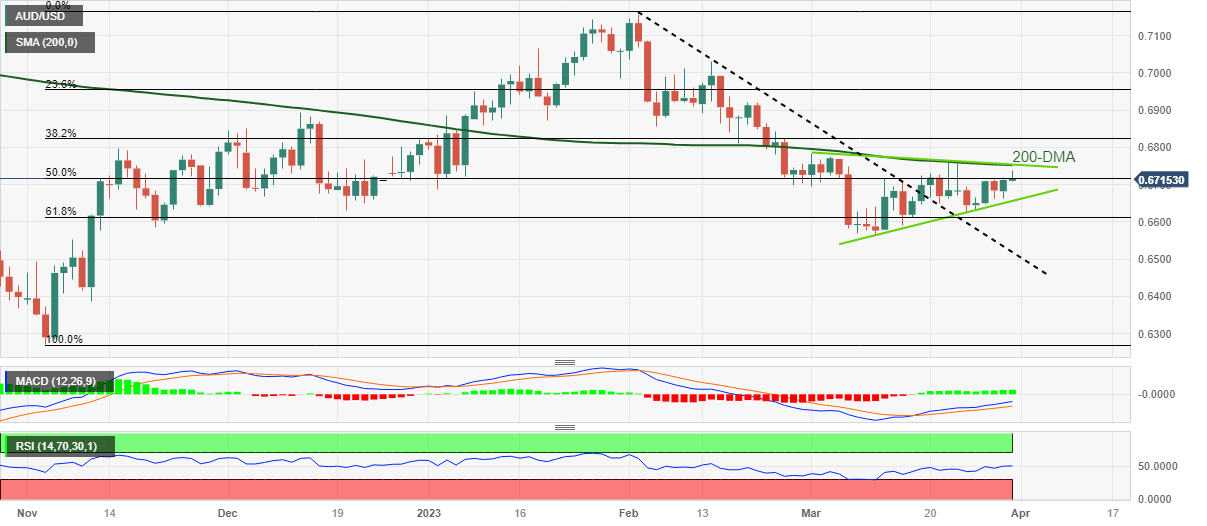

- Bullish MACD signals, upbeat RSI (14) keeps Aussie pair buyers hopeful.

- Convergence of 200-DMA, monthly triangle’s upper line restrict immediate advances.

- Bears remain off the table unless breaking 0.6520.

AUD/USD pares intraday gains around 0.6720, following the run-up to refresh weekly top to near 0.6740, as markets brace for the key US inflation clues during early Friday. Even so, the Aussie pair remains inside a monthly symmetrical triangle.

It’s worth noting that upbeat China PMI and broad US Dollar weakness, amid receding hawkish Fed bets, previously propelled the AUD/USD pair to renew a one-week high.

Even if the Aussie pair fades upside momentum ahead of the key data, bullish MACD signals join the above 50 levels of RSI (14), not overbought, to keep the buyers hopeful.

However, the 200-DMA and the stated triangle’s top line, close to 0.6750, appear a tough nut to crack for the AUD/USD bulls to crack.

Following that, a run-up towards the early February lows near 0.6855 and then to the last December’s high of around 0.6895 can’t be ruled out.

On the contrary, pullback moves need to defy the triangle formation, by slipping beneath the support line of 0.6660, to convince AUD/USD bears.

In that case, the 61.8% Fibonacci retracement of the pair’s November-February upside precedes the previous resistance line from February, respectively near 0.6610 and 0.6520, to challenge the AUD/USD sellers afterward.

AUD/USD: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.