AUD/USD Price Analysis: Refreshes day’s low below 0.7100 amid risk-off mood

- AUD/USD has refreshed its day’s low at 0.7083 as volatility soars amid the risk-off mood.

- The 50-EMA that was providing support to the Australian Dollar is now providing a cushion to the US Dollar.

- The formation of a Wyckoff Inventory Distribution indicates a bearish reversal.

The AUD/USD pair has refreshed its day’s low at 0.7083 as investors have turned risk-averse amid the interest rate decision by the Federal Reserve (Fed) this week. The US Dollar Index (DXY) has displayed a wild gyration in a 101.40-101.57 range as the volatility is accelerating dramatically.

S&P500 futures have surrendered their entire gains recorded on Friday and is expected to remain on tenterhooks amid a risk-off mood. The 10-year US Treasury yields have dropped below 3.51%.

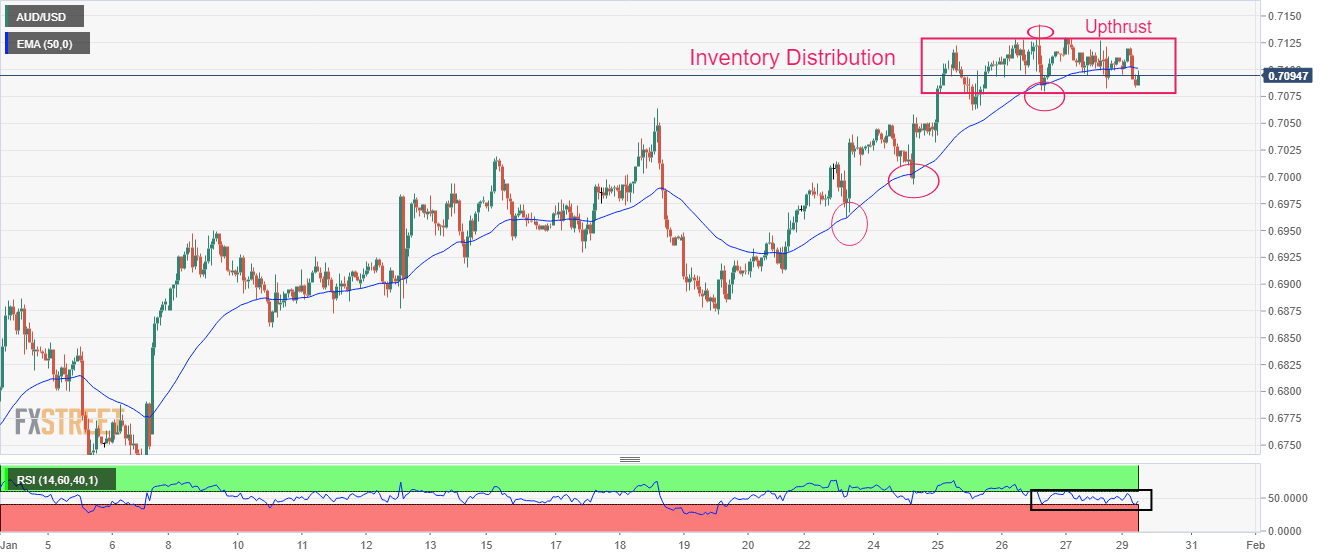

AUD/USD is demonstrating Wyckoff’s inventory distribution on an hourly scale, which indicates an inventory shift from the institutional investors to the retail participants. The Aussie asset has also witnessed an Upthrust formation that indicates the presence of responsive sellers.

The 50-period Exponential Moving Average (EMA) at 0.7100, which was providing support to the Australian Dollar is now providing cushion to the US Dollar.

While the Relative Strength Index (RSI) (14) is oscillating in a 40.00-60.00 range, which indicates that investors are awaiting a fresh trigger for a power-pack action.

Should the asset break below January 25 low at 0.7062, US Dollar bulls will drag the asset toward the psychological support at 0.7000 followed by January 17 low at 0.6948.

On the contrary, a break above August 11 high at 0.7137 will send the major toward the round-level resistance at 0.7200. A breach of the latter will expose the asset to June 3 high at 0.7283.

On the contrary, a downside move below December 29 low at 0.6710 will drag the major further toward December 22 low at 0.6650 followed by November 21 low at 0.6585.

AUD/USD hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.