AUD/USD Price Analysis: Bullish momentum in play, bulls to buy the dip

- The 61.8% golden ratio and the old resistance could be on the cards. This comes in just below 0.7150.

- Below there, the daily support structure will instead be in focus near 0.7110.

Ahead of the last key events for the pair this week, including Chinese inflation data today and US Consumer Price Index on Friday, AUD/USD is correcting the recent bullish rally and buyers are n the prowl for an optimum entry point.

The following illustrates the daily and hourly perspective which leans with a bullish bias for the sessions and days ahead.

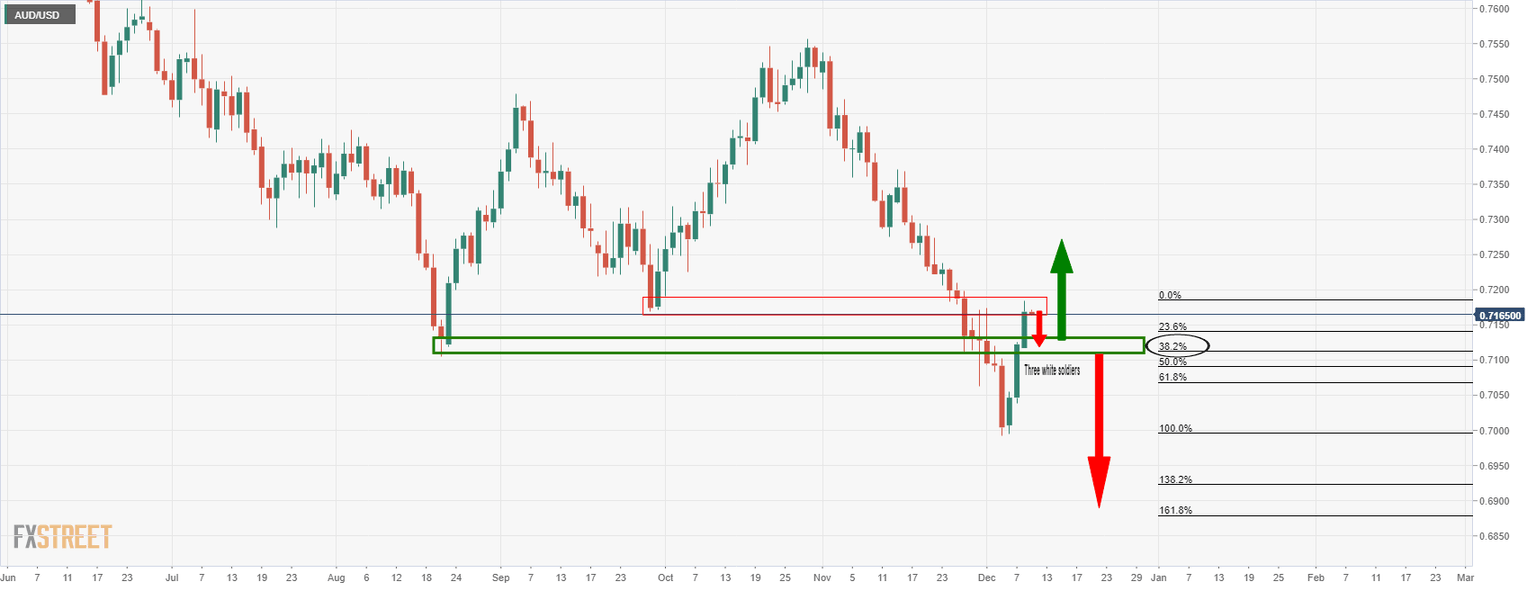

AUD/USD daily chart

The price has rallied to resistance and would be expected to correct at this juncture. The rally has consisted of three bullish daily candles (''Three White Soldiers'') that suggest a strong change in market sentiment.

With that being said, a 38.2% Fibonacci retracement at 0.7111 is not out of the question, but the hourly conditions suggest a shallower correction to prior resistance could be on the cards. Bulls will start to look to engage on signs of stabilisation and demand coming in for a continuation opportunity.

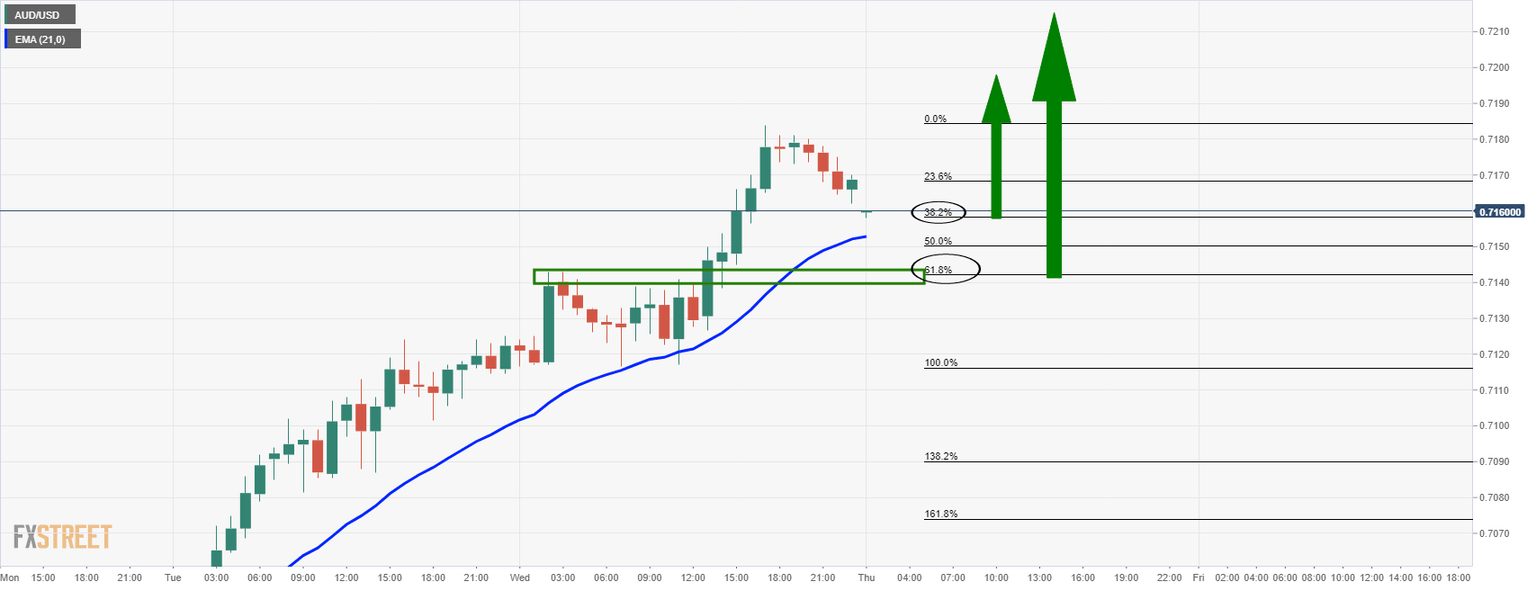

AUD/USD H1 chart

The price is correcting to a 38.2% Fibo near 0.7160. The market could easily flip higher from here, although a deeper test to the 61.8% golden ratio and the old resistance could be on the cards. This comes in just below 0.7150 and will have a confluence with the 21-EMA.

Bulls will be looking for bullish conditions and structure from where to engage with the potential fresh bullish impulse. If there are no bullish tendencies with the price extending lower, then the daily support structure will instead be in focus near 0.7110.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.