AUD/USD Price Analysis: Bears seeking a deep correction

- AUD/USD is back in the hands of the bears as the US dollar hardens.

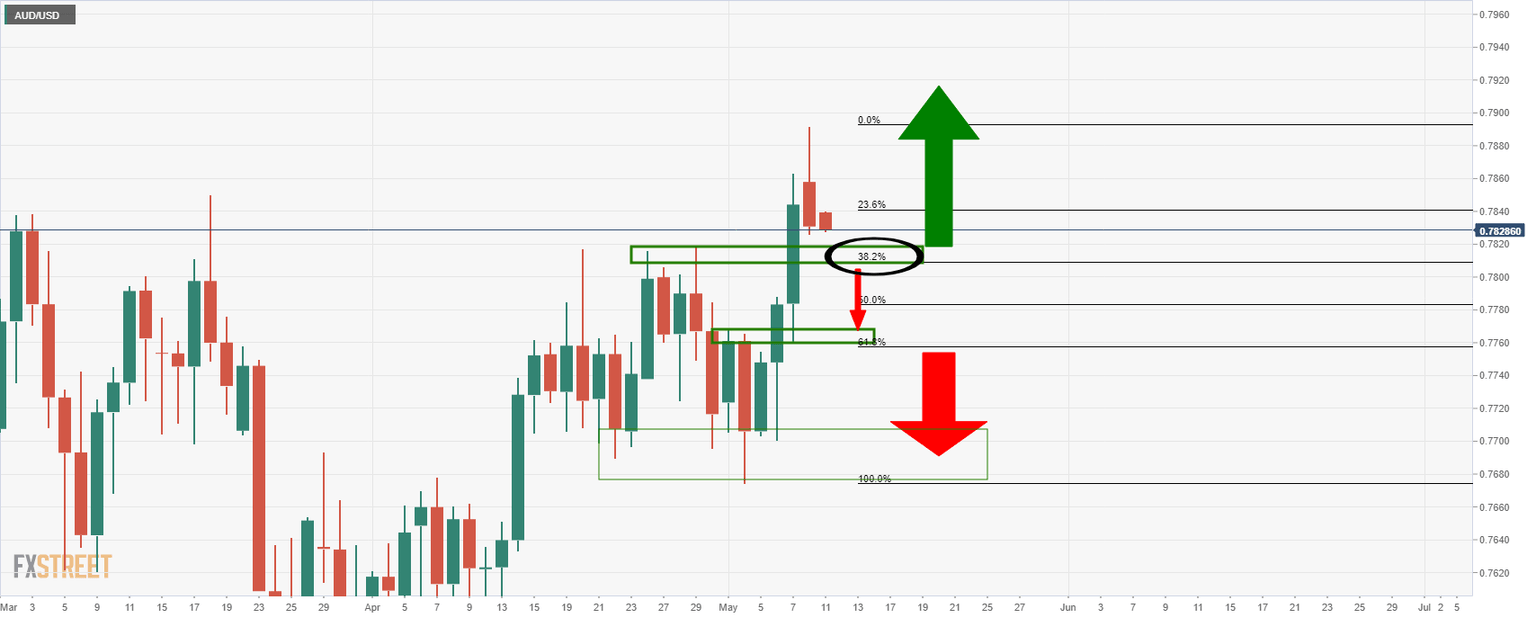

- Bulls need to defend the 38.2% Fibonacci or face being trapped back to prior structure.

AUD/USD has given back a sizeable amount of the bullish impulse over these past few sessions and the bulls need to commit to the purpose above a critical 38.2% Fibonacci retracement of the daily impulse.

The following illustrates the market structure on both a daily and 30-min time frame.

Daily chart

The daily chart shows that the price is under pressure having rallied way beyond the prior highs. a pullback was inevitable, but the questions whether the bulls will commit to where they need to.

A break of the 38.2% Fibo and support structure opens risk to a deeper 61.8% Fibo retracement and restest of the prior highs.

30 min chart

From a lower time frame perspective the outlook is illustrated with the price already being rejected by the prior support that is now acting as resistance at a key hour pivot point.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.