AUD/USD Price Analysis: Auctions below 0.6700 as soften Australian CPI cements steady RBA policy

- AUD/USD has shifted its business below 0.6700 after the Australian CPI softens consecutively.

- Subdued retail demand weighed heavily on Australian inflation.

- The 20-period EMA at 0.6686 is acting as a cushion for the Australian Dollar.

The AUD/USD pair is displaying topsy-turvy moves below the round-level resistance of 0.6700 in the Asian session. The Aussie asset has turned rangebound after a vertical downside move post-softening of the Australian Consumer Price Index (CPI).

Monthly Australian inflation (Fed) softened further to 6.9% from the prior release of 7.4% as households’ spending has trimmed dramatically. Households are struggling in bearing the burden of inflated goods and services with their nominal growth in earnings. This has bolstered the intention of pausing the policy-tightening spell by the Reserve Bank of Australia (RBA) from its April meeting.

Meanwhile, the US Dollar Index (DXY) has shown a firmer recovery from 102.40. The recovery move by the USD Index has escalated to 102.60.

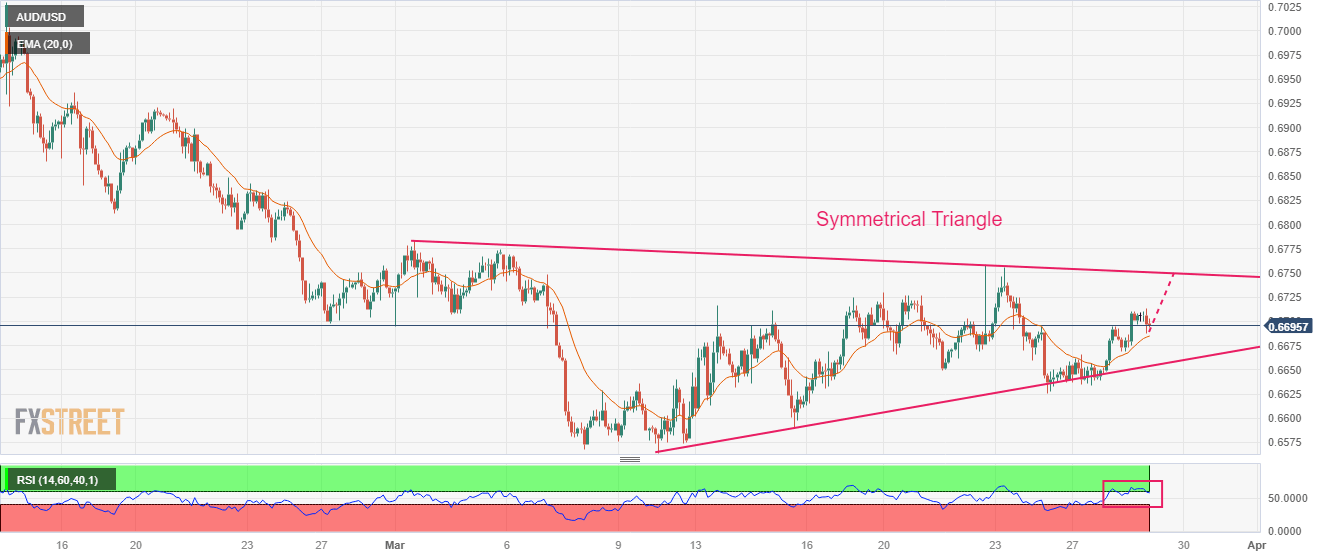

On a two-hour scale, AUD/USD has shown a decent upside after sensing strength near the upward-sloping trendline of the Symmetrical Triangle chart pattern, which is placed from March 10 low at 0.6564. The downward-sloping trendline of the chart pattern is plotted from March 01 high at 0.6784.

The 20-period Exponential Moving Average (EMA) at 0.6686 is acting as a cushion for the Australian Dollar.

In addition to that, the Relative Strength Index (RSI) (14) is making efforts in keeping itself in the bullish range of 60.00-80.00, which will keep the Australian Dollar in the grip of bulls.

Should the asset breaks above March 13 high at 0.6717, Aussie bulls would drive the asset further toward March 07 high at 0.67478 followed by the horizontal resistance plotted from February 23 low at 0.6781.

On the contrary, a slippage below March 15 low at 0.6564 will drag the asset toward October 4 high at 0.6547 and the round-level support at 0.6500.

AUD/USD two-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.