AUD/USD hits six-month low amidst US debt-ceiling impasse, investors mixed mood

- The AUD/USD takes a hit, trading at around 0.6505, as US debt ceiling discussions fail to conclude and tech stocks gain momentum due to rising interest in AI.

- The US economy demonstrates resilience with robust Retail Sales, Industrial Production, and a firm labor market, countering rising Initial Jobless Claims.

- Debt ceiling deadlock stirs fears over US AAA rating; Yellen warns of potential cash crunch by June.

AUD/USD tanks as Thursday’s North American session begins, amidst mixed market sentiment, with US debt ceiling discussions being the center stage, while the AI frenzy has taken tech stocks higher. In the meantime, the United States (US) economy is proving resilient amidst the recent data released. At the time of writing, the AUD/USD is trading at around 0.6511 after hitting a six-month low of 0.6503.

US economy shows resilience with the improved job market and GDP growth; the Australian economy faces pressure

US economic data showed that Initial Jobless Claims for the week ending on May 20 rose by 229K below estimates of 245K, according to data from the US Department of Labor. The US economy has gained momentum as Retail Sales, Industrial Production, business activity, and a “tight” labor market underpinned the US Dollar (USD). In a separate report, the US Bureau of Labor Statistics (BLS) showed that the second estimate of Gross Domestic Product (GDP) for Q1 was revised from 1.1% to 1.3%.

In the meantime, the US Dollar Index, which measures the buck’s performance against a basket of six currencies, rises for four consecutive trading days, up 0.21%, at 104.103. It should be said that a double-bottom chart pattern looms, and with an upside break above 105.883, that will validate the pattern.

US debt ceiling talks hit an impasse as the White House (WH) and the US Congress, led by US House Speaker Kevin McCarthy, failed to seal an agreement that could lift the US ceiling so that the country can pay its obligations, which, according to US Treasury Secretary Janet Yellen, saying the US would run out of cash by June 1. Some consequences of the political drama in Washington triggered a reaction by Fitch Rating, warning that the US AAA rating is under threat.

The AUD/USD continues to be pressured amidst the lack of a catalyst on the Australian front. The Reserve Bank of Australia’s (RBA) minutes showed the central bank’s beliefs that higher rates, inflation, and income tax would contribute to a slowdown in consumer spending.

Additionally, China’s economy losing momentum would likely keep the AUD/USD tilted to the downside. According to Bloomberg, “Recent data suggest gross domestic product growth this year will be closer to the government’s target of about 5%, contrary to expectations of a large overshoot formed earlier in the year.”

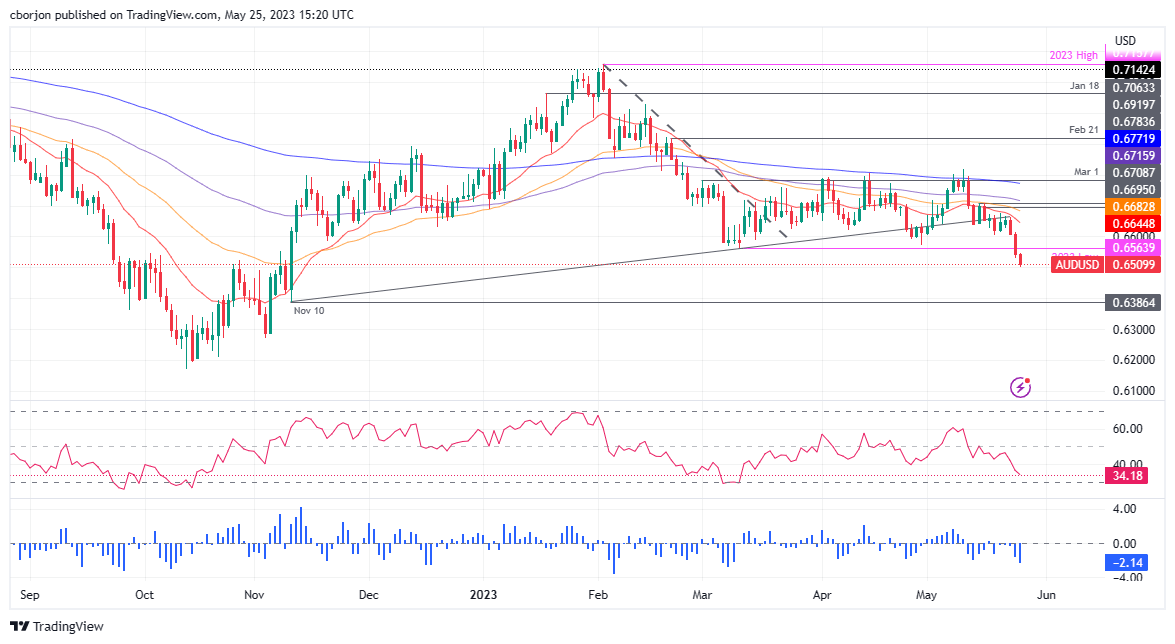

AUD/USD Price Analysis: Technical outlook

From a daily chart perspective, the AUD/USD is neutral to downward biased, with a clear path of challenging the November 10 daily low of 0.6386, but firstly, the AUD/USD pair must fall below crucial support levels. The first one would be 0.6500. A decisive break will expose the 0.6400 figure before testing the abovementioned area at the 0.6200 handle. Otherwise, if AUD/USD stays above 0.6500, the 0.6600 psychological figure is up for grabs.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.