AUD/USD recovers somewhat after Powell's words

- Federal Reserve leaves rates unchanged at 4.25%-4.50% as expected.

- Fed statement removes prior language on inflation progress, signaling a cautious approach.

- Jerome Powell was seen somewhat dovish in his presser.

The AUD/USD pair extended its decline on Wednesday, falling to 0.6220 following the Federal Reserve’s policy decision. As widely anticipated, the Fed left interest rates unchanged at 4.25%-4.50%, but the statement carried a hawkish tone. Notably, policymakers removed prior language indicating that inflation had made progress toward the 2% target, signaling a more cautious outlook on future rate cuts. The US Dollar strengthened immediately after the announcement, pressuring the Aussie lower. However, the pair managed to erase some of its initial losses as markets digested Powell’s comments.

The Federal Reserve maintained its policy rate but delivered a subtle hawkish shift in its statement. Unlike its December communication, the latest statement omitted any mention of inflation moving toward the Fed’s target, reinforcing expectations that policymakers are not in a hurry to cut rates. Fed Chair Jerome Powell reiterated that the US economy is maintaining solid growth, while the labor market remains strong, with unemployment still at low levels.

However, Powell later played down the significance of this change, calling it a "language cleanup" rather than a shift in policy stance. Initially, markets interpreted the removal of the inflation progress comment as hawkish, but Powell’s clarification made it appear more dovish. He emphasized that policy remains restrictive, though slightly less so, hinting that the Fed is not in a rush to cut rates further.

Powell also sidestepped a political questions and reinforced that while policy is still restrictive, it could transition to a non-restrictive stance over time. This added to the dovish undertones, contradicting the initial market reaction that had driven the US Dollar higher.

Technical overview

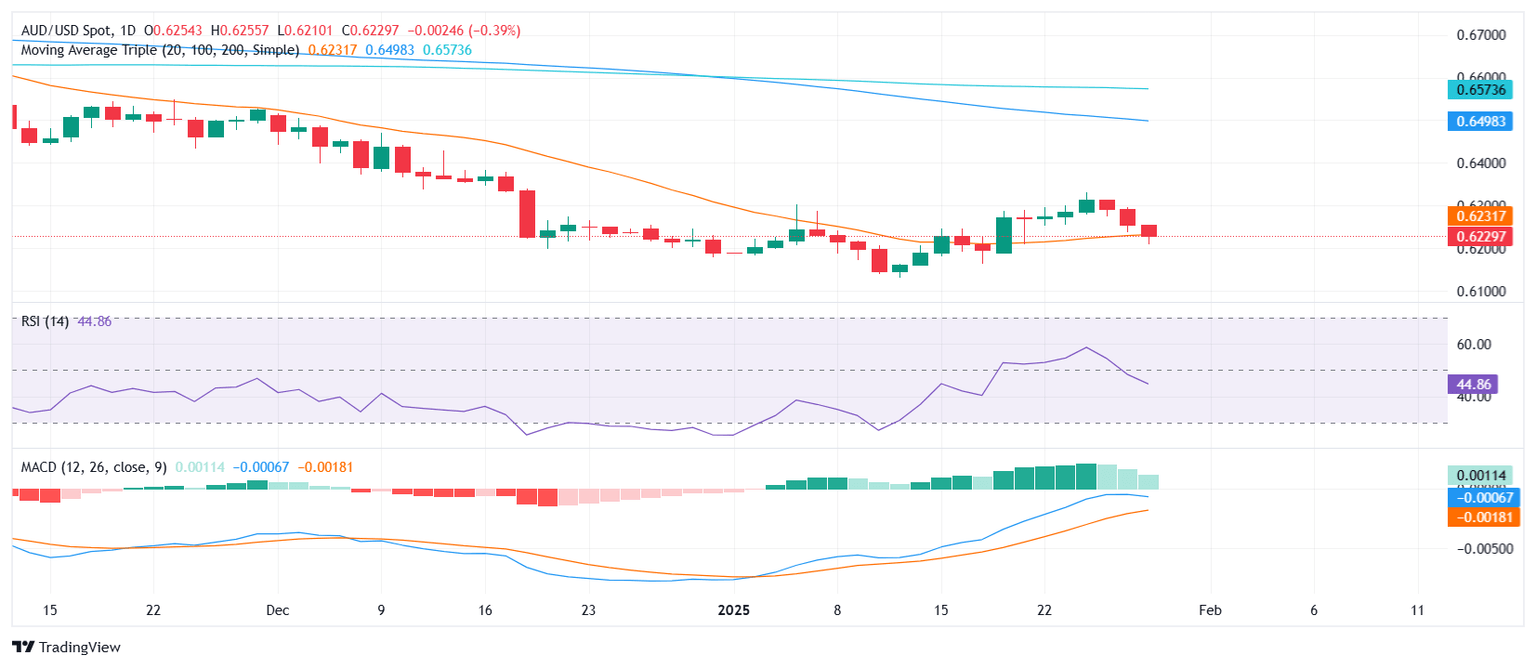

The AUD/USD remains under selling pressure, with the pair struggling to regain momentum. The Relative Strength Index (RSI) hovers in negative territory, reflecting bearish sentiment. Meanwhile, the MACD histogram prints rising green bars, suggesting some divergence. Key support lies at 0.6200, with a break below exposing 0.6170. On the upside, resistance is seen at 0.6230 (20-day Simple Moving Average).

AUD/USD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.