AUD/NZD recovers ground, eyeing critical Australian and New Zealand data

- On Monday, the AUD/NZD paused its selling trend, marking a two-day losing streak at the end of last week.

- New Zealand's June ANZ consumer and business surveys are eyed in this Wednesday's Asian session.

- Australia's AUD continues to be driven by anticipations of the upcoming CPI data, also due this Wednesday.

The AUD/NZD sellers took a Monday pause after the tally of a two-day losing streak at the end of last week. The Reserve Bank of Australia (RBA) and the Reserve Bank of New Zealand (RBNZ) moves are awaited by investors, who continue to place their bets.

In New Zealand, the June ANZ consumer and business surveys are in focus this Wednesday. The data for May showed a clear weakening in activity and easing inflation pressure, with the business confidence dropping to 11.20. Moreover, the consumer confidence index advanced to 84.90 in May but stayed at historically weak levels. Despite inflation receding slowly in the New Zealand services sector and some signs of fragility in the overall economy, the RBNZ is delaying its first rate cut for Q3 2025, contradicting the market which fully expects a cut this November.

For Australia, the spotlight turns to the May Consumer Price Index (CPI) data released this Wednesday. Headline inflation is expected to leap by two ticks to a five-month peak of 3.8% year on year. As for now, the swaps market gave up nearly all rate cut hopes in 2024 and approximates a 70% likelihood of the initial cut in February 2025. In the meantime, the RBA remains patient, maintaining that a considerable period will elapse before inflation sustainably sits within the 2-3% target range. It's worth noticing that Governor Bullock noted last week that the bank will do whatever is necessary to tackle inflation and this hawkish stance might cushion the Aussie.

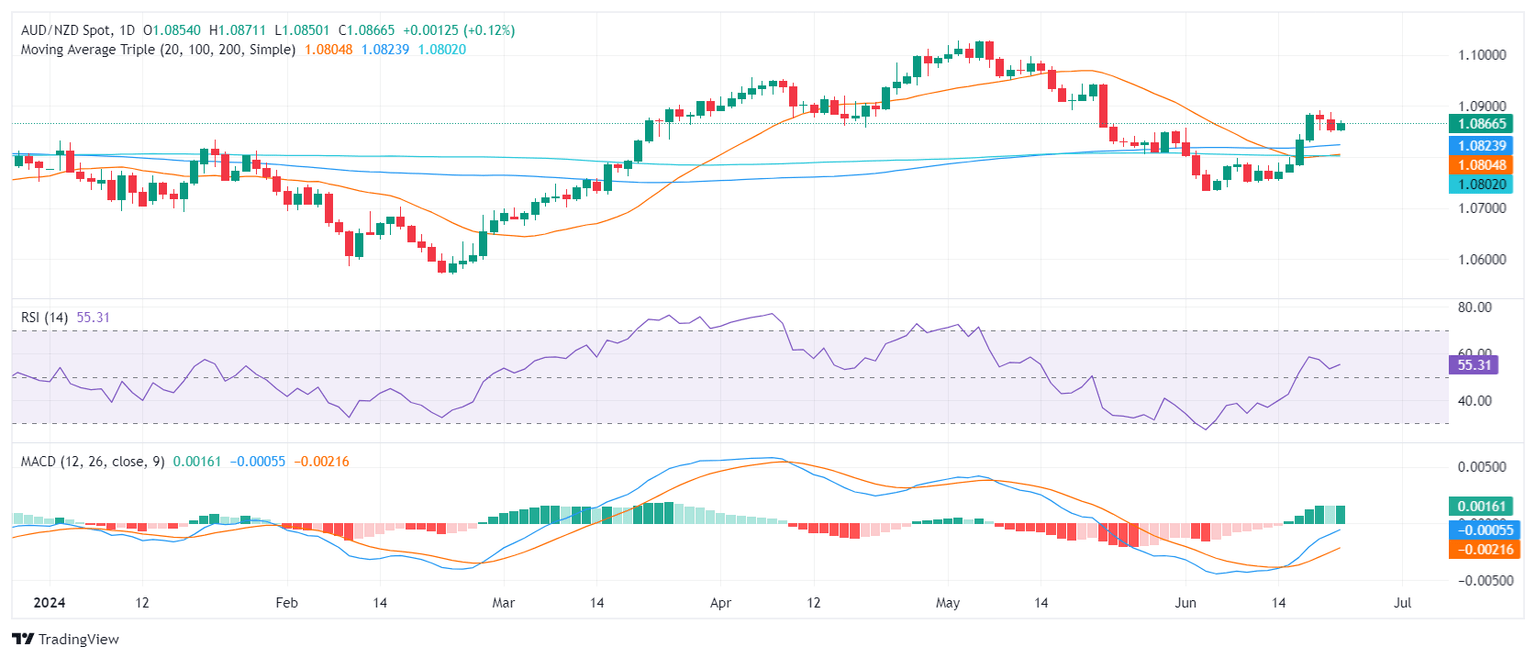

AUD/NZD technical analysis

In the near term, the technical outlook for the AUD/NZD cross remains positive, recording a gain of nearly 0.80% in the previous fortnight. While the indicators may have flattened, the overall scenario suggests that the bearish spell might be taking a break.

However, the Simple Moving Averages (SMA) position remains like previously mentioned, capping the upward potential.

AUD/NZD daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.