AUD/JPY Price Prediction: Consolidates near monthly top, 100.00 confluence holds the key for bulls

- AUD/JPY oscillates in a range below a fresh monthly top touched earlier this Tuesday.

- The mixed technical setup warrants some caution before positioning for further gains.

- A sustained strength beyond the 100 confluence will be seen as a fresh trigger for bulls.

The AUD/JPY cross seesaws between tepid gains/minor losses through the first half of the European session and now seems to have stabilized around mid-98.00s, just below the monthly peak touched earlier this Tuesday.

The Japanese Yen (JPY) continues with its volatile two-way price moves amid domestic political uncertainty, which could hinder the Bank of Japan's (BoJ) plan to steadily lift interest rates from near zero. This, in turn, fails to assist the AUD/JPY cross to build on the overnight modest gains and leads to subdued range-bound price action. That said, the prevalent risk-on mood continues to undermine the safe-haven JPY, which, along with the Reserve Bank of Australia's (RBA) hawkish stance, acts as a tailwind for the currency pair.

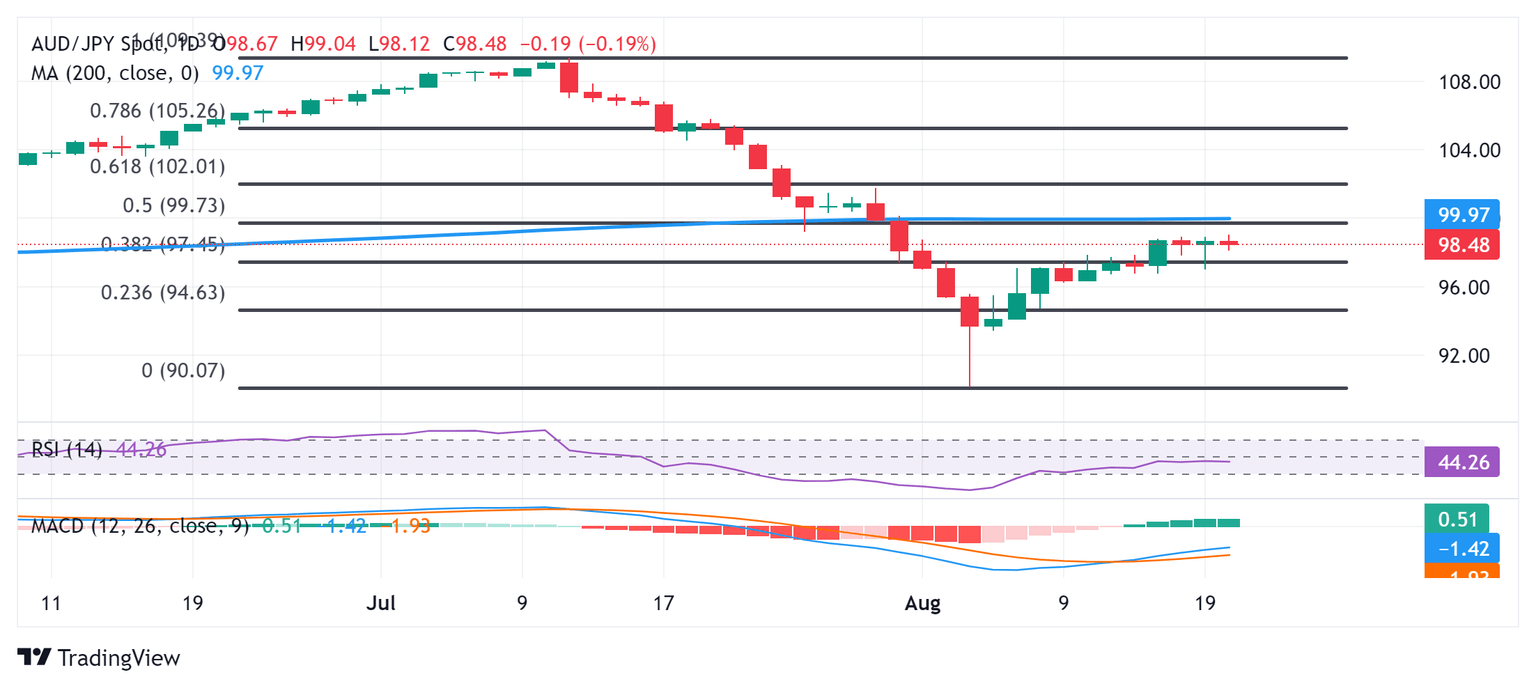

From a technical perspective, the AUD/JPY cross is holding comfortably above the 38.2% Fibonacci retracement level of the July-August downfall. This, in turn, supports prospects for an extension of the recent strong recovery from the vicinity of the 90.00 psychological mark, or the lowest level since May 2023 touched earlier this month. That said, mixed oscillators on the daily chart warrant some caution for bullish traders. Hence, any subsequent move up is more likely to remain capped near the 100.00 confluence resistance.

The said handle comprises the very important 200-day Simple Moving Average (SMA) and the 50% Fibo. level, which if cleared decisively will be seen as a fresh trigger for bullish traders. The AUD/JPY cross might then accelerate the positive move towards the 101.00 mark before aiming to test the 102.00-102.10 supply zone or the 61.8% Fibo. level.

On the flip side, the 97.45 area (38.2% Fibo. level) now seems to have emerged as immediate strong support. This is followed by the 97.00 round figure and support near the 96.30-96.25 region. Some follow-through selling below the 96.00 mark might expose the 23.6% Fibo. level, around the 94.65 region, with some intermediate support near the 95.55 horizontal zone and the 95.00 psychological mark.

AUD/JPY daily chart

Bank of Japan FAQs

The Bank of Japan (BoJ) is the Japanese central bank, which sets monetary policy in the country. Its mandate is to issue banknotes and carry out currency and monetary control to ensure price stability, which means an inflation target of around 2%.

The Bank of Japan has embarked in an ultra-loose monetary policy since 2013 in order to stimulate the economy and fuel inflation amid a low-inflationary environment. The bank’s policy is based on Quantitative and Qualitative Easing (QQE), or printing notes to buy assets such as government or corporate bonds to provide liquidity. In 2016, the bank doubled down on its strategy and further loosened policy by first introducing negative interest rates and then directly controlling the yield of its 10-year government bonds.

The Bank’s massive stimulus has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation. The BoJ’s policy of holding down rates has led to a widening differential with other currencies, dragging down the value of the Yen.

A weaker Yen and the spike in global energy prices have led to an increase in Japanese inflation, which has exceeded the BoJ’s 2% target. With wage inflation becoming a cause of concern, the BoJ looks to move away from ultra loose policy, while trying to avoid slowing the activity too much.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.