AUD/JPY Price Forecast: Struggles to continue winning streak

- AUD/JPY turns sideways near 97.00 after a three-day winning spree.

- The Australian Dollar rises on improved market sentiment and RBA Bullock’s hawkish interest rate guidance.

- Growing concerns over BoJ further policy tightening.

The AUD/JPY pair exhibits indecisiveness among market participants near 97.00 in Friday’s European session. The cross struggles to extend its winning spree for the fourth trading session on Friday. However, the near-term trend is bullish as the strong appeal of the Japanese Yen (JPY) as a safe haven amid market mayhem has diminished.

Lower-than-expected United States (US) Initial Jobless Claims for the week ending August 2 and higher-than-expected China’s Consumer Price Index (CPI) data for July have improved risk-appetite of market participants.

Meanwhile, easing expectations of more rate hikes by the Bank of Japan (BoJ) has also limited the upside in Yen. On Wednesday, BoJ Deputy Governor Shinichi Uchida said, “We won’t raise rates when markets are unstable.”

On the Aussie front, hawkish guidance from Reserve Bank of Australia (RBA) Governor Michelle Bullock on interest rates has boosted the Australian Dollar’s (AUD) appeal. Bullock said the central bank is vigilant to inflation risks and interest rates would be hiked further if needed.

Going forward, the next move in the Australian Dollar will be influenced by the Q2 Wage Price Index data, which will be published on Tuesday. Investors will keenly focus on the wage data as it influences consumer spending, which eventually impacts inflationary pressures.

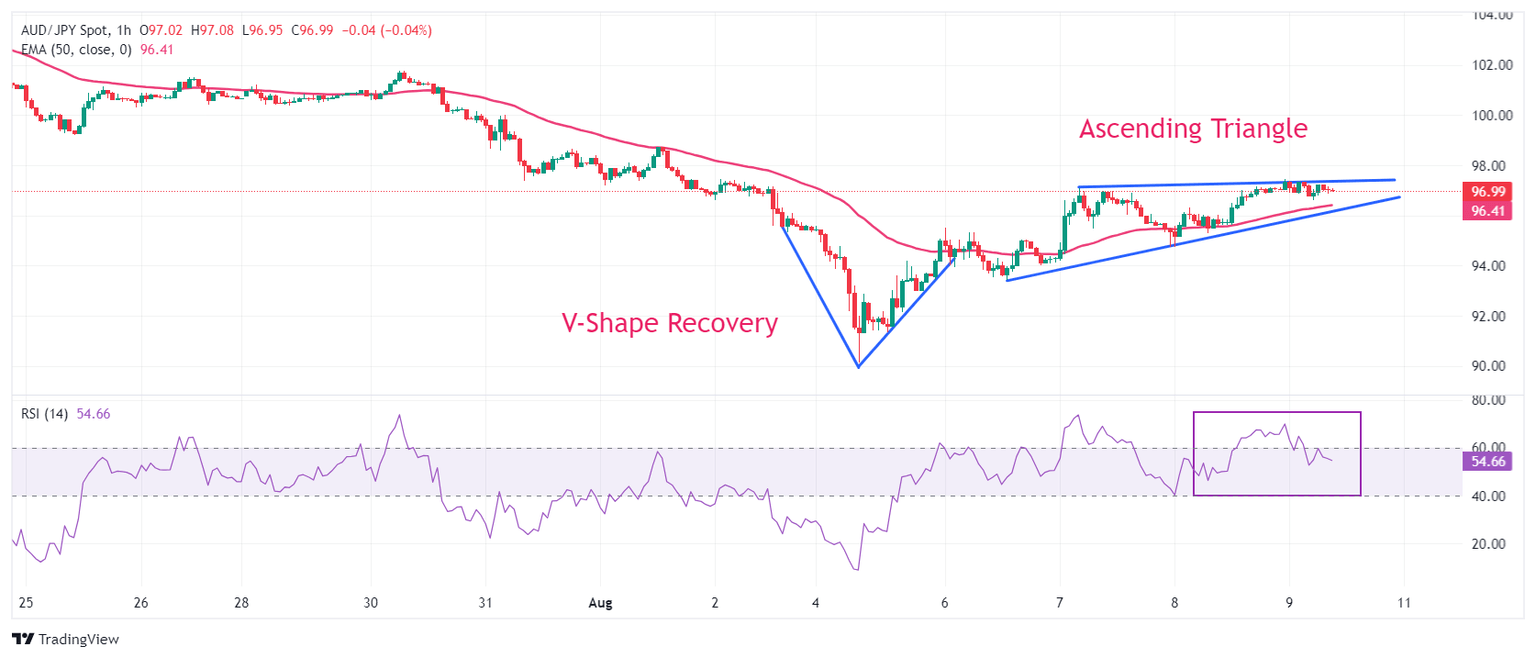

AUD/JPY oscillates in an Ascending Triangle chart pattern on an hourly timeframe, which exhibits a sharp volatility contraction. The 50-hour Exponential Moving Average (EMA) near 96.40 continues to provide support to the Australian Dollar bulls. Earlier, the asset delivered a V-shape recovery after posting a fresh annual low near 90.00.

The 14-period Relative Strength Index (RSI) falls inside the 40.00-60.00 range, suggesting a sideways trend.

The formation of a volatility contraction pattern after a strong recovery leads to a decisive break on the upside. The occurrence of the same would drive the asset towards 98.00 and August 1 high of 98.74.

On the contrary, a breakdown below the round-level support of 95.00 will expose the cross to August 6 low at 93.42, followed by August 5 average price of 92.46.

AUD/JPY hourly chart

Economic Indicator

RBA Governor Bullock speech

Michele Bullock is the the ninth Governor of the Reserve Bank of Australia. She commenced her current position in September 2023, replacing Philip Lowe. Bullock was the Assistant Governor (Financial System) at the Reserve Bank of Australia, a position she held since October 2016.

Read more.Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.