AUD/JPY Price Analysis: Sellers look for entry below 78.00, Australian GDP eyed

- AUD/JPY consolidates near 16-month high above 78.00.

- 50-HMA, late-August top restrict immediate downside.

- Short-term descending triangle challenges the upside moves amid bearish MACD.

- Aussie GDP expected to drop 6.0% versus -0.3% in Q2 2020.

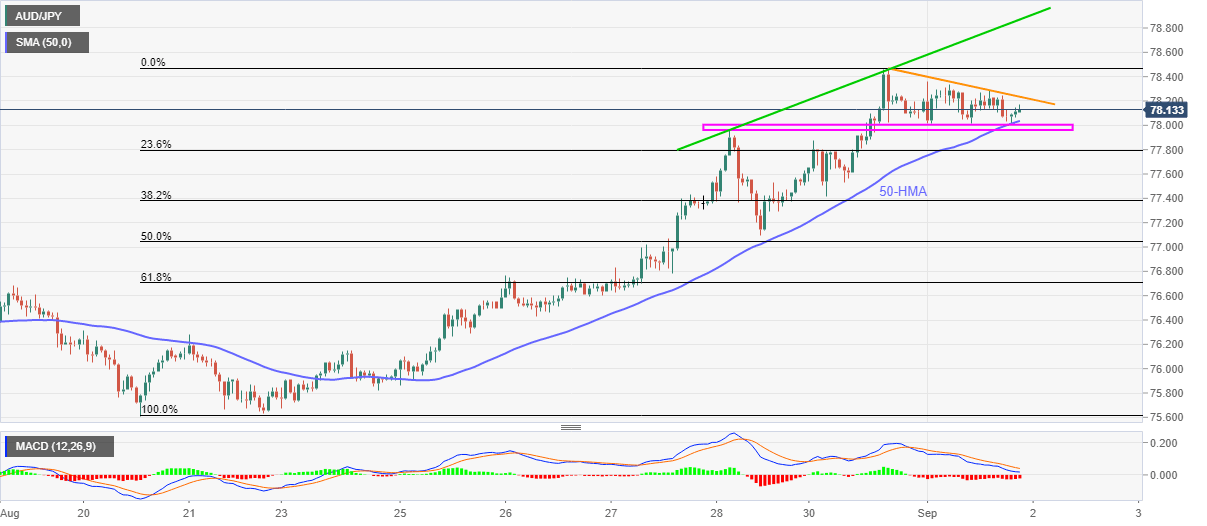

AUD/JPY struggles for a clear direction around 78.15 during the early Wednesday morning in Asia. While looking at the pair’s latest performance, it seems to form a descending triangle on the hourly chart amid bearish MACD. However, sellers are waiting for the second quarter (Q2) GDP data from Australia, as well as a clear break below 78.00, to take entries.

Read: Australian GDP Preview: Aussie bulls to weather an economic shock?

In doing so, multiple bounces off the range comprising August 28 top and 50-HMA offer strong support between 78.00 and 77.95.

Should the anticipated downbeat GDP print drags the quote under 77.95, Friday’s low near 77.10 will be the sellers’ first choice ahead of 50% Fibonacci retracement of August 20-31 upside close to 77.00.

Given the bears’ dominance past-77.00, a 61.8% Fibonacci retracement close to 76.75 will be the next to watch.

Alternatively, an upside clearance of the triangle’s resistance line, at 78.23 now, will attack the multi-month-old high near 78.45 while targeting an ascending trend line from August 28, near 78.90, during the further rise.

AUD/JPY hourly chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.