AUD/JPY Price Analysis: Refreshes weekly high near 98.00 ahead of BoJ-RBA policy decisions

- AUD/JPY jumps to 98.00 as the BoJ is expected to delay plans of exiting an ultra-dovish stance.

- BoJ Ueda manifested a bleak assessment of Japan’s economic outlook.

- The RBA is expected to keep its OCR steady at 4.35%.

The AUD/JPY pair prints a fresh weekly high near 98.00 in Monday’s early American session as the market sentiment remains upbeat. The market mood remains cheerful as China’s better-than-projected Retail Sales and Industrial Production data for February indicated a robust recovery in domestic demand.

The Australian Dollar capitalizes on China’s upbeat data, which is considered a proxy for Chinese economic growth. Going forward, the next move in the Australian Dollar will be guided by the Reserve Bank of Australia’s (RBA) interest rate decision, which will be announced on Tuesday. The RBA is widely anticipated to keep the Official Cash Rate (OCR) steady at 4.35%.

Meanwhile, the Japanese Yen remains under pressure as Bank of Japan (BoJ) Governor Kazuo Ueda’s bleak assessment of the economy has undermined sticky inflation above 2% and higher wage hikes rewarded by big firms. Market expectations for the BoJ announcing an end to negative interest rates and the Yield Curve Control (YCC) policy have shifted for the April meeting as uncertainty persists over the wage price spiral.

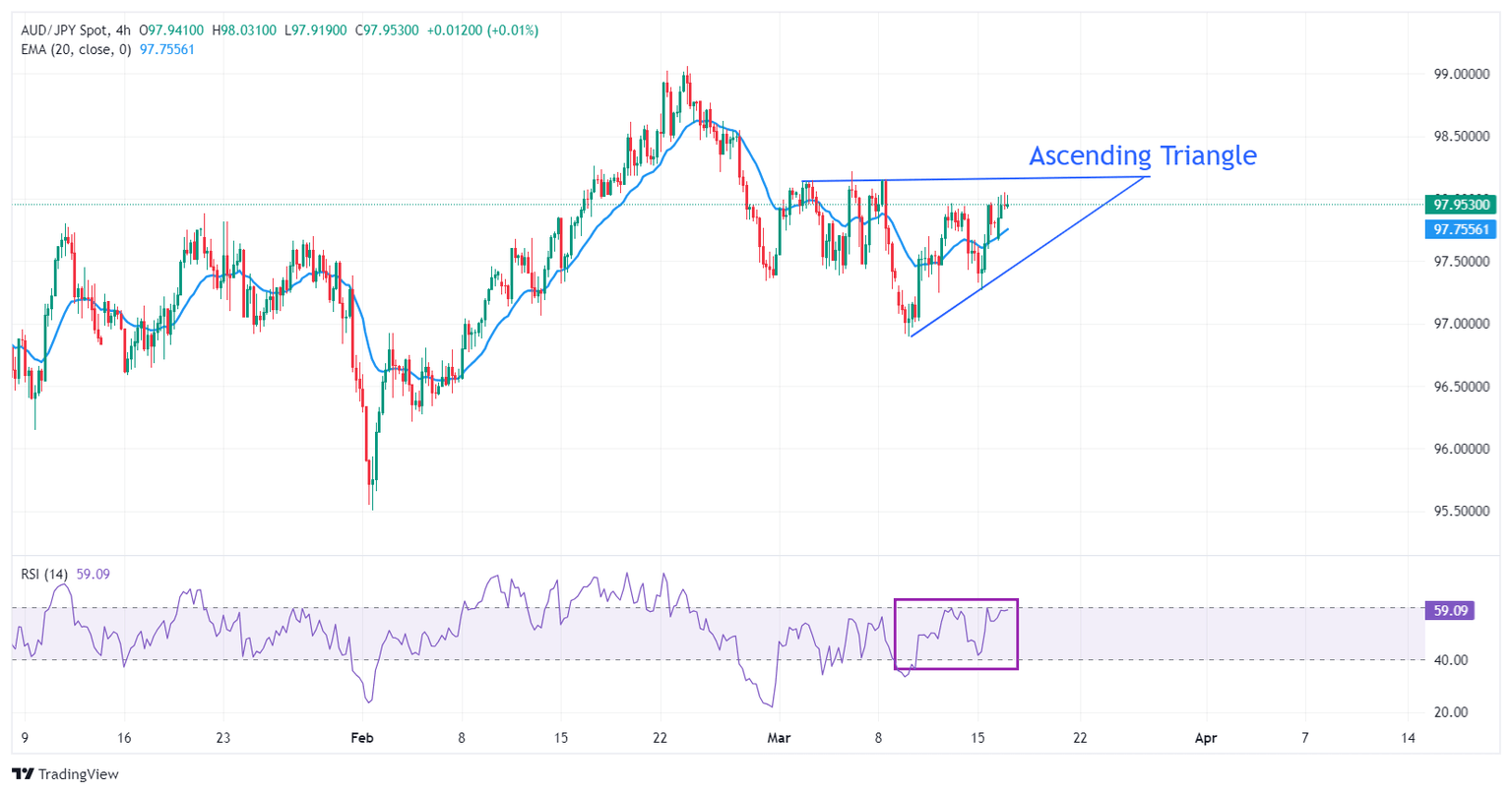

AUD/JPY approaches the horizontal resistance of the Ascending Triangle pattern formed on a four-hour timeframe, plotted from the March 4 high at 98.13. The upward-sloping border of the aforementioned pattern is placed from March 11 low at 96.90.

The 20-day Exponential Moving Average (EMA) near 97.75 remains sticky to the risk-barometer, indicating a sideways trend.

The 14-period Relative Strength Index (RSI) oscillates inside the 40.00-60.00 region, which indicates indecisiveness among investors.

The appeal for the AUD/JPY would strengthen if the asset breaks above March 6 high at 98.27, which will drive the asset towards February 20 high at 98.61 and February 23 high at 99.06.

On the flip side, the asset's appeal could weaken if it drops below its March 15 low at 97.27. This would expose the asset to its March 11 low at 96.90. A breakdown below that would extend the downside towards its January 16 low at 96.59.

AUD/JPY four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.