AUD/JPY Price Analysis: Grinds near 92.00 post-RBA Minutes, inverse H&S teases bulls ahead of BOJ

- AUD/JPY grinds higher even as RBA Minutes fail to impress traders.

- RBA Minutes stated that policymakers discussed all options, eyed further rate hikes.

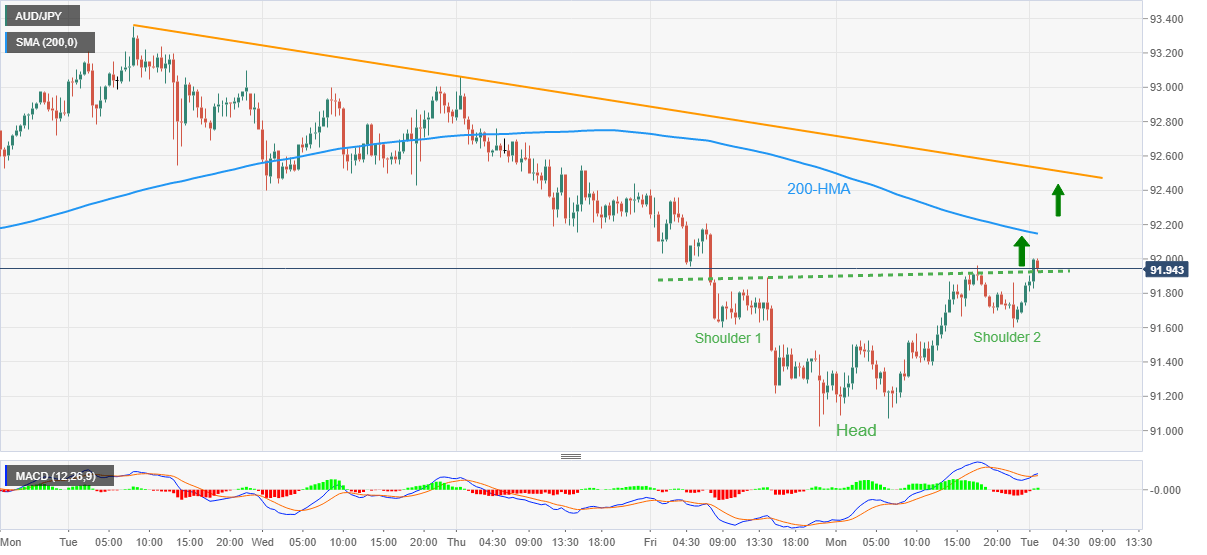

- Inverse Head-and-Shoulders pattern, impending bull cross on MACD lure buyers.

- 200-SMA, weekly resistance line add to the upside filters.

AUD/JPY picks up bids to 91.90 as buyers attack a short-term key hurdle after the Reserve Bank of Australia's (RBA) latest Monetary Policy Meeting Minutes during early Tuesday.

Even so, the cautious mood ahead of the Bank of Japan’s (BOJ) monetary policy meeting tests the cross-currency pair traders as it portrays the Inverse Head and Shoulders bullish chart pattern amid the looming bull cross on the MACD.

That said, the quote’s further upside aims for the 200-SMA level surrounding 92.15 before a one-week-old resistance line, close to 92.55 by the press time, could challenge the AUD/JPY buyers.

It’s worth noting that the inverse H&S formation suggests the theoretical target of 92.80 but an upside break of the 92.55 resistance line, mentioned above, won’t hesitate to challenge the previous weekly top of 93.35. In doing so, the quote may take a halt near the 93.00 round figure.

On the contrary, a downside break of the stated bullish formation’s neckline, currently around 91.90, could drag the quote back towards the monthly low marked the previous day near the 91.00 round figure.

However, lows marked in October and August, respectively near 90.85 and 90.55, could challenge the AUD/JPY bears afterward.

AUD/JPY: 30-minute chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.