You may have previously heard someone say, “ Vertical spreads are the same as getting weekly paychecks! “ Is that even true?

We’re going to go in-depth on each strategy to discuss each of the pros and cons. I’m also going to discuss how each strategy should be used in any given market condition. Since we’ve previously discussed credit spreads and debit spreads, you’re probably wondering… what’s the BEST vertical spread option strategy?

Let’s break down each of the vertical spread option strategies in detail and look at examples in Tasty Trade.

Call Debit Spread

What is a Call Debit Spread? A call debit spread is a position in which you buy a call option and sell a call option at different strike prices using the same expiration date.

When should this strategy be used? This strategy is used when you believe the stock is increasing in price, but not a dramatic movement.

What are the benefits of this strategy? Trading this position can potentially reduce the overall cost associated with taking on the trade. This type of strategy also reduces the break-even price of the trade.

When does this trade lose money? When the underlying stock moves sideways or downward.

What is the max risk for this trade? The max risk associated with this strategy is the cost of the premium paid to take on the trade.

What is the max reward for this trade? The max reward for this strategy is the difference between the strike price of the two calls, multiplied by 100. Minus the premium paid to take on the trade.

Call Debit Spread Example

-

Reduced Margin Requirement: $910

-

Max Risk Reduced: $910

-

Max Reward: $4090

Put Debit Spread

What is a Put Debit Spread? A put debit spread is a position in which you buy a put option and sell a put option at different strike prices with the same expiration date.

When should this strategy be used? This strategy is used when you believe the stock is decreasing in price.

What are the benefits of this strategy? Trading this position can potentially reduce the overall cost associated with taking on the trade. This type of strategy also lowers the break-even price of the trade.

When does this trade lose money? The underlying stock moves sideways or downward.

What is the max risk for this trade? The max risk associated with this strategy is the cost of the premium paid to take on the trade.

What is the max reward for this trade? The max reward for this strategy is the difference between the strike price of two calls, multiplied by 100. Minus the premium paid to take on the trade.

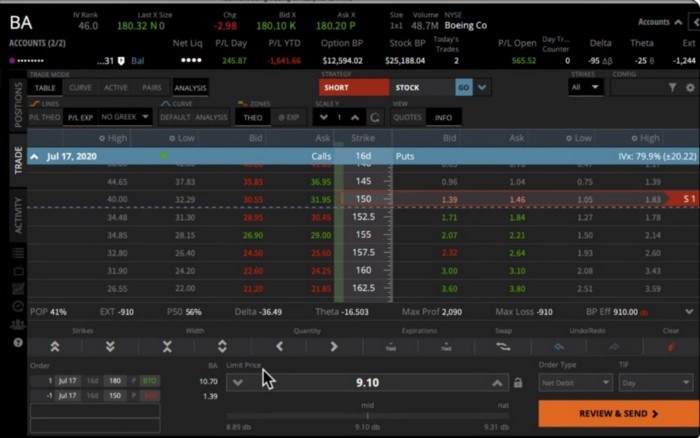

Put Debit Spread Example

-

Reduced Margin Requirement: $910

-

Max Risk Reduced: $910

-

Max Reward: $2090

Call Credit Spread

What is a Call Credit Spread? A call credit spread is a position in which you sell a call option and buy a call option as protection. These option contracts have different strike prices but have the same expiration date.

When should this strategy be used? This strategy is used when you believe the stock is decreasing in price or trading sideways.

What are the benefits of this strategy? Trading this position produces a credit from the premium received for selling the put option. Buying the additional call option provides protection, limiting the risk of the trade.

When does this trade lose money? This trade loses money when the underlying stock moves up quickly past your strike price.

What is the max risk for this trade? The max risk associated with this strategy is the difference between the strike prices, multiplied by 100.

What is the max reward for this trade? The max reward for this strategy is the premium received for selling the call option, minus the premium paid for protection.

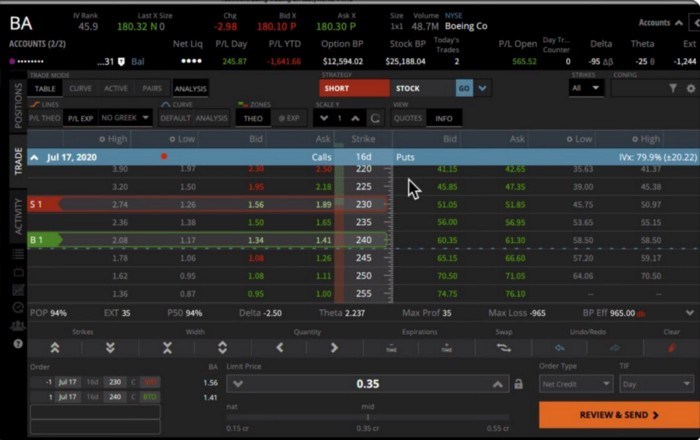

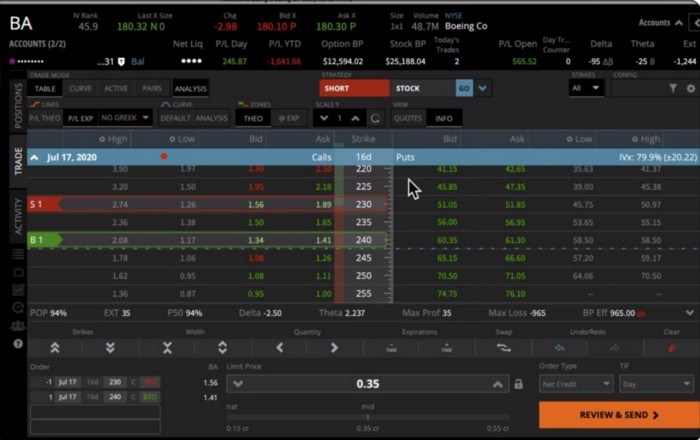

Call Credit Spread Example

-

Margin Requirement: $965

-

Max Risk: $965

-

Max Reward $35

-

Premium Received: $35

Put Credit Spread

What is a Put Credit Spread? A put spread is a position in which you sell a put option and buy a put option as protection. These option contracts have different strike prices but have the same expiration date.

When should this strategy be used? This strategy is used when you believe the stock is increasing in price or trading sideways.

What are the benefits of this strategy? Trading this position produces a credit in the form of the premium received for selling the put option. Buying the additional put option provides protection, limiting the risk of the trade.

When does this trade lose money? The underlying stock moves downward sharply.

What is the max risk for this trade? The max risk associated with this strategy is the difference between strike prices, multiplied by 100.

What is the max reward for this trade? The max reward for this position is the premium received for selling the put option, minus the premium paid for protection.

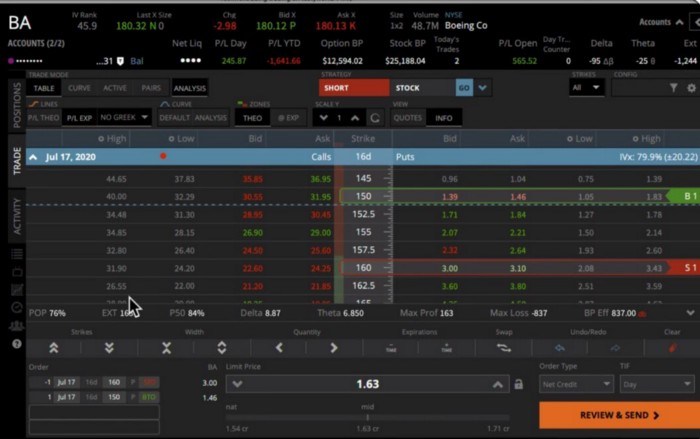

Put Credit Spread Example

-

Margin Requirement: $837

-

Max Risk: $837

-

Premium Received: $163

-

Max Reward: $163

How Do I Choose The Best Vertical Spread Option Strategy?

I personally only select options that match my trading plan. You’ve probably heard me say it a million times if you’ve heard it once…

There are 3 things you need to know to be successful at trading.

1.) You need to know which options to trade

2.) You need to know when to enter

3.) You need to know when to exit

I use the PowerX Optimizer to help me execute these trades successfully.

Trading Futures, options on futures and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. The lower the day trade margin, the higher the leverage and riskier the trade. Leverage can work for you as well as against you; it magnifies gains as well as losses. Past performance is not necessarily indicative of future results.

Editors’ Picks

Gold plunges on sudden US Dollar demand

Gold drops markedly on Thursday, challenging the $4,900 mark per troy ounce following a firm bounce in the US Dollar and amid a steep sell-off on Wall Street, with losses led by the tech and housing sectors.

EUR/USD turns negative near 1.1850

EUR/USD has given up its earlier intraday gains on Thursday and is now struggling to hold above the 1.1850 area. The US Dollar is finding renewed support from a pick-up in risk aversion, while fresh market chatter suggesting Russia could be considering a return to the US Dollar system is also lending the Greenback an extra boost.

GBP/USD change course, nears 1.3600

GBP/USD gives away its daily gains and recedes toward the low-1.3600s on Thursday. Indeed, Cable now struggles to regain some upside traction on the back of the sudden bout of buying interest in the Greenback. In the meantime, investors continue to assess a string of underwhelming UK data releases released earlier in the day.

LayerZero Price Forecast: ZRO steadies as markets digest Zero blockchain announcement

LayerZero (ZRO) trades above $2.00 at press time on Thursday, holding steady after a 17% rebound the previous day, which aligned with the public announcement of the Zero blockchain and Cathie Wood joining the advisory board.

A tale of two labour markets: Headline strength masks underlying weakness

Undoubtedly, yesterday’s delayed US January jobs report delivered a strong headline – one that surpassed most estimates. However, optimism quickly faded amid sobering benchmark revisions.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.