Keep reading to discover why it instils supreme confidence.

For context:

By keeping you present, multiple points of evidence silence the voice of doubt, ensuring it doesn't interfere with your trading.

But it's the way in which you stay present that positions you two to three steps ahead of the crowd, ensuring you:

-

Don't miss moves.

-

Avoid giving back profits.

-

Enter with surgical precision to limit harm to a paper cut.

However, achieving this requires all the stars to align. Agree? This is equivalent to accumulating multiple points of evidence.

As evidence accumulates, so do the odds of making winning trades.

Example: On Wednesday the 13th of this month, evidence for a short trade was as follows:

With our sequence of 11 points of evidence, awaiting the final piece feels like a 'fait accompli'.

But instead of preempting our process:

We wait for our final piece of evidence which requires an existing segment of aggressive sellers to move onside. Then something unexpected occurs...

Despite all the preceding evidence, the segment of aggressive sellers remains offside. It's such a rare occurrence I can count the times I've seen it on one hand.

What happens next?

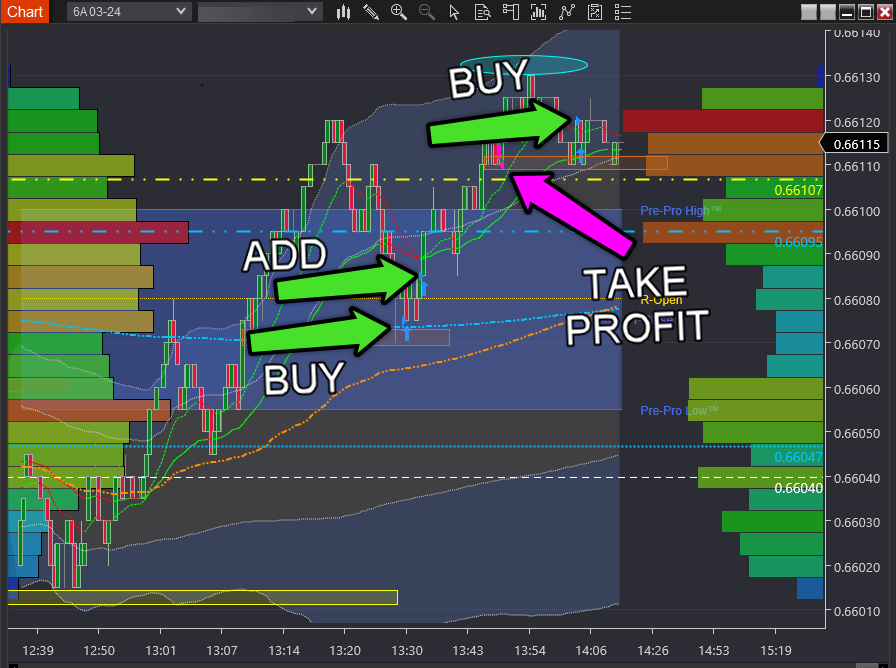

Despite all the evidence indicating a high-probability short trade, we now find ourselves executing the Once Bitten Twice Shy playbook trade on the long side.

What's the meaning behind once bitten twice shy?

The aggressive sellers found themselves in a deeply losing trade. During this period, they experienced moving deep into the red and the associated emotional discomfort beyond what they anticipated.

As the pain subsides (almost returning to a profitable position) relief washes over them.

But when they witness the price reversing against them for a second time—their emotional distress reignites—intensifying with each upward tick.

Coupled with the fresh memory of past losses they hit the 'eject button' on the trade to avoid further financial loss and emotional pain.

Back to the short trade evidence:

When markets defy such odds they often mark significant turning points.

Traders who recognise these opportunities act with conviction—increasing their position size.

Increased position size means greater payouts—essential for meaningful trading results.

Also known as outlier returns they're essential to winning the trading game.

In the trading above, notice the immediate add to increase the size of the trade. This is a rare opportunity where as a trader you need to press (aka increase your exposure).

And notice both above and below the strategic profit taking along the way while also continuing to increase the position using the recently banked profits.

Remember

Without multiple points of evidence, we wouldn't distinguish this trade opportunity from any other.

Key takeaways

Imagine yourself at your trading desk, observing multiple points of evidence, knowing the more connections you make, the greater your confidence grows.

This approach keeps you deeply engaged in the trading process, leaving no room for self-sabotaging thoughts to undermine your decisions. Make sense?

Now, imagine consistently executing similar trades daily for months.

Do you have any guesses as to why you're always strides ahead of the crowd?

Consider this:

Navigating the market can be overwhelming for many people, making trading a nerve-wracking experience. Perhaps you've felt this way, too?

Constant discomfort, wavering confidence, and inconsistent results can weigh heavily on one's mental well-being.

These challenges often cloud your judgment, hindering your ability to spot genuine opportunities and avoid pitfalls. Sound familiar?

On the flip side:

The trading scenario described above holds true for every trade when you employ multiple points of evidence and playbook trades, reinforcing your confidence and competence.

Unlike the majority, you gain clarity on when to engage with the market and when to step back, regardless of surface-level allure.

Tell me:

How many times have you heard "Learn to take your losses"?

Probably countless times. But is it helpful? Tell you in a second.

Taking losses without knowing the real odds of the trade working and without having supreme confidence doesn't fix your trading results. Maybe it's said with good intentions, but in reality, it's unhelpful advice.

Why is that?

The fundamental principle behind multiple points of evidence is safety first. If you've practiced this method repeatedly starting with simulation, then tiny losses are easy to accept.

Trading in simulation to gain experience and prove you can make trades which, at worst, are a papercut builds your confidence.

You can then transition to employing the same strategy in real-life trading.

This is the process I went through at a professional trading firm, so it's certainly the best approach for working with clients, as confidence plays a crucial role.

In closing

Now you know why multiple points of evidence are so much more than 'finding good trades'. They take a safety-first approach by showing you when not to trade and how to limit trades that don't work to papercuts. Moreover, they empower you to combat self-sabotage and bolster your self-confidence.

If you're ready to transform your trading by implementing multiple points of evidence, reach out to someone with an extensive understanding of the subject who's experienced in transferring these skills.

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

EUR/USD: US Dollar comeback in the makes? Premium

The US Dollar (USD) stands victorious at the end of another week, with the EUR/USD pair trading near a four-week low of 1.1742, while the USD retains its strength despite some discouraging American data released at the end of the week.

Gold: Escalating geopolitical tensions help limit losses Premium

Gold (XAU/USD) struggled to make a decisive move in either direction this week as it quickly recovered above $5,000 after posting losses on Monday and Tuesday.

GBP/USD: Pound Sterling braces for more pain, as 200-day SMA tested Premium

The Pound Sterling (GBP) crashed to its lowest level in a month against the US Dollar (USD), as critical support levels were breached in a data-packed week.

Bitcoin: No recovery in sight

Bitcoin (BTC) price continues to trade within a range-bound zone, hovering around $67,000 at the time of writing on Friday, and falling slightly so far this week, with no signs of recovery.

US Dollar: Tariffed. Now What? Premium

The US Dollar (USD) reversed its previous week’s decline, managing to stage a meaningful rebound and retesting the area just above the 98.00 barrier when tracked by the US Dollar Index (DXY).

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.