Below I’ve created a checklist, which will help you correctly prepare for the trading day. Most of the work in trading is done before the market opens. Some, the better you prepared, the more stable your trading is going to be.

Step 1. Are you emotionally and physically capable to trade today?

That’s right – your first question should be not about the markets, but about yourself. Are you feeling healthy today? Did you sleep well at night? Did you have any stressful situations today or the day before?

You are the main trading instrument – don’t underestimate the importance of your physical and mental state! Experiments with poker players have shown that people tend to be more risk seeking and less prudent after sleep deprivation and other unusual physical states. Just don’t trade if you have one. Go take a rest.

Also, if you are anxious about the stressful situation outside the market, resolve the situation and get back to trading after that. Markets will be there tomorrow. You will do a good job as a risk manager removing yourself from the process for a while.

Step 2. Do markets await important news or economic releases?

Traders often forget about economic releases which can make volatility explode. They just forget, too much focusing on chart analysis. Surprisingly, a big move appears “from nowhere” and wipes out our trader from a position.

To avoid getting caught in similar circumstances, it’s worth opening economic calendar and watching whether any important releases are underway. I prefer to use this one since it’s very convenient, but you can use other of your choice, or even watch calendars of events on official websites of FED and other institutions.

Not all releases influence all markets, some are local (like interest rate decision from B

ank Of New Zealand, for example), some influence markets on a broader scale (like Non-farm payrolls). Discover what release will influence your preferred trading instrument and monitor economic calendar for that. For example, those trading Crude Oils are affected by Petroleum status report.

Step 3. Does the weekly chart show any prominent trend?

Next step is to switch to the chart of your preferred instrument and note: is market trending or balanced? It price located outside of important extremes or is it located inside?

Strong trending activity may be an indication of big money involved and it’s better to take it into consideration. It doesn’t mean that you automatically would search for continuation trade if you see a strong trend, but you would think twice before accepting reversal trade. Strong trends don’t reverse very quickly.

Traders often rush to trade, but those who are patiently examining long-term trends have an edge over the rest, even in day trading.

The example of a trending market is shown below (Euro FX futures, Weekly chart*):

The example of a balanced market is shown below (Crude Oil futures, Weekly chart*):

Step 4. Does the daily chart show “one time-framing move”?

After you’ve found trending market on a weekly chart, it’s worth opening daily chart of your preferred instrument and see whether there is a sequence of at least 2-3 days with higher lows and higher highs (for ascending trend) and lower lows and lowers highs (for descending trend).

“One time-framing move” is an indication of imbalance between supply and demand that is visible right now. In case one is visible on the chart, window of opportunity is open – you may monitor for continuation trades or filter reversal trades.

Example of “one time-framing move” is shown below (E-min S&P500 future, Daily chart):*

Step 5. Is volatility of your preferred instrument high or low?

If you haven’t found any clues of a strong trend, don’t get disappointed – you still can trade on smaller time frames in short-term perspective (1-3 days).

In this case, you’d better make sure that markets which you want to trade are volatile enough. If volatility is very small, your expenses for day or short-term trading (stop-losses and spreads) would be more difficult to cover with profits (since they are limited due to limited opportunities).

Important note: in this article, we are talking about historical volatility only! There are different types of volatility in trading – we are not going to cover them all here. Just remember, that when we write “volatility”, we mean “historical volatility”.

Volatility can be measured in several ways listed below (it’s recommended to measure it on a daily chart):

With Bollinger Bands Indicator;

With the Average True Range Indicator;

With StdDev indicator;

Explanation of each indicator is beyond the scope of our article. We hope to do it in the next articles. A common way of measuring volatility is straightforward: the more value of an indicator, the more is volatility.

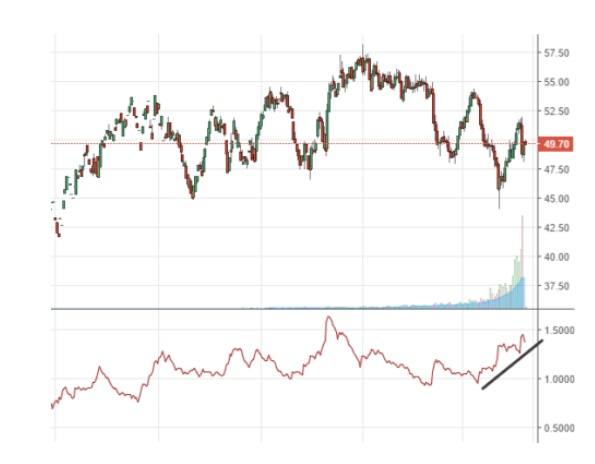

On a screenshot below you see, that volatility on the chart of CL* (Crude oil future) is going up (ATR is moving higher). Thus, this market can be traded in spite of the lack of directional (trending) component. Of course, we are talking about trading short-term swings in this case.

Step 6. Is rotational factor big/small?

The rotational factor is an ability of a price to generate “choppy” moves around current price level. The more is a rotational factor, the riskier would be day trading – your stops could be captured by the “noisy move” in this case.

The example of market phase with big rotational factor is shown below* (EURUSD, M30). You may see that choppy and manipulative market action is pretty difficult to trade. By the way – the more is a rotational factor, the fewer odds are that big time frame buyers/sellers are there – you can observer trading range on daily or weekly charts.

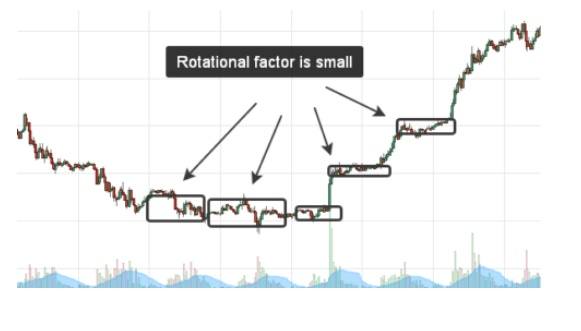

You can view the example of a small rotational factor below* (it’s EURUSD again, M30). Note that small rotational factor was the prelude for the notable breakout. In this case, intra-day volatility is smaller, thus your stops can be placed closer to the price action. In case you capture a large trending day, your profit/loss ratio may be significant:

Step 7. Combine everything together and apply points on each step.

After you completed everything, you can aggregate all pieces of information to a list and apply 1 point to each observation.

For example, if you see that market was trending on a weekly chart, you add 1 point to your list. Then, you see "one-timeframing" move on a daily chart, add 1 point again. Thus, you go through your checklist, and in case, you have many points added, you can add this market to a watch-list and start monitoring for possible entry points.

Checklist won’t tell you when to buy or to sell, it just helps you focus attention on potentially interesting markets, which contain opportunity.

Setups for entry are a completely different story.

Trading the financial markets is associated with increased level of risk. Past performance is not indicative of future results. All materials are provided for educational purposes only and by no means may serve as a trading or investment advice.

Editors’ Picks

EUR/USD: Yes, the US economy is resilient – No, that won’t save the US Dollar Premium

Some impressive US data should have resulted in a much stronger USD. Well, it didn’t happen. The EUR/USD pair closed a third consecutive week little changed, a handful of pips above the 1.1800 mark.

Gold: Metals remain vulnerable to broad market mood Premium

Gold (XAU/USD) started the week on a bullish note and climbed above $5,000 before declining sharply and erasing its weekly gains on Thursday, only to recover heading into the weekend.

GBP/USD: Pound Sterling remains below 1.3700 ahead of UK inflation test Premium

The Pound Sterling (GBP) failed to resist at higher levels against the US Dollar (USD), but buyers held their ground amid a US data-busy blockbuster week.

Bitcoin: BTC bears aren’t done yet

Bitcoin (BTC) price slips below $67,000 at the time of writing on Friday, remaining under pressure and extending losses of nearly 5% so far this week.

US Dollar: Big in Japan Premium

The US Dollar (USD) resumed its yearly downtrend this week, slipping back to two-week troughs just to bounce back a tad in the second half of the week.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.