Know the feeling?

- You enter a trade and feel your heart racing as you watch the price move underwater.

- You've made a mistake and have no choice but to crystalize a loss.

- Suddenly price moves as you'd planned. You jump back in with a feeling of excitement and relief. You'll make that loss back and some in a minute.

- But price moves against you for a second time and it's another loss.

You're feeling drained and frustrated. Agree?

In a minute you're going to learn:

- Why it happens.

- How you avoid it.

- And how you monetise it.

There's a part of your brain that can overpower rational thinking, logic and even the will to live

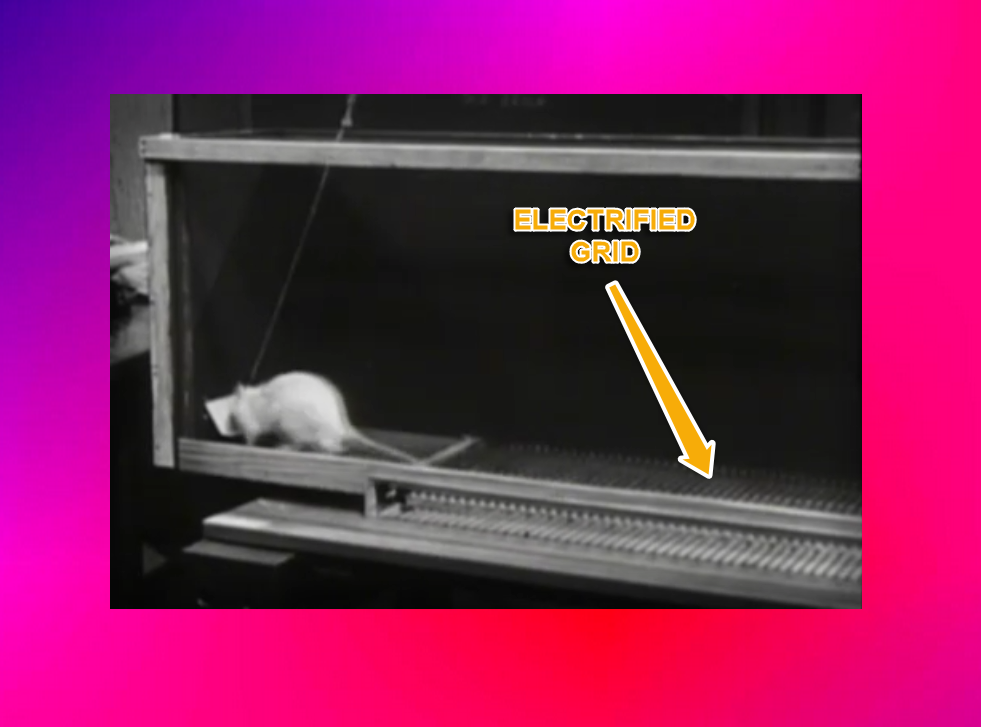

Psychologists James Olds and Peter Milner inserted an electrode into a region of a rat's brain, later called the pleasure centre.

The rat could self-administer an electrical current to the region by pressing a lever. The sensation was so pleasurable the rat endured pain of an electrified grid to get its charge.

The rat ignored food and drink and kept pressing the lever until it died of exhaustion.

The scientific name for the pleasure centre is nucleus accumbens.

When stimulated, it releases the feel-good chemical dopamine, responsible for energy, motivation and drive. But it's the timing of its release that will intrigue you.

Surprise anticipation of a reward triggers the release of dopamine

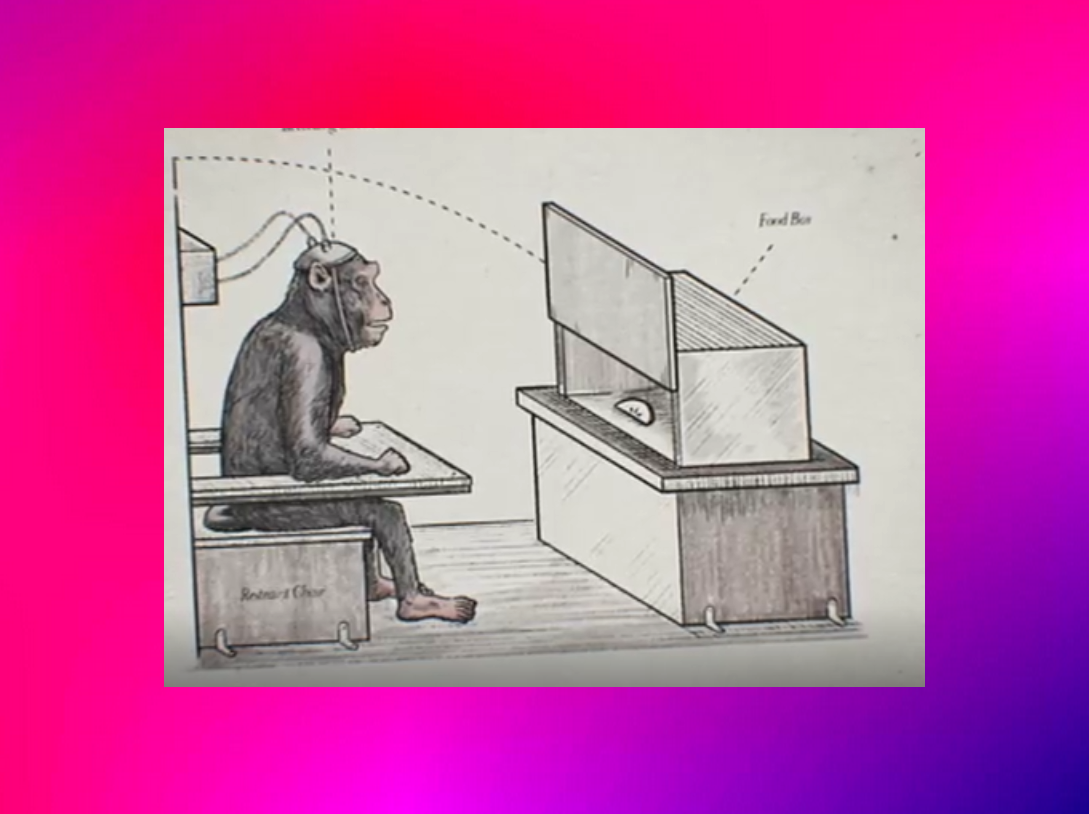

In the early 90's, Wolfram Schultz, (Professor of Neuroscience at Cambridge University), and his team had a revelation.

To an unexpecting monkey, revealing a piece of apple sent the monkey's neurons wild. The feel-good chemical dopamine was signalling a reward to the brain.

But the dopamine neurons stopped firing when the monkey realised the treat was on its way. The key to dopamine release is surprise.

A conflict occurs when you trade. It's your innate human tendency to find a pattern amongst the randomness of market behaviour. And in the struggle to predict when a reward will occur your dopamine neurons' level of activity increases.

Ever wondered why you took a trade for seemingly no reason? It turns out that stimulating your dopamine neurons is the root cause. You'll see why in a minute.

The MRI allowed us to see dopamine in action

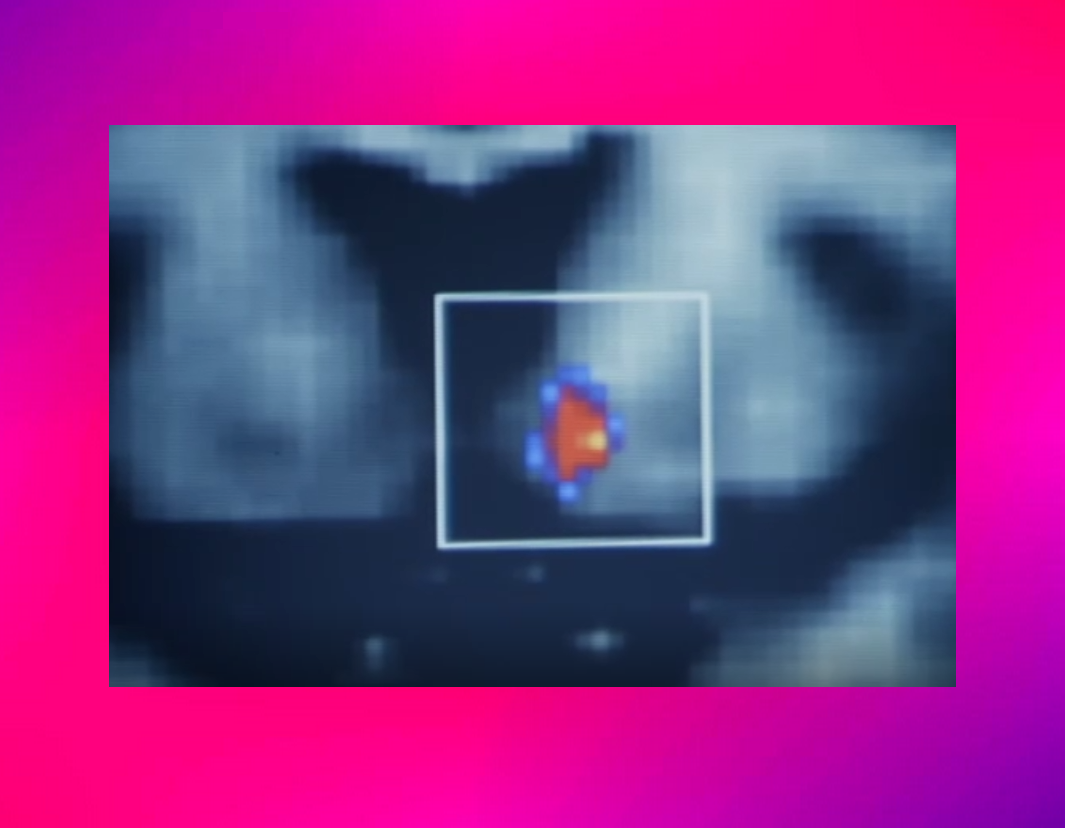

In the first experiment, Dr Hans Breiter of Northwestern University and his team administered cocaine to a cocaine addict.

Where you see red and a dot of yellow - that's right on the nucleus accumbens - these colours represent the turning on of your reward system.

But you'll find it fascinating the release of dopamine - your core reward system in action - occurs in anticipation of receiving the cocaine.

What other things besides drugs turn on this system?

The next experiment involved subjects playing games of monetary reward. None of Breiter's team predicted cocaine addicts anticipating a cocaine infusion looked exactly like healthy control subjects anticipating a monetary win.

Anticipation is fundamental to your experience of reward

When you trade, you repeat going through an experience of anticipation.

Like the rat, each trade is a jolt in electricity from your reward system.

This is all important because...

In his 1987 letter to shareholders, Warren Buffett said: "If you've been in the [poker] game 30 minutes and you don't know who the patsy is, you're the patsy."

Every day the cocktail of looking for patterns, reward anticipation and the associated neurochemicals gets expressed by people buying and selling without knowing what's driving their actions.

Skilled traders know this and profit from it

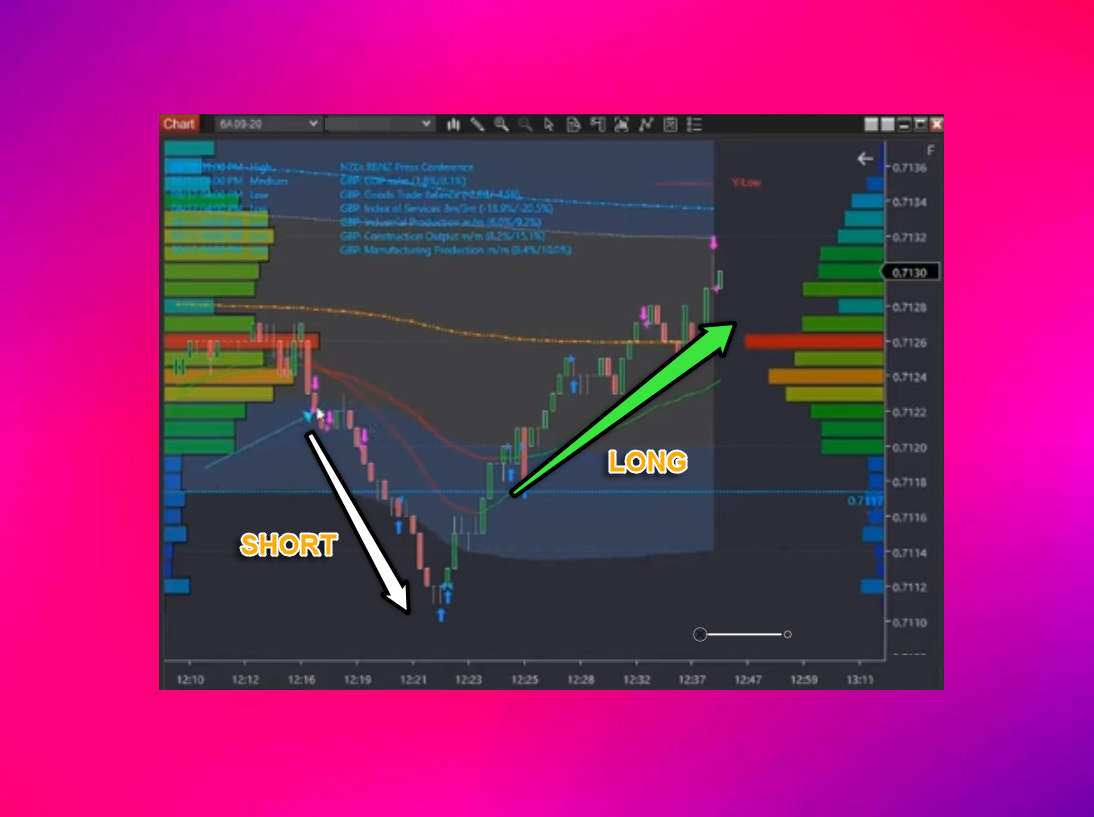

Each trade sequence below consisted of a hypothesis for a long trade opportunity.

And whether it was yesterday:

Or the day before:

Or even three years ago:

It occurs very frequently

But the bars on the charts don't tell you who the traders are buying or selling or what motivates them to do so. Correct?

So how can you tell?

First:

If we use driving a car as an analogy - it's quite a few reps before driving your car became unconscious. You know - like when you're suddenly shaken realising you can't recall the last 12 minutes of your journey because you were completely on autopilot - right?

This is why honing in on one playbook trade at a time is so important.

You see:

When you focus all your time on one playbook trade instead of a whole bunch of trades at once - that trade becomes unconscious much faster.

And once you're no longer preoccupied with processing the mechanics of the trade - your full suite of cognitive functions can pay attention to:

- Watching for all the pieces of your playbook trade to fit permitting you to take the trade.

- Simultaneously noticing all of the pattern-based mumbo jumbo your mind innately produces that's behind the voice that says "enter."

- Using your playbook trade as your defence against this voice (not a playbook trade? Can't enter)

- And noticing all of the traders unaware of how they are succumbing to entering into what will be a losing trade.

Second:

Ever been to an art gallery?

When you visit an art gallery, you'll see someone sit and stare at a painting for 20 minutes. What are they looking at?

They're looking at what you can only see if you are a painting aficionado. Right? And trading's the same.

Below is my trading station.

Guess what?

Almost every window is data for the same instrument. I'm looking at many different layers of the same onion. Makes sense?

Oh man that seems daunting

For all of the trades above I simultaneously walked a small group of traders through what the other traders in the market were thinking, what actions they would take, and how to trade amongst them. With sufficient immersion, they moved quickly to replicating the same concepts.

So it's possible to have someone show you how to do this in a way that enables you to get on top of it in a tight time frame if that's what you want to do.

Want more?

See events you can back in to trade in this webinar.

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

EUR/USD: Yes, the US economy is resilient – No, that won’t save the US Dollar Premium

Some impressive US data should have resulted in a much stronger USD. Well, it didn’t happen. The EUR/USD pair closed a third consecutive week little changed, a handful of pips above the 1.1800 mark.

Gold: Metals remain vulnerable to broad market mood Premium

Gold (XAU/USD) started the week on a bullish note and climbed above $5,000 before declining sharply and erasing its weekly gains on Thursday, only to recover heading into the weekend.

GBP/USD: Pound Sterling remains below 1.3700 ahead of UK inflation test Premium

The Pound Sterling (GBP) failed to resist at higher levels against the US Dollar (USD), but buyers held their ground amid a US data-busy blockbuster week.

Bitcoin: BTC bears aren’t done yet

Bitcoin (BTC) price slips below $67,000 at the time of writing on Friday, remaining under pressure and extending losses of nearly 5% so far this week.

US Dollar: Big in Japan Premium

The US Dollar (USD) resumed its yearly downtrend this week, slipping back to two-week troughs just to bounce back a tad in the second half of the week.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.