Let's dive in...

First

We want the trading to align with the core business - providing liquidity to unsuspecting traders who find themselves offside and forced to exit losing trades.

What next?

We need a unique trade idea the crowd isn't aware of. An idea people are unsuspecting of that leads to them urgently having to exit losing trades.

The idea

Early into the trading session, there's an eagerness for the long side as per the comparison between aggressive buyers and sellers.

It makes sense because the positioning of commercial longs vs. speculator shorts are at relative extremes, and the September contract is days away from expiry

So many traders must exit September positions. But who comes off second-best when forced to exit? Speculators. Agree? /p>

Conclusion?

A short rally is likely, but going long 'right now' isn't unique. Keep that in mind.

Further observations

-

Pending is a related influential market open.

-

Breaking down the 23-hour trading session into trading times aligned with overlapping markets lets you see the different audiences who come and go based on other market hours.

-

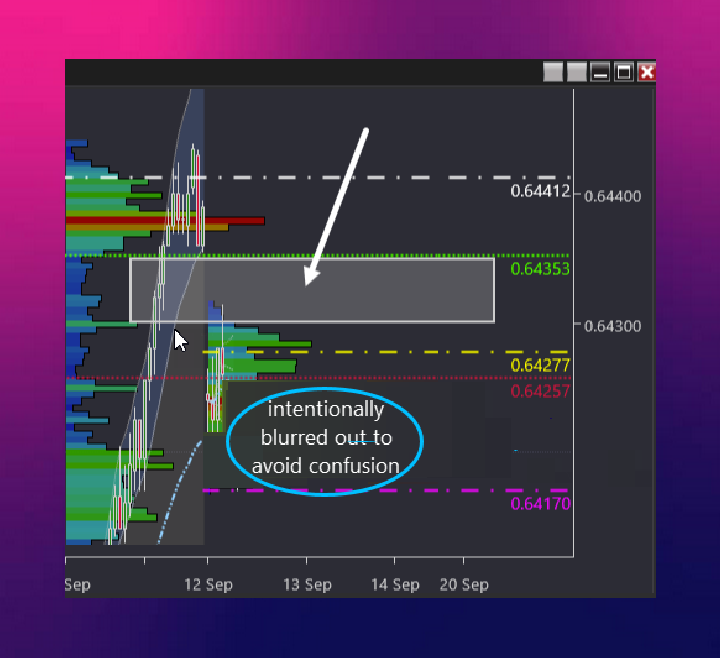

In the image below, a value gap (see white rectangle) won't fill when a specific audience is trading. It suggests an opportunity for relative value players seeking non-directional trades at lower levels. We've identified a reason for a short-term bearish view..

Combining the above, we see the opportunity for new longs finding themselves on the wrong side of the market and urgently exiting.

But what's the catalyst?

Every meaningful move needs a catalyst.

The catalyst will be the pending related market open - creating the necessary downward pressure for relative value players looking to secure lower-level business.

Executing the idea

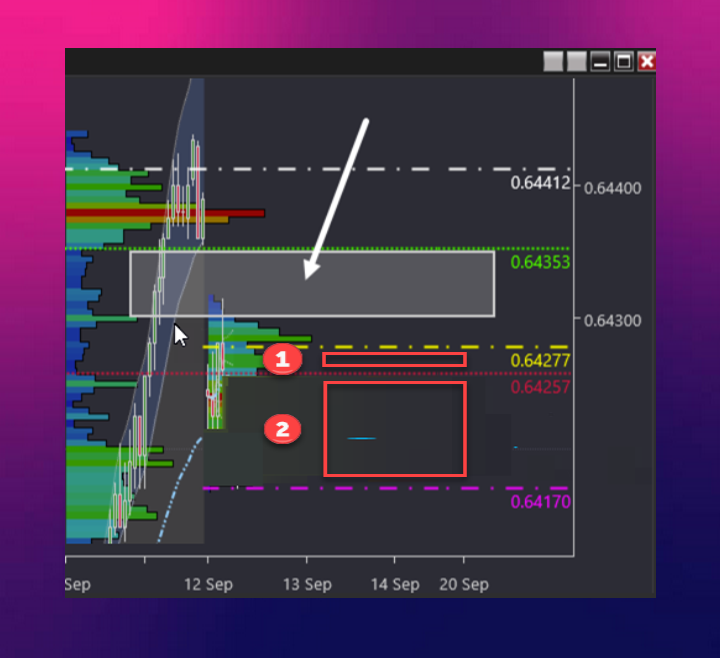

Below is the same image but with the playing fields marked in.

As per the idea, areas marked '1' and '2' are areas for short trades. Why? If the price reaches these levels, numerous validations for the long side will have failed.

(Note: Always consider where other people's line in the sand is - that point that will trigger them to exit.)

Trading works within boundaries, much like playing fields in sports:

-

Price within bounds. Here it's okay to trade based on your idea.

-

Price out-of-bounds. Regardless of your conviction, avoid trading when price is out-of-bounds.

This concept minimises poorly timed trades, improving trading success.

Colour coding for the win

Large groups of people use concepts such as support and resistance. And yet, the problem with consensus approaches is they don't give you a chance to achieve distinctive returns. Correct?

By contrast, the different coloured lines are colour-coded according to their representation - relative value, inventory positioning, market-making themes, etc. Importantly, these are concepts not used widely.

As such, they provide a robust framework to the execution of your trading. See how in a second.

Below is the chart with the executions for the idea we covered.

See how the trading is within the playing fields?

It's not foolproof

The trading below is from the same day.

- Different idea.

- Different catalyst.

- Same playing field.

Reviewing the first image, you can see a playing field boundary identified at 0.6441

Notice how a short trade occurs when the market can't exceed this boundary. But you also see the initial attempt resulted in a loss, akin to a 'false start'.

False starts are common in trading. When combined with bad trades, they're detrimental to your trading account.

Therefore, a framework with playing fields reduces the risk of bad trades and guides entry and exit points.

Crucial because it safeguards you against the substantial negative impact of combining false starts with bad trades.

From trading August 23

Below is a trade that worked.

But what you don't see are the six! false starts beforehand.

And yes - some of those 'false starts' were unforced errors (poor timing or trade location choices) - emphasising the importance of using parameters like playing fields to reduce unforced errors.

In summary

We covered three essential contributors for crafting unique strategies that set you apart from the crowd.

- All trades start with an idea (hypothesis) based on collating data the crowd isn't aware of. This is fundamental to finding an edge.

- A catalyst starts the move.

- And the rationale for entering into trades is based on unique evidence the crowd isn't aware of.

Dr. Brett Steenbarger - performance coach to elite traders - offers valuable insights into trading strategies. He emphasises the importance of avoiding consensus thinking, stating:

"There is no edge in being consensus. If you are part of the herd looking at the same charts, regurgitating the same narratives, there is no way to achieve distinctive returns"

Thoughts?

Taking a moment to reflect on what you've just read, what are your thoughts on:

- The concept of "playing fields" in trading? Have you used a similar framework?

- Dr Brett Steenbarger advises against following consensus thinking in trading. How do you differentiate your trading strategies from the crowd?

- What's the most significant challenge you face trying to implement unique strategies?

Related viewing:

Five signs of a high-calibre trade

Forex and derivatives trading is a highly competitive and often extremely fast-paced environment. It only rewards individuals who attain the required level of skill and expertise to compete. Past performance is not indicative of future results. There is a substantial risk of loss to unskilled and inexperienced players. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent

Editors’ Picks

EUR/USD: US Dollar comeback in the makes? Premium

The US Dollar (USD) stands victorious at the end of another week, with the EUR/USD pair trading near a four-week low of 1.1742, while the USD retains its strength despite some discouraging American data released at the end of the week.

Gold: Escalating geopolitical tensions help limit losses Premium

Gold (XAU/USD) struggled to make a decisive move in either direction this week as it quickly recovered above $5,000 after posting losses on Monday and Tuesday.

GBP/USD: Pound Sterling braces for more pain, as 200-day SMA tested Premium

The Pound Sterling (GBP) crashed to its lowest level in a month against the US Dollar (USD), as critical support levels were breached in a data-packed week.

Bitcoin: No recovery in sight

Bitcoin (BTC) price continues to trade within a range-bound zone, hovering around $67,000 at the time of writing on Friday, and falling slightly so far this week, with no signs of recovery.

US Dollar: Tariffed. Now What? Premium

The US Dollar (USD) reversed its previous week’s decline, managing to stage a meaningful rebound and retesting the area just above the 98.00 barrier when tracked by the US Dollar Index (DXY).

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.