Zilliqa Price Prediction: ZIL uptrend to $0.215 remains strong as long as key support level holds

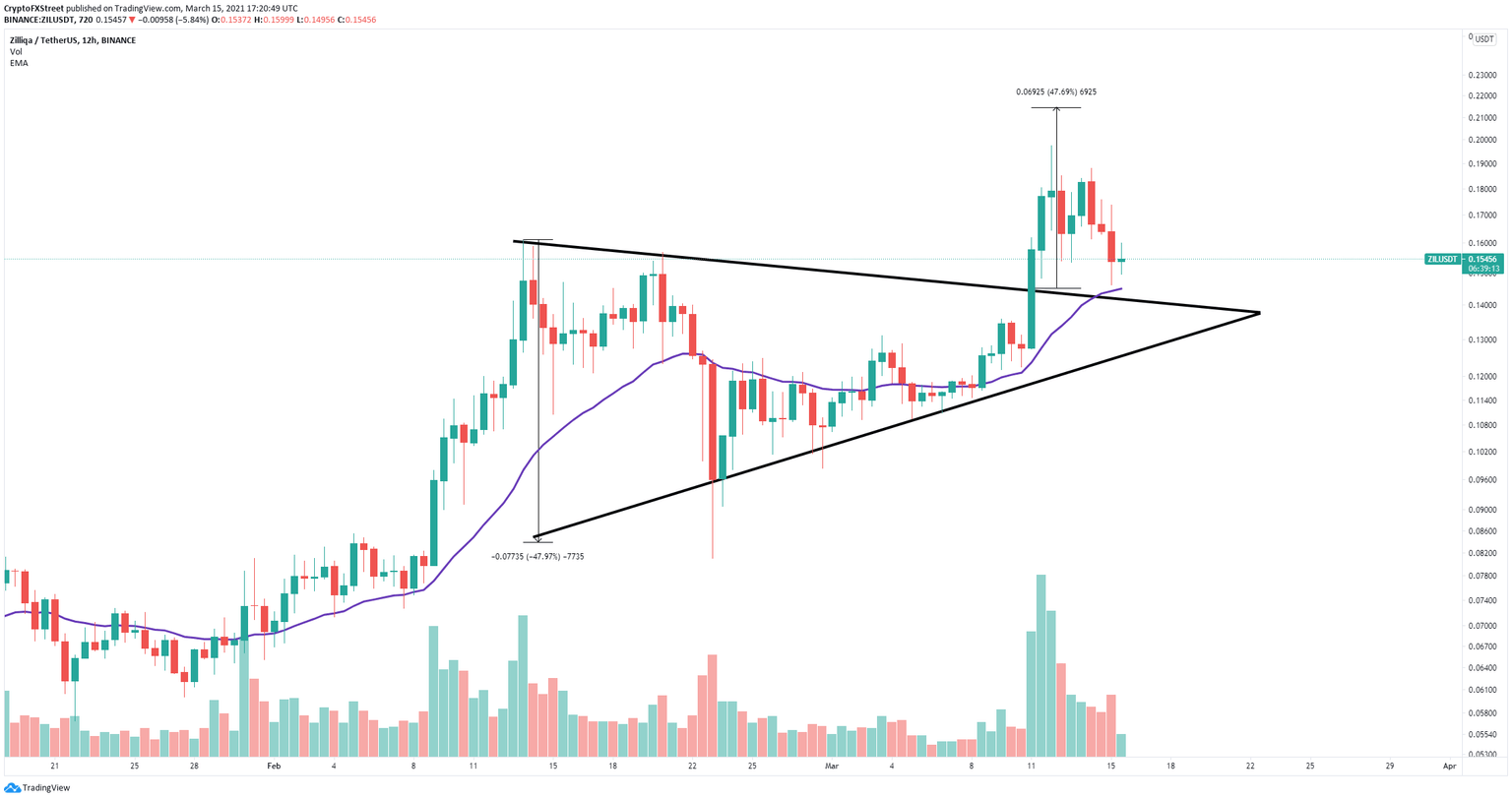

- Zilliqa price broke out of a symmetrical triangle pattern on the 12-hour chart.

- The digital asset must hold a key support level to continue with its uptrend towards $0.215.

- Losing this critical support point would be notably bearish for ZIL.

Zilliqa had another leg up in the past three days to $0.197 after a significant breakout from a key pattern on the 12-hour chart. The digital asset is closer than ever to a new all-time high since 2018.

Zilliqa price must stay above this level for a bounce towards $0.215

On the 12-hour chart, Zilliqa broke out of a symmetrical triangle pattern with a price target of $0.215. After hitting $0.197, the digital asset has fallen towards the previous resistance trendline.

ZIL/USD 12-hour chart

Additionally, the 26-EMA also coincides with the previous trendline resistance point at around $0.144. As long as the bulls can hold this key support level, the uptrend should resume towards $0.215 with weak resistance ahead. The only notable level is the previous high of $0.197 where ZIL could briefly pause again before a new leg up.

On the other hand, ZIL bears could invalidate the bullish outlook by pushing the digital asset below $0.144 which will easily drive Zilliqa price towards the previous support trendline at $0.126.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.