Zilliqa price encounters significant selling pressure from various indicators

- Zilliqa price had a massive 53% rally in the past two days hitting $0.197.

- The digital asset is bound for a significant correction as it has entered overbought territory.

- Various indicators show that Zilliqa could continue to drop even lower.

Zilliqa price had a massive spike in the past two days after Zilliqa Capital announced the official launch of the Southeast Asian financial ecosystem, which will invest in ZIL.

At Zilliqa Capital, we are firm believers in the long-term, life-changing potential of blockchain technology, reflected in our support for promising projects striving to serve the unbanked and underbanked across Southeast Asia and India

Zilliqa price faces a potential correction down to $0.15

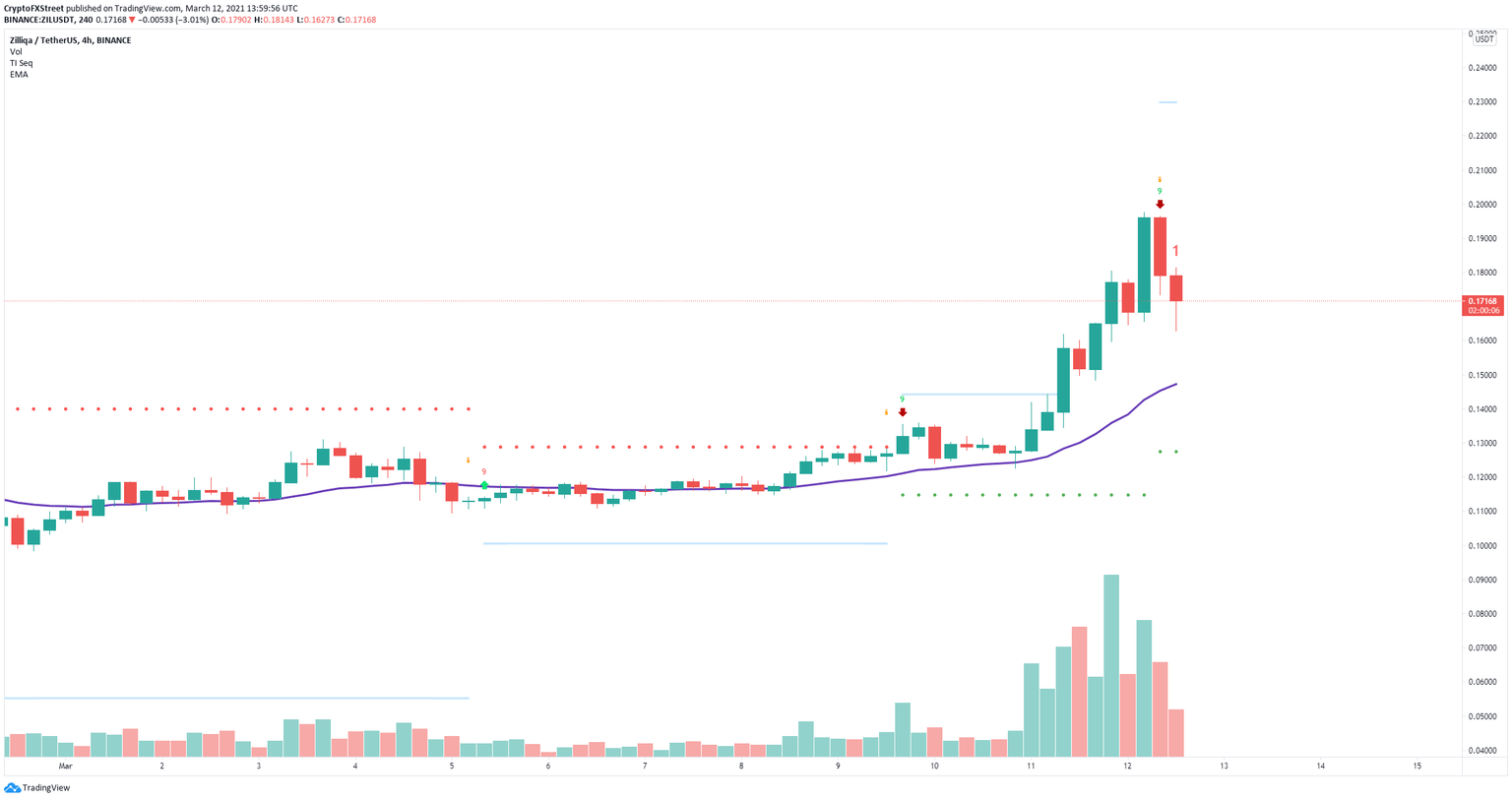

On the 4-hour chart, the TD Sequential indicator has just presented a sell signal that already got a notable bearish continuation down to $0.162. The digital asset is certainly bound for a correction after a 50% breakout in just two days.

ZIL/USD 4-hour chart

The next most significant support level is located at $0.15, which coincides with the 26-EMA. Additionally, ZIL has also seen a spike in social volume which is also an indicator of upcoming correction periods.

ZIL Social Volume

To fully invalidate the sell signal, Zilliqa bulls would need to push the digital asset above the previous high of $0.197.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B15.00.05%2C%252012%2520Mar%2C%25202021%5D-637511545414177067.png&w=1536&q=95)