YGG price remains stable despite $6.05 million worth of tokens entering the market

- YGG price dropped by a little over 4% on Monday to trade at $0.3645.

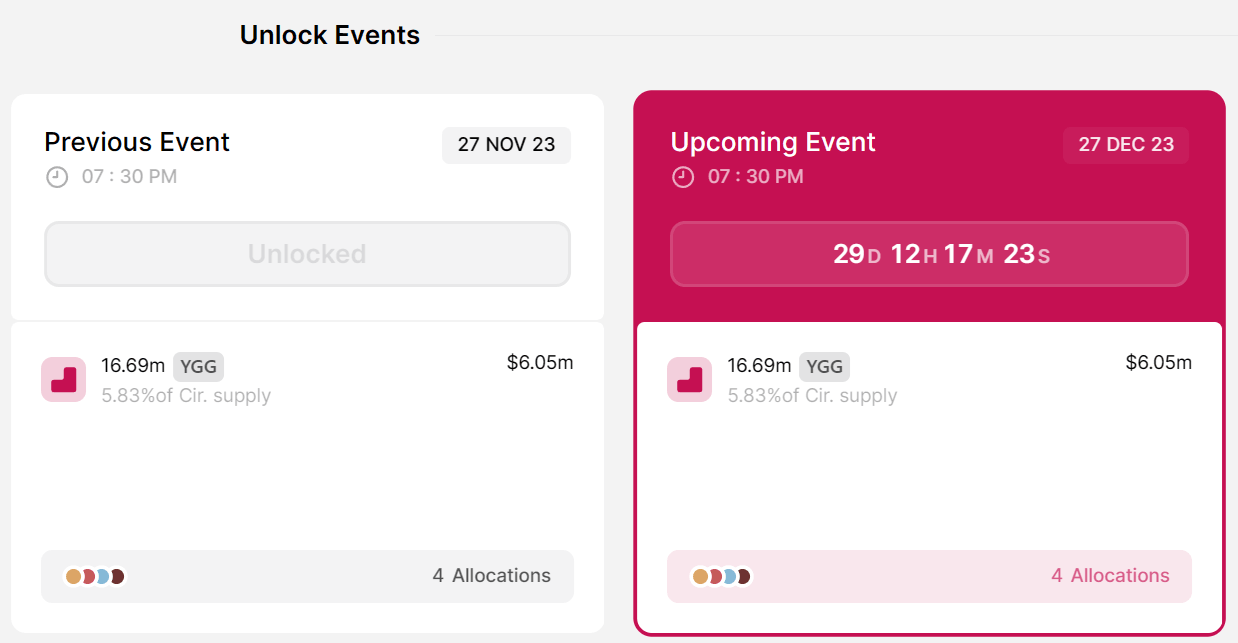

- Yield Guild Games was expected to witness a further decline, given about 16.69 million YGG tokens were unlocked on November 27.

- The token unlock event did, however, advance the downtrend, which could push YGG towards critical support of 23.6% Fibonacci Retracement.

YGG price was expected to take a hit on November 27 in lieu of the token unlock event that took place during the day. Interestingly, this was not the case as the altcoin managed to not only deflect damage but also retain investors’ profits.

Yield Guild Games token unlock

Yield Guild Games, the biggest web3 gaming guild, witnessed a major token unlock event on Monday wherein 16.69 million YGG tokens were flooded into the market. These tokens represent nearly 5.83% of the entire circulating supply of 284.9 million YGG.

Valued at $6.05 million, these tokens surprisingly did not cause a bearish development. Generally, token unlock events tend to cause a price crash or initiate a downtrend momentum. This is caused by the sudden flood of assets into the market, which then leads to an increase in supply while the demand remains the same.

YGG token unlock event

If the demand, however, matches the supply flood, then the assets tend to minimize the decline, which was the case with YGG as well. Yield Guild Games has another token unlock scheduled after 29 days, which will see the same amount of YGG tokens - 16.69 million - valued at $6.05 million entering the market.

Whether the price reacts or not is yet to be seen

YGG price tests support

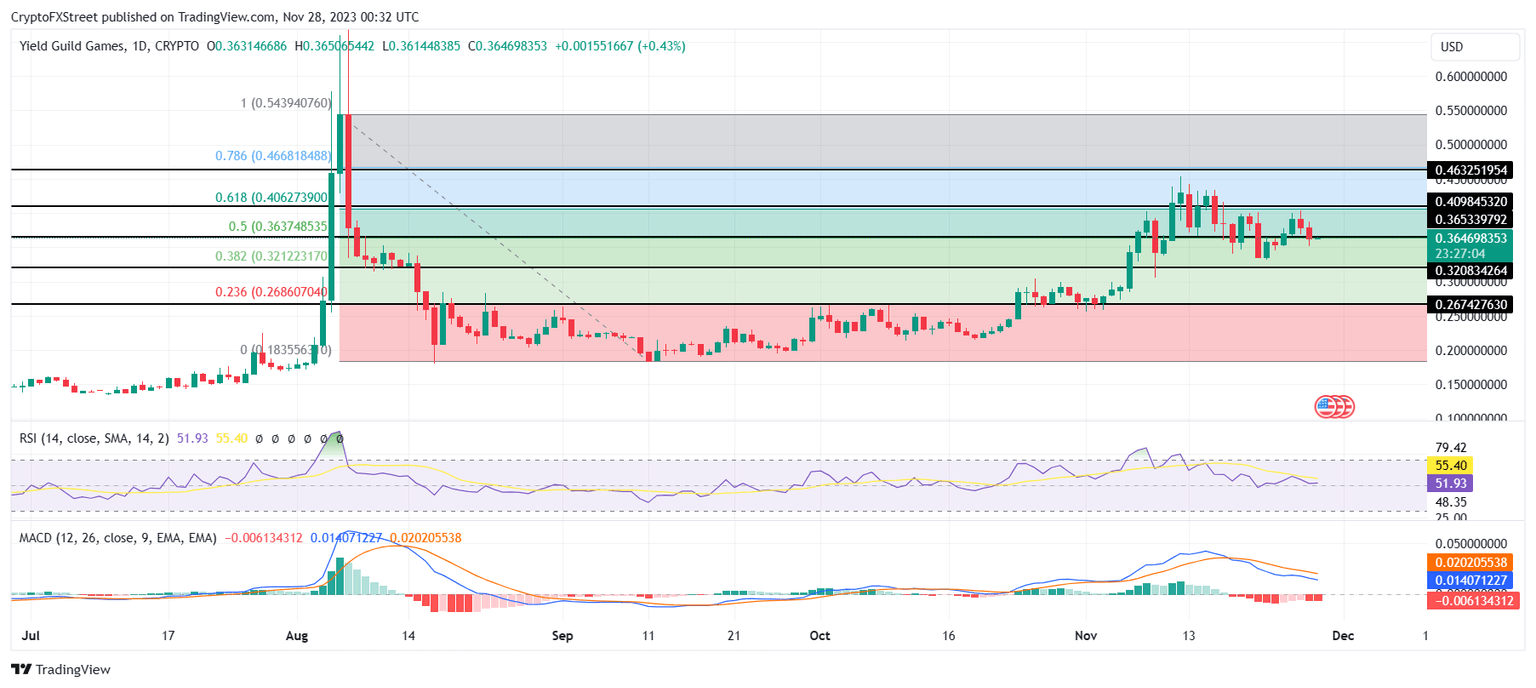

YGG price on the daily chart slipped by a little over 4% following the token unlock event, bringing the price to $0.3646. The altcoin is presently testing the 50.0% Fibonacci Retracement of $0.5439 to $0.1835, marked at $0.3637. This line has been tested as both support and resistance in the past, making it crucial to ascertain the next leg of the price action.

If this support line is lost, the YGG price would most likely test the 38.2% Fibonacci Retracement line at $0.3212. The Moving Average Convergence Divergence (MACD) has witnessed a bearish convergence. Furthermore, the appearance of the red bars on the histogram confirms that the altcoin is more susceptible to extended decline.

The cryptocurrency, however, would lose its recent gains if the support line of the 23.6% Fibonacci Retracement at $0.2686 is lost.

YGG/USD 1-day chart

But if YGG price manages to reclaim the 61.8% Fibonacci Retracement marked at $0.4062 as a support floor, it would be able to rise further. This would invalidate the bearish thesis and set YGG up to mark a fresh three-month high.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.