Yearn.Finance price looks unstoppable as network continues growing and bulls target $32,000

- Yearn.Finance price is on the verge of a massive breakout.

- Several key on-chain metrics indicate the digital asset is exceptionally bullish.

YFI is currently trading at $29,500 and only faces one significant resistance at $29,890 before a potential massive breakout. The network's growth indicates that investors are highly interested in the digital asset which is on the verge of a breakout.

Yearn.Finance price needs to crack the $29,890 resistance level to climb higher

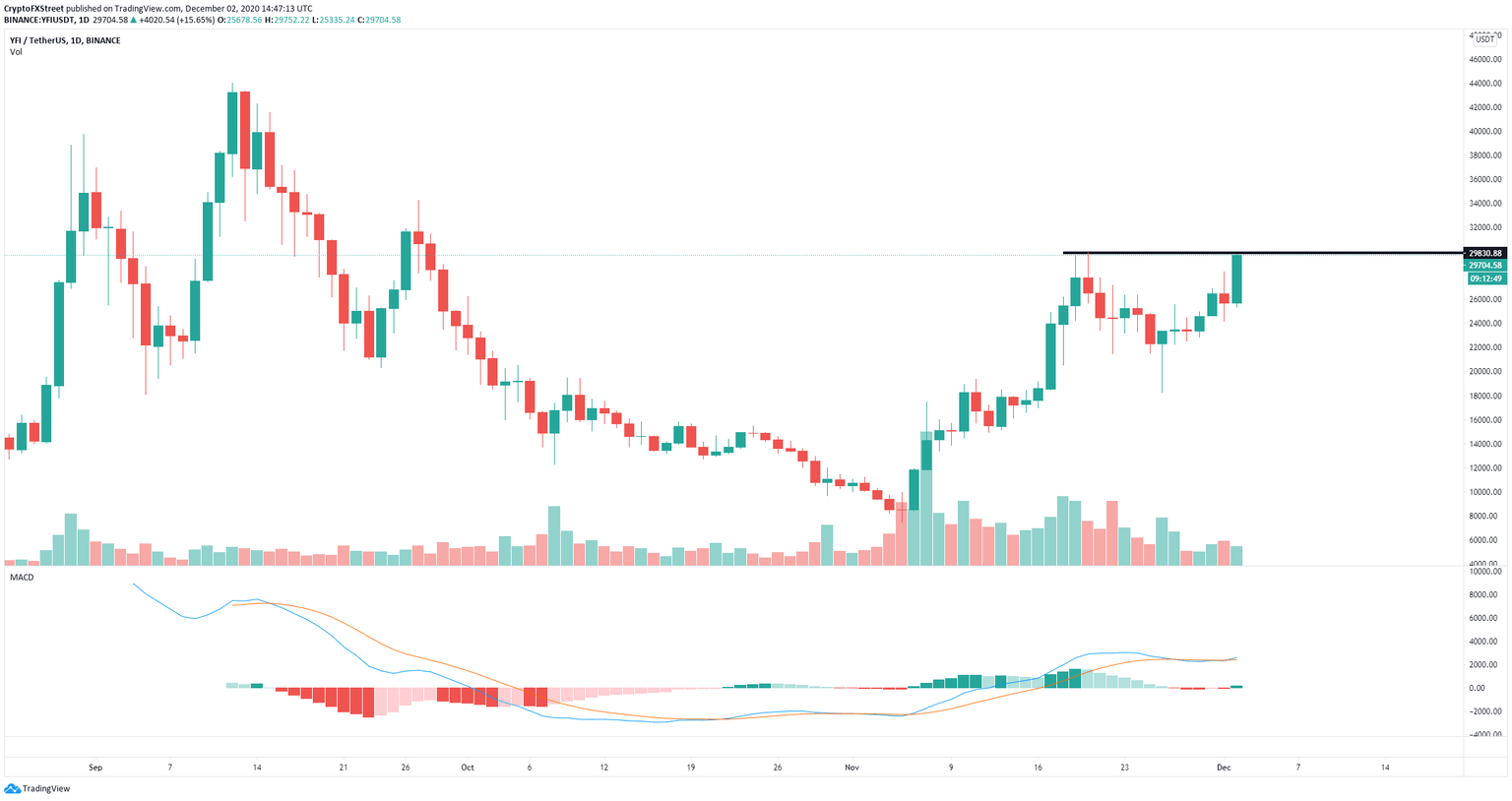

On the daily chart, YFI is now under a critical resistance level at $29,890, the high established on November 20. A breakout above this point would quickly drive Yearn.Finance price towards $32,000.

YFI/USD daily chart

The digital asset remains inside a robust daily uptrend establishing a clear higher low at $18,228 compared to $7,451 seen on November 5. The MACD has turned bullish again for the first time since November 6, indicating that YFI bulls currently have a lot of strength.

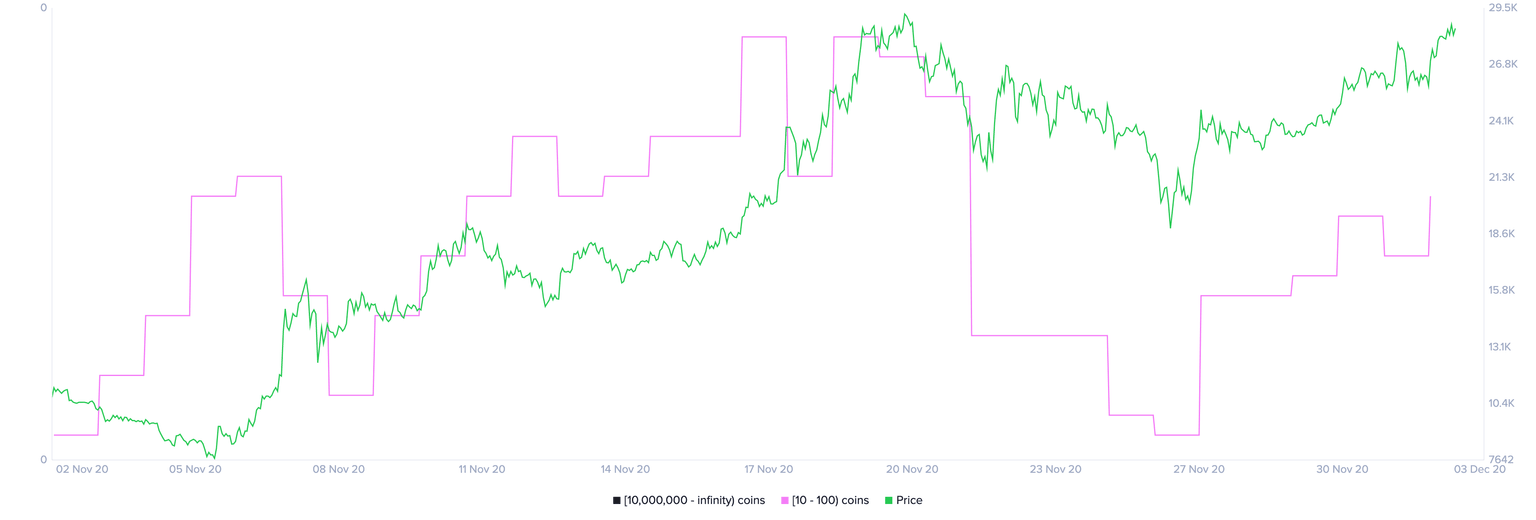

YFI Holders Distribution chart

It seems that the number of whales holding between 10 and 100 coins, $290,000 and $2,900,000, has increased significantly in the past five days from 125 to 138, indicating that large investors are not interested in selling despite Yearn.Finance price rising.

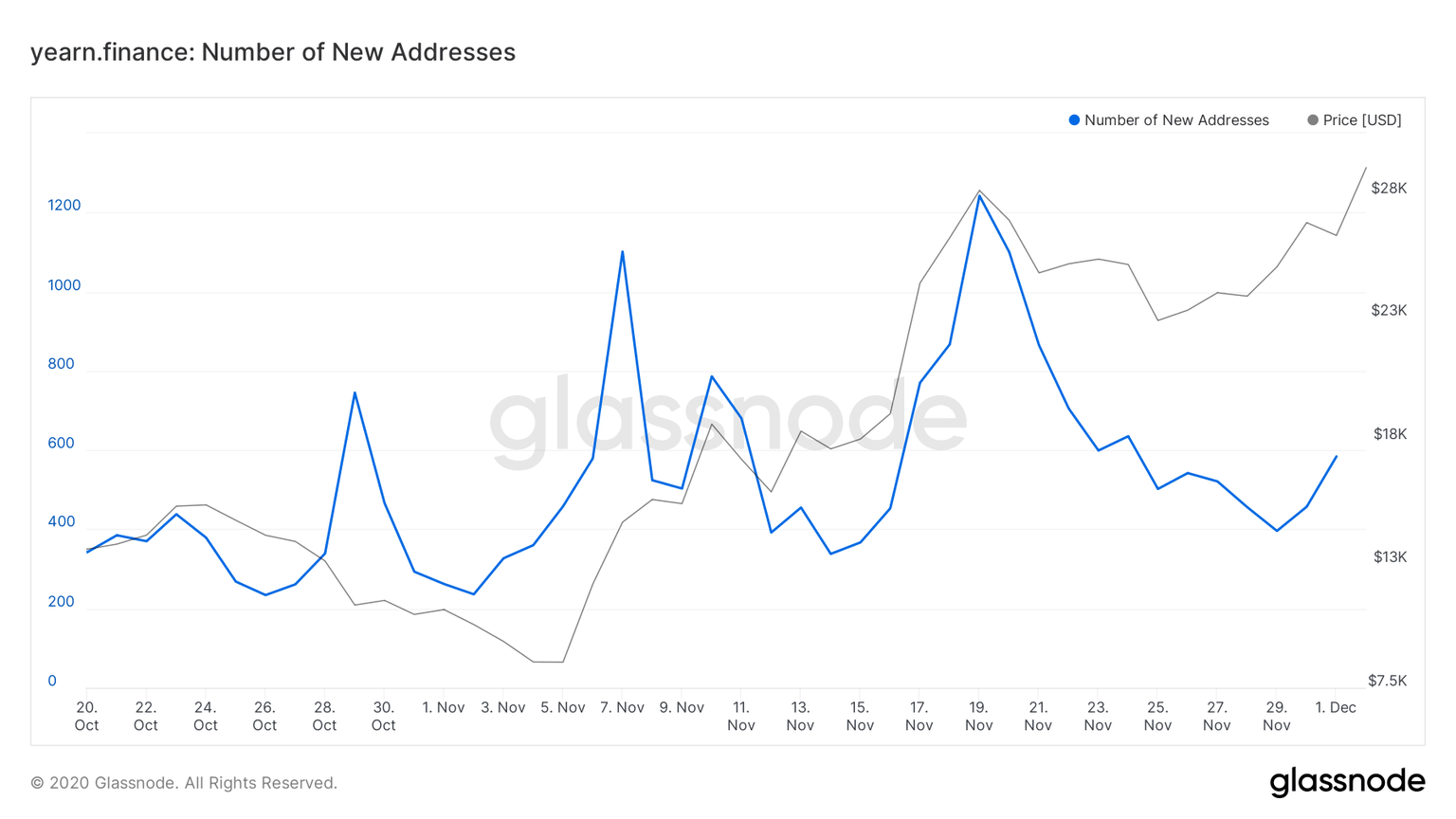

YFI New Addresses chart

Additionally, the number of new addresses joining the YFI network is also growing significantly over the past month, with several major spikes on November 6 and November 19. This metric indicates that new investors are highly interested in YFI, adding more buying pressure.

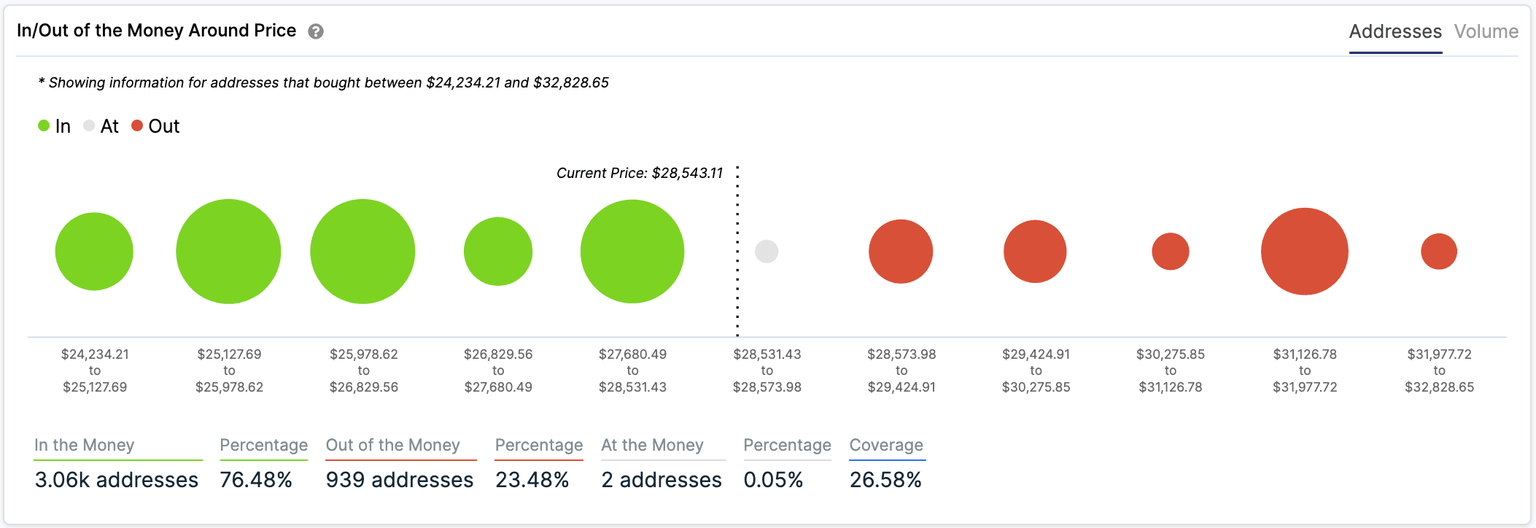

YFI IOMAP chart

On top of that, the In/Out of the Money Around Price (IOMAP) chart shows practically no resistance until $32,000, confirming the bullish price target. On the way down, there seems to be stable support from $28,531 until $25,127.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.