Yearn.Finance on a M&A spree, YFI ready to retreat to $24,000 before another growth attempt

Yearn.Finance adopts a strategy of acquiring hacked projects.

YFI may extend the short-term correction to $24,000.

The Yearn.Finance team has been acquiring the DeFi projects en masse since the previous week. On Monday, November 30, multi-purpose DeFi protocol Akropolis joined the YFI ecosystem on December 1, Andre Cronje announced the acquisition of SushiSwap.

Yearn.Finance acquired five DeFi projects

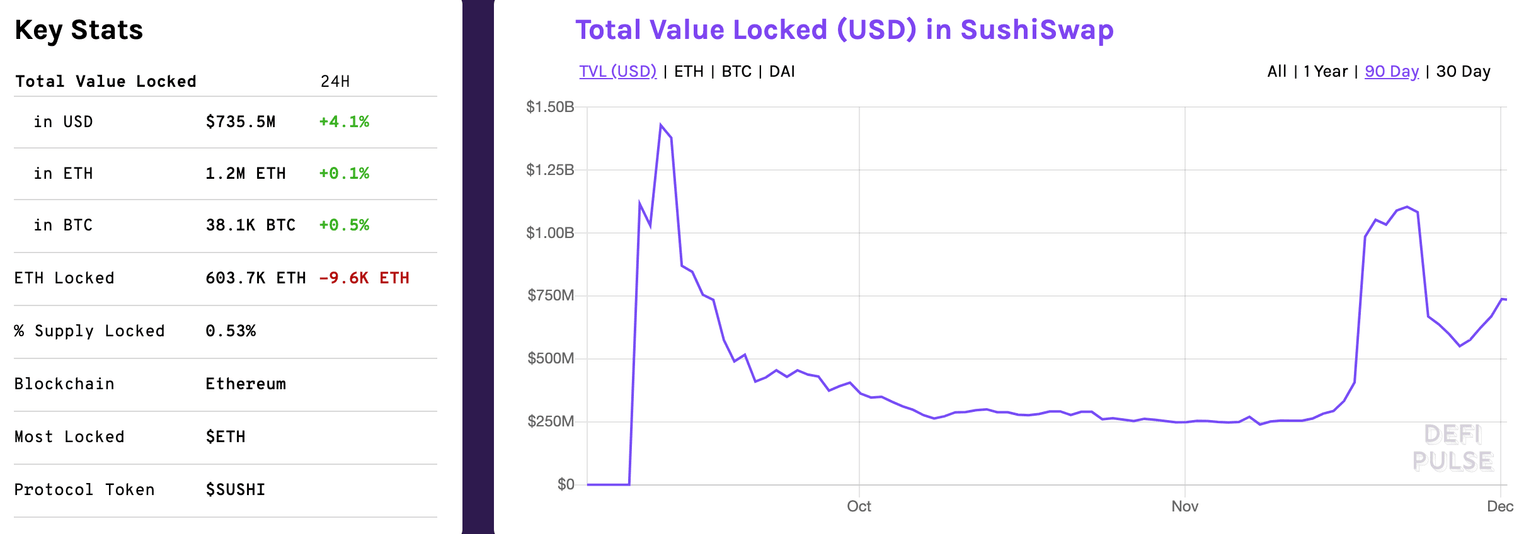

The fork and the main rival of the leading decentralized trading platform Uniswap will transfer the total value locked (TVL) on the protocol to Yearn.Finance. At the time of writing, SushiSwap takes seventh place in the global DeFi rating with a TVL of $735 million.

SushiSwap data, DefiPulse

Commenting on the merge, Andre Cronje noted on his blog on Medium:

As Sushi focused on expanding their AMM ecosystem, and as Yearn focused on expanding their strategies, more and more overlap became apparent, Yearn needed custom AMM experiences for their strategies, and Sushi started pushing the boundaries of yield and money markets.

Cover Protocol, Cream Finance, and Pickle Finance became a prat of Yearn during the previous week.Finance universe. It seems that the project adopted a strategy of acquiring ailing projects that suffered from hack attacks. This approach gives Cronje access to innovative technologies of the less lucky competitors and expands business opportunities.

YFI may retest $30,000 after a correction

YFI bottomed at $17,795 on November 26 and managed to recover to $26,300 by the time of writing. The token with the current market capitalization of $787 million has gained over 8% on a week-to-week basis, but further growth may be limited at this stage.

YFI/USD, 12-hour chart

The TD Sequential indicator sends a sell signal in the form of a red nine candlestick on a 12-hour chart. If the bearish signal is confirmed, the price may start a correction pattern of one to four red candlesticks with the initial target at $24,000.

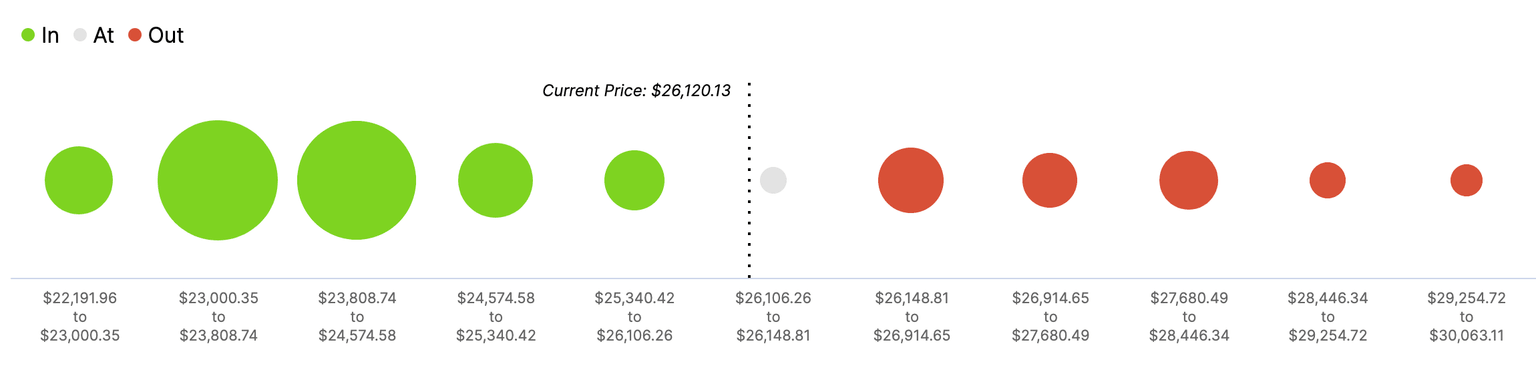

IOMAP shows that 1,240 addresses purchased 3,770 YFI from $23,800 to $24,500. This barrier is followed by another massive wall that goes all the way down to $23,000, suggesting that there are enough buy orders to absorb the selling pressure.

YFI's IOMAP data

On the other hand, if it gives way, the downside may be extended towards $20,500. This barrier stopped the decline at the end of November and also served as a backstop for YFI on numerous occasions in September,

There is no resistance ahead on the upside, meaning that the rebound from the support area may result in a strong rally towards $30,000. This resistance stopped the recovery on November 20; however, once it is out of the way, the upside is likely to gain traction with the next focus on $43,00, the September recovery high.

Author

Tanya Abrosimova

Independent Analyst