Yearn.Finance Price Analysis: YFI whales are ready to dump the token

- Yearn.Finance token has been one of the biggest gainers of the week.

- The technical picture implies that the price may continue growing.

- On-chain metrics send warning signals to the market.

Yearn.Finance (YFI) has been one of the biggest gainers recently. The 40th largest digital asset with the current market capitalization of $500 million topped at $17,700 on Saturday, November 7, and retreated to $14,700 by the time of writing. Despite the price decrease, it is 5% higher on a day-to-day basis. In the past seven days, the token has gained over 34%.

The token's average daily trading volumes settled at $500 million after a $1.2 billion spike on November 7. The asset is most actively traded on Binance and Coinbase Pro against USD and USDT.

YFI whale slashed its token holdings

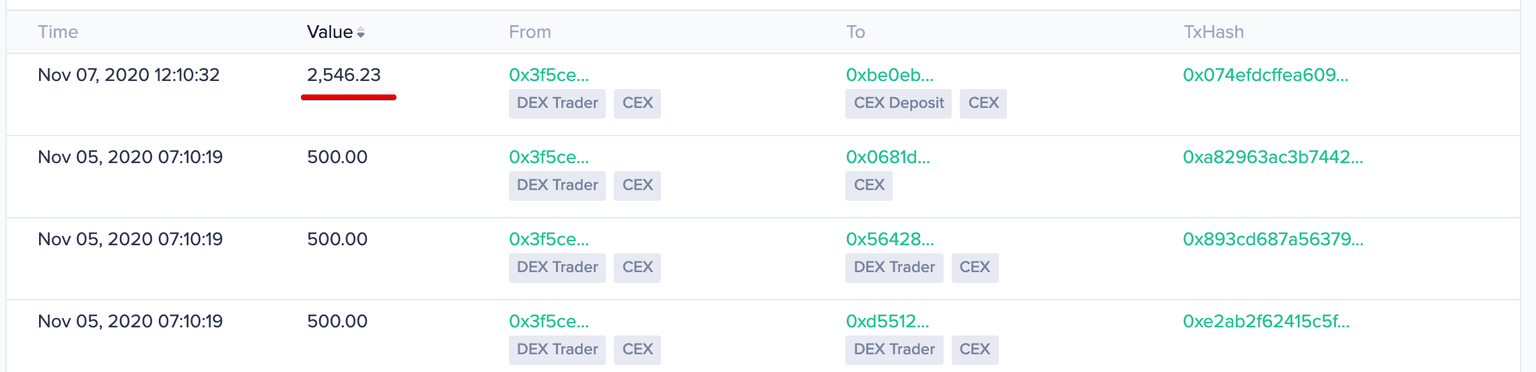

While the cryptocurrency market enjoys the recovery following the volatile period caused by the US presidential election uncertainty, someone has been moving tons of YFI to the centralized exchange wallet. According to Santiment's transaction tracker, a YFI whale transferred over 2,500 million YFI tokens (about $13.8 million) to a new cryptocurrency exchange address.

The on-chain data provider reports that this is the fourth largest transaction on record for YFI that coincided with the spike in the trading volumes registered on November 7. The previous record-big transaction was registered in August and was followed by a 50% price correction from ($39,000 to $18,000).

YFI's transaction tracker. Source: Santiment

Apart from that, the Holder Distribution data shows that the network lost one wallet holding 1,000 to 10,000 YFI tokens. While the number is not significant at this stage, it may be an early signal of the further sell-off in the market.

YFI's Holders' Distribution

YFI technical picture remains positive

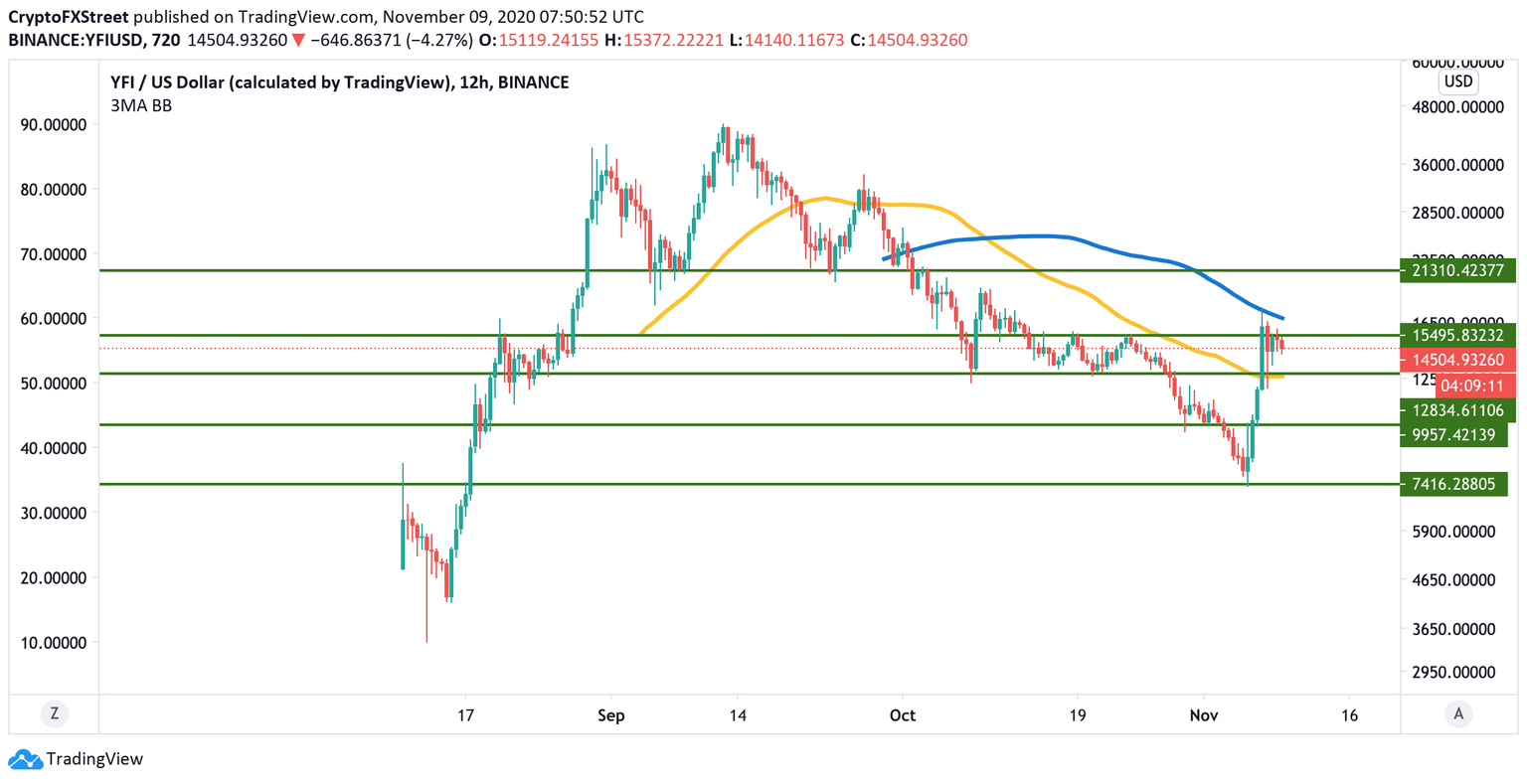

On the intraday charts, YFI/USD recovery is limited by a strong supply zone of $15,500. An initial attempt to break through failed to yield sustainable results as the price swiftly returned inside the current range. The above-mentioned resistance served as an upper line of the consolidation channel in the middle of October.

Once it is out of the way, the upside is likely to gain traction with the next focus on 12-hour EMA100 at $16,700. The next strong barrier comes at $21,300. This area created strong support for the price in September; now, it can be verified as a resistance.

YFI/USD 12-hour chart

A failure to move above $15,500 will result in an extended correction towards $12,700. This technical barrier served as channel support in October, while now it coincides with the 12-hour EMA50. A sustainable move below this area will confirm the bearish scenario and open up the way to the psychological $10,000.

It is worth mentioning that the token is sitting above the strong support area. Based on IntoTheBlock's "In/Out of the Money Around Price" model, over 900 addresses previously purchased over 10,000 YFI tokens between $13,600 and $14,000. If this supply is absorbed is confirmed, and buy orders continue to pile up, YFI may move towards $12,700.

YFI In/Out of the Money Around Price

Meanwhile, the way to the North looks like the path of the least resistance at this stage as there are no significant clusters of supply noted above the current price. A minor barrier comes on approach to $15,500, with 700 addresses holding 2,000 YFI. Once it is cleared, the recovery may be extended towards at least $16,700.

Key levels to watch

YFI/USD is likely to stay above $14,000 and resume the upside after a short-lived correction, with the first significant barrier created by $15,500. Once it is out of the way, the bullish momentum may start snowballing. On the other hand, a failure to clear this barrier will result in an extended downside correction with the initial aim at $14,000-$13,600, followed by $12,700.

While the short-term technical picture is mildly positive, the on-chain data implies that YFI whales may be getting ready to dump the token, which means the traders need to be extra cautious.

Author

Tanya Abrosimova

Independent Analyst

%20%5B10.13.35%2C%2009%20Nov%2C%202020%5D-637405050236895116.png&w=1536&q=95)

%20Analytics%20and%20Charts-637405051022302689.png&w=1536&q=95)