Yearn Finance price bleeds as 95% of the YFI community opposes latest proposal

- Yearn Finance price has declined 3.54% on the day as the community voted against a proposal to loan nearly $2 million to market maker Wintermute.

- The market maker has requested the community to approve a loan for a 12-month period at 0.1% interest.

- Nearly 95% of the community’s votes were against issuing a loan to Wintermute for purchase and staking of tokens in a CRV pool.

Wintermute, a crypto market maker, requested Yearn Finance community members for a loan of 350 YFI tokens, worth approximately $1.98 million from the DAO treasury. The market maker intends to use the loan to purchase yCRV tokens and deploy them in the yCRV-CRV liquidity pool.

Also read: Genesis creditors closer to recovering $630 million in funds lost to bankrupt lender

Yearn Finance community not on board with Wintermute’s plan to generate yield

The crypto market maker is keen on generating extra yield. For the same, Wintermute proposed that the Yearn Finance DAO offer the market maker a 12-month loan of 350 YFI tokens, at an interest of 0.1%.

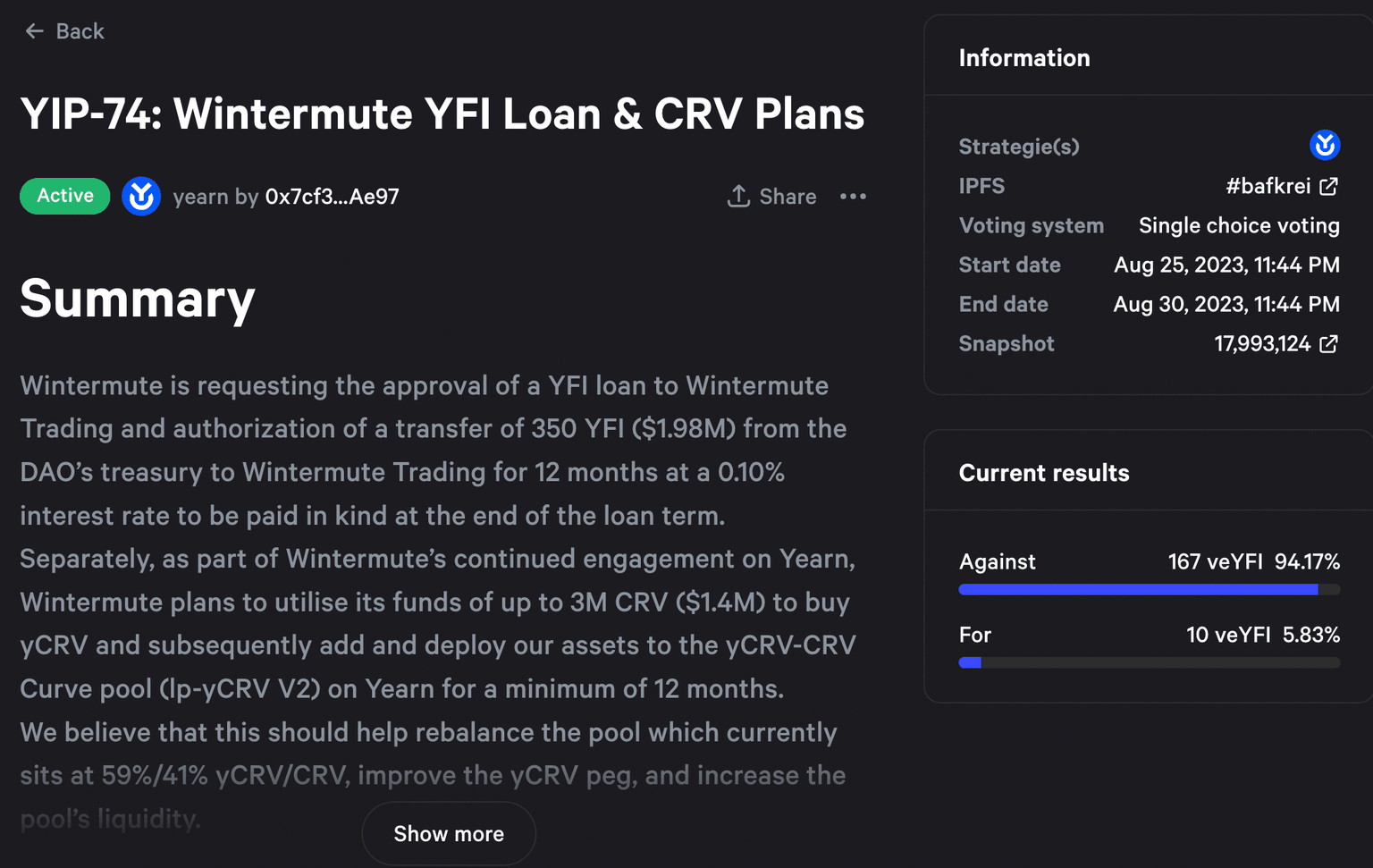

As per the snapshot of the proposal, 177 members have already voted, of which, 167 or 94.17% are against the issuance of the $1.98 million loan to Wintermute. The community members rejecting the loan believe it is an unfavorable deal for the YFI community.

Voting ends at 03:34 on August 31, Beijing time.

Snapshot of the vote on the proposal

The market maker has been attempting to shore yield by approaching DAOs for loans and to convince the community members that it would support markets for Yearn’s yCRV token. Voters believe that the proposal is unfair to the community of YFI holders and believe that Wintermute is trying to “extract value” from the crypto projects it supports.

Why the deal is unfavorable to the Yearn Finance community

By securing YFI tokens, Wintermute will stake it in a yCRV-CRV pool to generate higher yields and leverage its own CRV tokens at minimal cost. However, Yearn Finance’s community members see minimal upside for the project.

At its core, Yearn is focused on decentralization and loaning out its governance token to a market maker does not seem favorable to the ethos of the DAO.

At the time of writing, YFI token price yielded 3.57% losses in the 24-hour timeframe. The token continues to bleed as the community of voters reject the market maker’s request.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.