XRP price seeing light at the end of the tunnel

- XRP price has rallied 60% over the last two weeks.

- SEC grants Ripple’s motion to temporarily seal four documents.

- First Fibonacci retracement level of the 2018-2020 bear market in play.

XRP price has been a wildcard ever since the Securities and Exchange Commission (SEC) filed a lawsuit against two Ripple executives in late 2020. The price bias has been higher after the December crash, and volatility has been pronounced, but the weekly close above $0.60 last week was a statement to the legal bears, and it opened the door to the explosive gains so far this week.

Ripple defense making incremental progess

On March 31, in another step forward for defense, a New York judge granted Ripple’s motion to temporarily seal four documents. The judge did instruct Ripple and the SEC to come together on the redactions by April 2. However, the defense lawyers did convince the judge to permit redactions in two email correspondences.

An agreement over the other two documents has not been reached, according to Ripple’s lawyer, Andrew Ceresney. Meanwhile, the SEC does not want any email exchange that contains personal financial information to be excluded. Ripple lawyers responded by saying they are not judicial documents and not for public access.

“All four documents are ‘discovery materials filed with the court in connection with the discovery-related disputes,’ and therefore not judicial documents and not entitled to a presumption of public access.”

Nonetheless, the lawsuit is not over, and the headlines will continue to offer the occasional jolt to price. Still, it appears that XRP traders and investors are beginning to see the light at the end of the tunnel.

XRP price needs a weekly close above $0.80 to leave legal worries behind

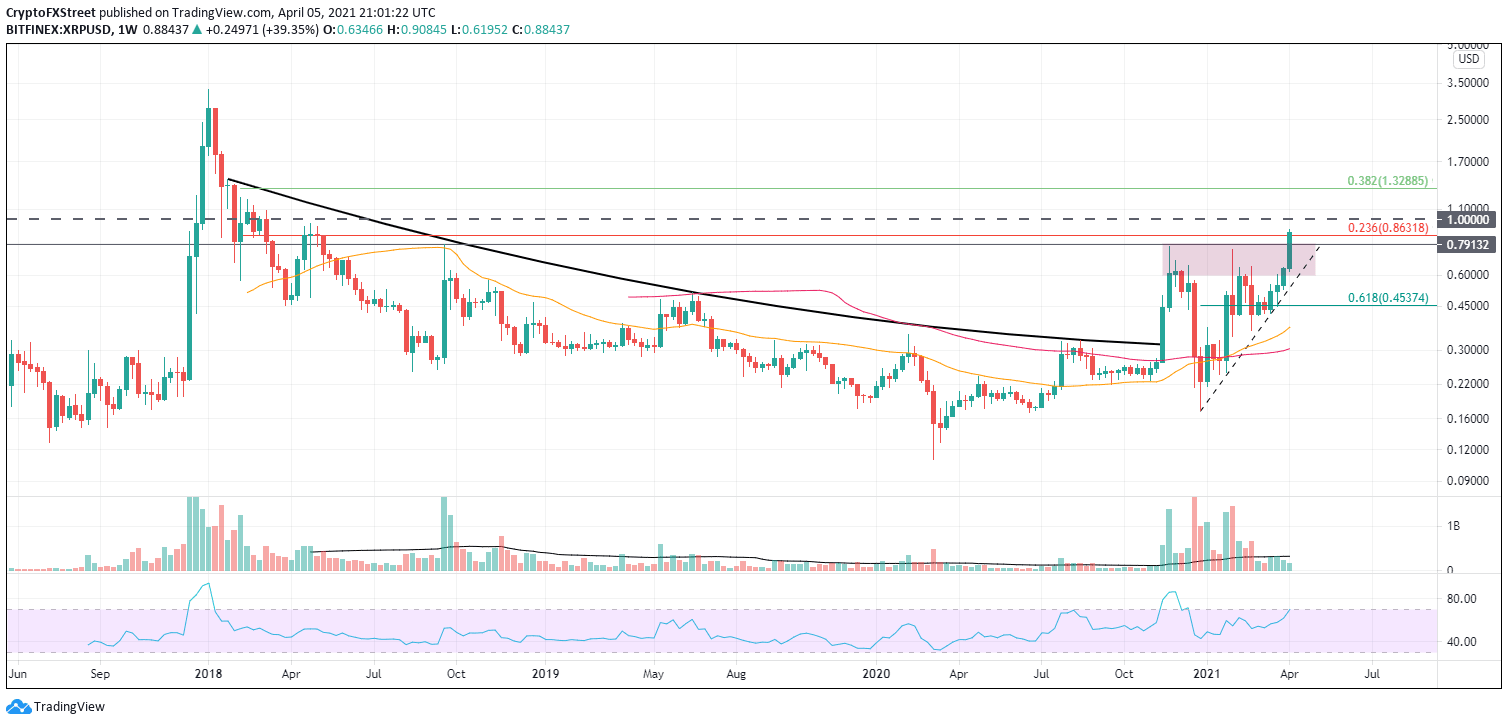

Ripple is currently up 38% on the day, shattering the resistance at $0.80 and tagging the 0.236 Fibonacci retracement level of the 2018-2020 bear market at $0.863. Further strength would target the psychologically important $1.00, followed by the 0.382 retracement level at $1.33.

XRP/USD weekly chart

A reversal in legal fortunes or deterioration in technicals would hasten a U-turn back into the critical $0.60 - $0.80 price range and potentially threaten the rising trendline from December 2020. If the trend line melts away, it will lead to a collapse in Ripple to the 0.618 retracement of the rally since the December 2020 low at $0.454.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.