XRP Price Prediction: Ripple awaits the next catalyst

- XRP price fails to rally above the breakout high of May 6 at $1.76.

- Ripple has lagged other cryptocurrencies raising questions over the durability of the rally.

- Ichimoku cloud provides support on the daily chart.

XRP price was dealt a blow yesterday. As a result, the outlook has turned neutral and elevates the importance of a bullish news roll for the ongoing legal case between Ripple and the Securities and Exchange Commission (SEC).

XRP price missing the FOMO effect in May

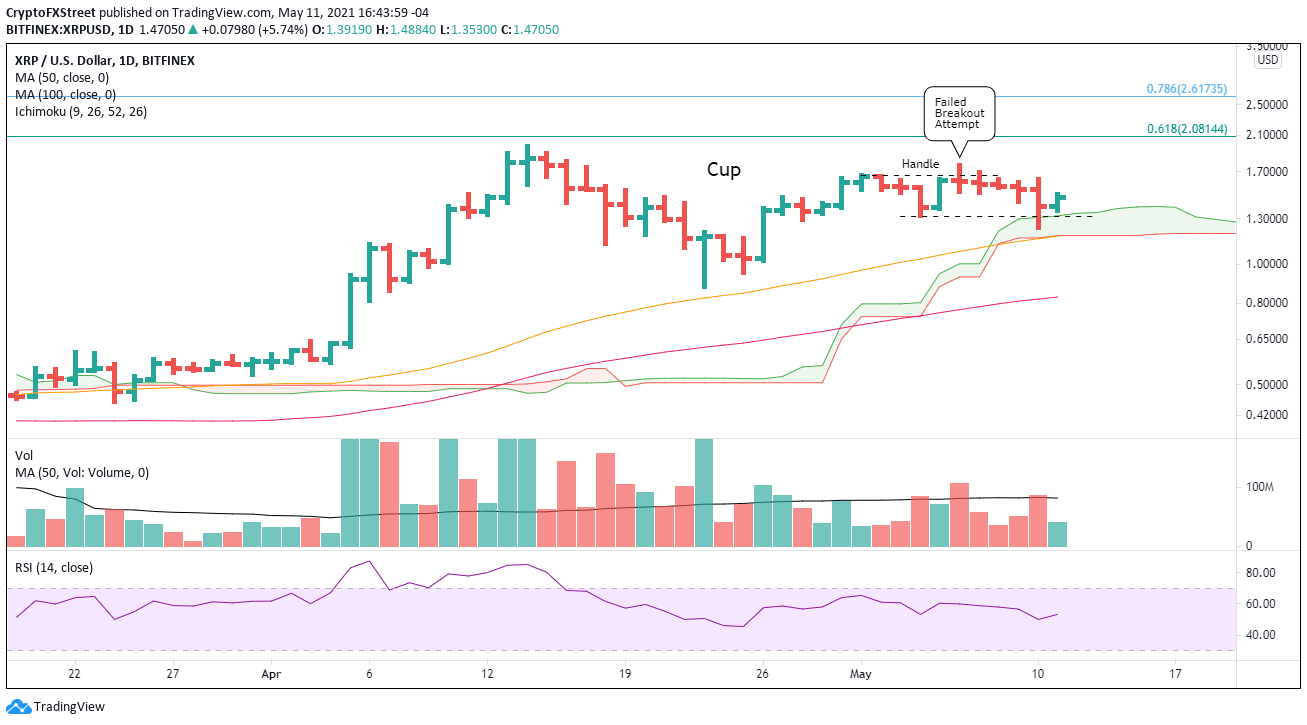

Yesterday, XRP price failed to conquer the cup-with-handle breakout high of $1.76 and undercut the handle low at $1.31, voiding the pattern and prompting a reconsideration of the bullish outlook for the remittance token. Moreover, it raises the probability of a more complex bottoming process taking control of Ripple.

Moving forward, it is imperative to consider the Ichimoku cloud ranging from $1.32 to $1.18 for downside support, an area that halted yesterday’s notable decline. Adding to the value of the range is the intersection with the 50-day simple moving average at $1.17. Any failure at that level will introduce a test of the psychologically important $1.00 and potentially the April low at $0.87.

XRP/USD daily chart

A bullish scenario begins with a daily close above $1.76. If successful, XRP price could test the April 14 high at $1.96.

All eyes will be focused on the psychologically important $2.00 and the 61.8% Fibonacci retracement of the 2018-2020 decline at $2.08.

It will take serious commitment and emotion to overcome the $2.00 price area, but if successful, speculators can look to the 78.6% retracement of the 2018-2020 decline at $2.61 as the next significant resistance.

Unlike other cryptocurrencies, Ripple is challenged by the overhang of an SEC case that could sway XRP price in an instant. Understandably, the altcoin has not accomplished much since the 32% gain on April 26, and it is conceivable that an indecisive pattern will persist in the days or weeks ahead.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.