XRP Price Prediction: Largest volume influx in 2023 as Ripple bulls reconquer the trend

- XRP price is up 25% since the early month liquidation.

- Ripple could rally toward $0.44 for a 17% gain.

- The uptrend’s health would be in jeopardy if the $0,34 level were breached.

XRP price suggests all signs are a go for a bullish trade idea. Traders should be on the look for an entry with a landing zone above the $0.40 level.

XRP price is poised to move

XRP price could embark on a new journey north as stars seem to be in alignment for a bull run in the making. Following an early month liquidation of the 2022 lows on January 1, the XRP price has ascended feverishly. At the time of writing the digital remittance token is up 25%, and there are subtle cues to suggest that more gains will be had in the very near future.

XRP price currently auctions at $0.37. On January 11, The XRP price saw the largest gain this year with a 7% uptick and a surge past the 8-day exponential moving average. The hurdle was a significant confirmation of the ongoing uptrend as the indicator persistently acted as resistance earlier in the month.

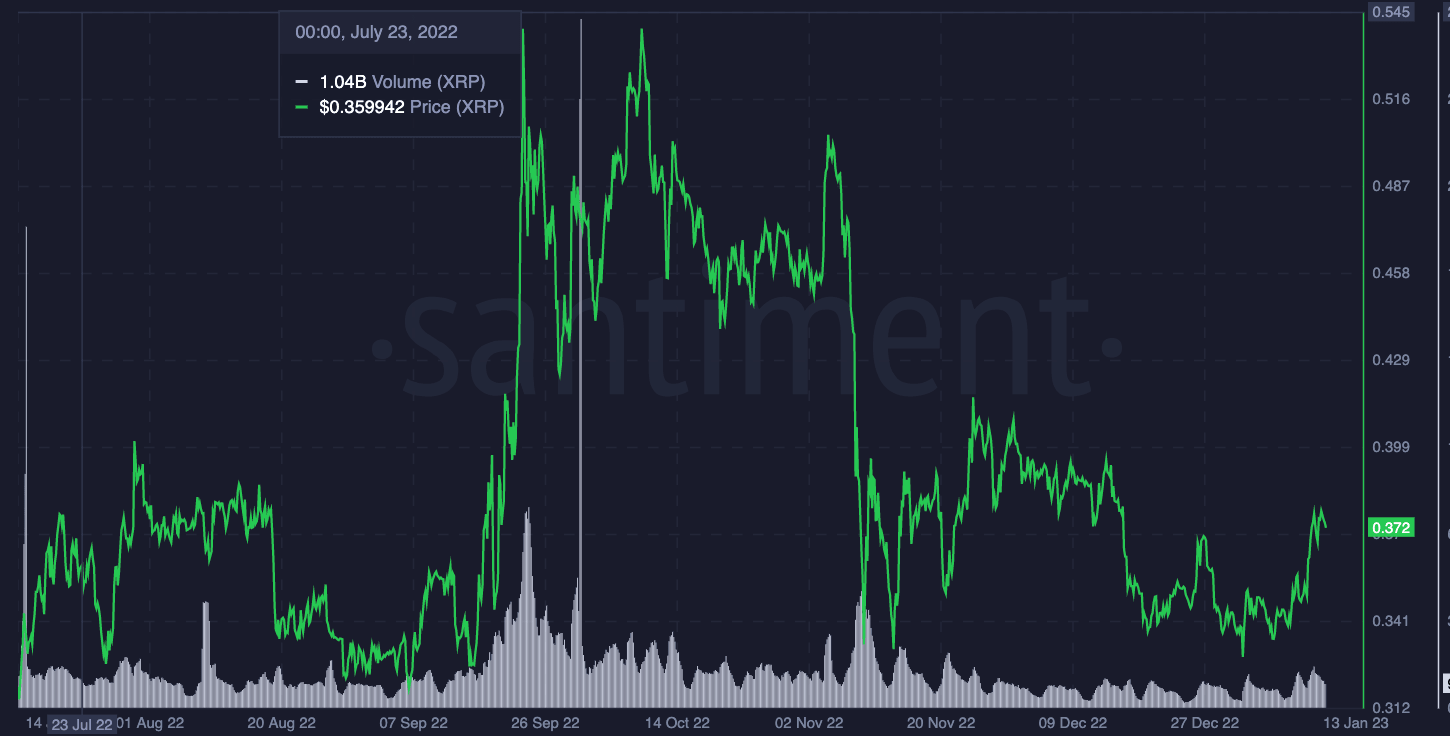

Santiment’s Volume Indicator, a tool used to aggregate transactions from all cryptocurrency exchanges showed the largest influx of transactions in 2023 on the same day. According to the indicator, $1.62 billion worth of transactions took place on the Jan-11 green day, a 10% increase from the previous 1.4 billion dollars worth on January 3 when XRP breached the $0.35 barrier.

The gradual increase in volume along with the trending price is a healthy display of genuine uptrend market behavior. Since this is the case one could assume XRP bulls are backed by high-cap investors aiming to challenge poorly positioned bears in the market. The $0.44 is an untagged liquidity level that acted as support in October before caving to the bearish onslaught shortly after. A spike in the aforementioned level proposes a potential 17% rise from the current XRP price.

XRP/USDT 1-Day Chart

Traders who partook in the previous XRP trade idea are in profit and could use the 8-day exponential moving average to gauge the health of the uptrend me uptrend moving forward. A breach below the barrier, positioned at $0.34 could void the bullish potential. If the bears are successful, they could induce a 20% decline targeting the $0.30 swing low established on January 1.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.