XRP price likely to suffer a setback as Ripple bulls rethink strategy

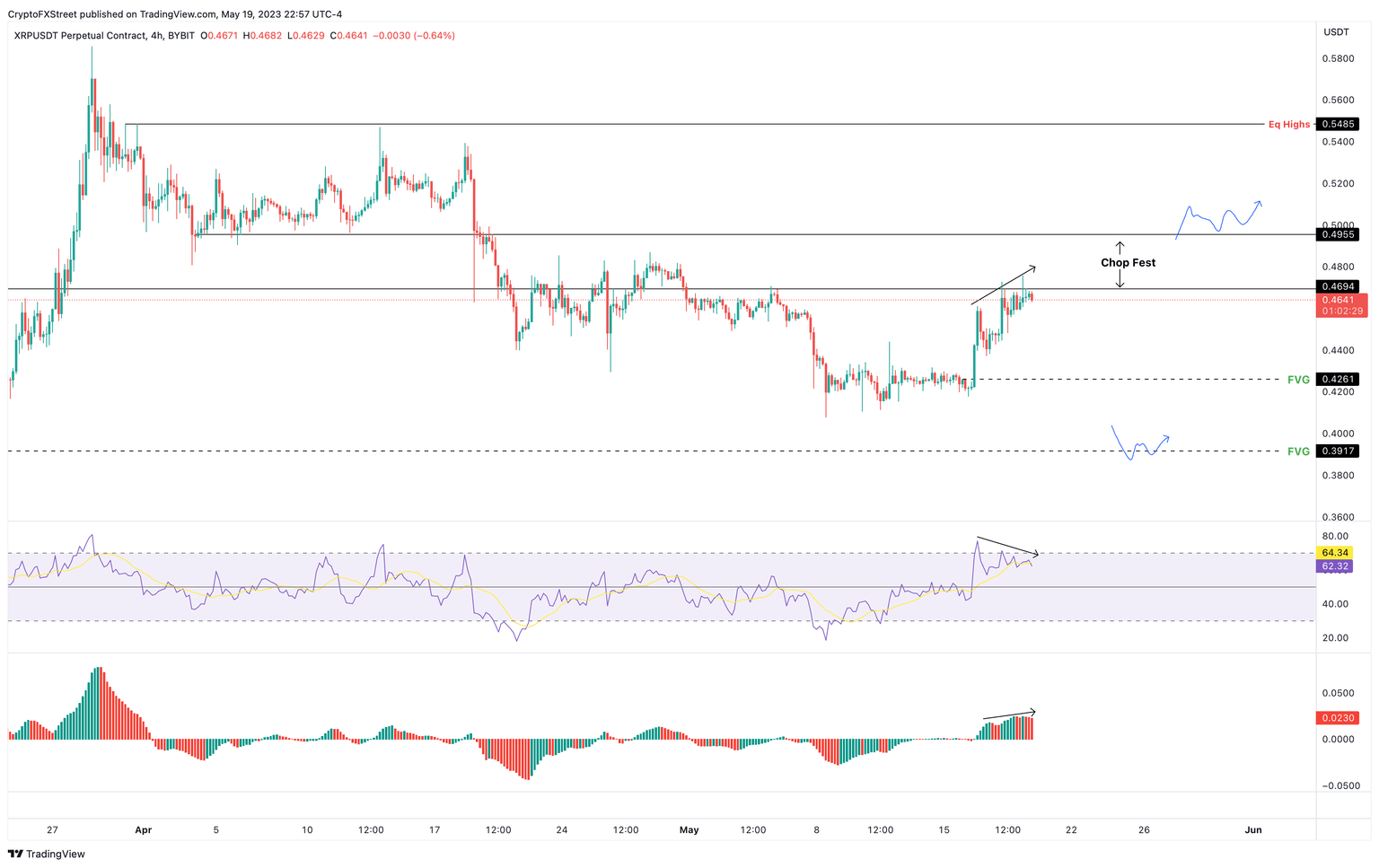

- XRP price shows a lack of bullish momentum as it approaches a set of crucial hurdles at $0.469 and $0.495.

- The bearish divergence between the remittance token and the RSI hints at a potential pullback.

- Invalidation of the bearish thesis will occur if Ripple bulls overcome the $0.495 hurdle.

XRP price has been slowly climbing higher over the last few days. Due to the changing crypto landscape, bullish momentum seems to be waning for Ripple. This development suggests that a potential pullback might be brewing for the remittance token.

Also read: Ripple and SEC speculated to settle the lawsuit

XRP price needs to take control

XRP price rallied 13% between May 16 and 19 and is currently facing a resistance level at $0.469. The lack of buying pressure and the choppy outlook witnessed in Bitcoin has caused altcoins to take a rest.

Additionally, the higher highs produced by the XRP price in the last two days are contrasted by the Relative Strength Index’s (RSI) lower highs. This non-conformity is termed “bearish divergence” and often leads to a drop in the underlying asset’s price.

In this case, the bearish divergence hints that a pullback for the XRP price is likely. The likely target is $0.426, which is the first inefficiency to the downside. If the selling pressure continues to build up, Ripple is likely to visit the next inefficiency at $0.392.

These pullbacks would constitute 8% and 15% moves, respectively for holders form the current position at $0.465.

XRP/USDT 1-day chart

While the bearish outlook makes logical sense for XRP price, investors need to observe that the Awesome Oscillator (AO) has not produced lower highs. Instead, the momentum indicator has set up higher highs.

So, the bears are unlikely to have free reign. If the overall market outlook improves with Bitcoin price climbing higher, XRP price is also likely to trigger a run-up as well. In such a case, if bulls take control and flip the $0.495 hurdle into a support level, it would invalidate the bearish thesis.

This development could see XRP price attempt to collect the buy-stop liquidity resting above the equal highs at $0.548.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.