XLM price punches through resistance, targets $0.32

- XLM price sees bullish knee-jerk after two rejections by the monthly S1 support level.

- XLM bulls are buying actively as investors start to preposition for 2022.

- Expect a further bullish squeeze going against global market turmoil.

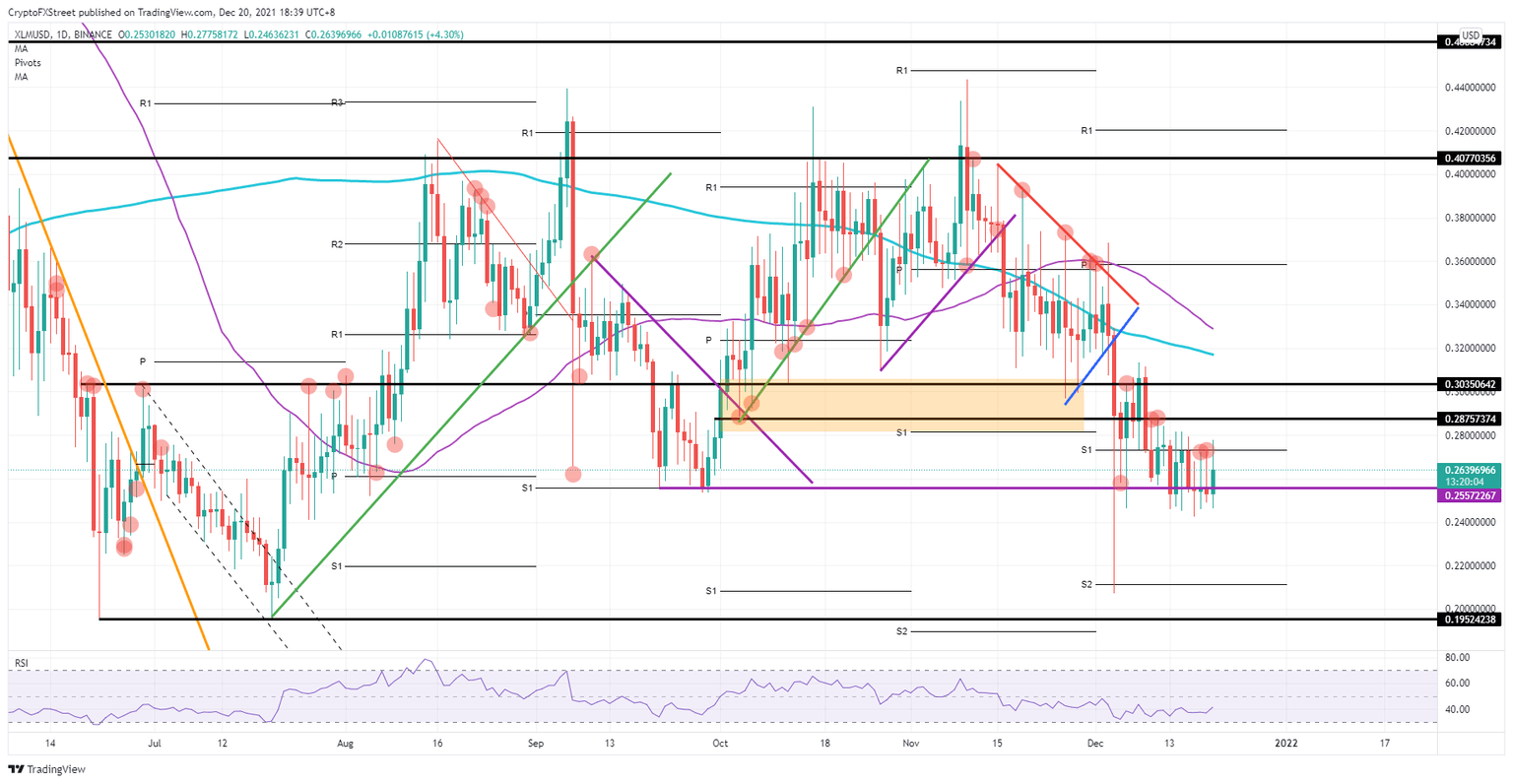

Stellar (XLM) price is stuck in a sideways pattern, with price slowly but surely fading below the S1 support level at $0.27. Bulls, for now, are a bit hamstrung by global market turmoil caused by Omicron fears. Once they have faded, however, expect bulls to kick-off a new rally that will likely break above $0.29 and $0.30, targeting $0.32 where the 200-day Simple Moving Average (SMA) is situated.

XLM bulls squeeze out bears in the preparation of a rally

XLM price action sees a bullish knee-jerk reaction this morning after bears dictated the price action over the weekend with a firm rejection of the monthly S1 support level at $0.27. Bulls were able to break above that same S1 this morning and, in the process, hit some stop losses from bears that were trying to push XLM price action to the downside. In this way, the road got paved for a bullish rally that should face less resistance in the coming trading session at around $0.29.

The only thing that keeps price action a bit muted, for now, however, is the market turmoil this morning as investors weigh in on the hard lockdowns in Europe and the Omicron variant spreading. Once that starts to fade in the coming days, expect bulls to unleash a further rally with the first hurdles at historical resistance at $0.29 and $0.30. Once bulls can charge past those points, the 200-day SMA at $0.32 could see an explosion in buying volume as this will be perceived as a strong signal, triggering further aspirations of more upside to come.

XLM/USD daily chart

Current headwinds could weigh even more on sentiment and spark a sell-off amongst investors in cryptocurrencies. This would see a retest around $0.24, targeting the monthly S2 support level at $0.21. That level comes into focus because when coupled with the falling knife price action on December 4 it describes a double bottom.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.