XLM bulls defend uptrend to push Stellar into a 20% breakout

- Stellar price sees bulls stepping in as XRP price sees an uptick.

- XLM price back towards retest of $0.40 resistance level.

- With bulls targeting $0.44, XLM price rally holds 20% of gains.

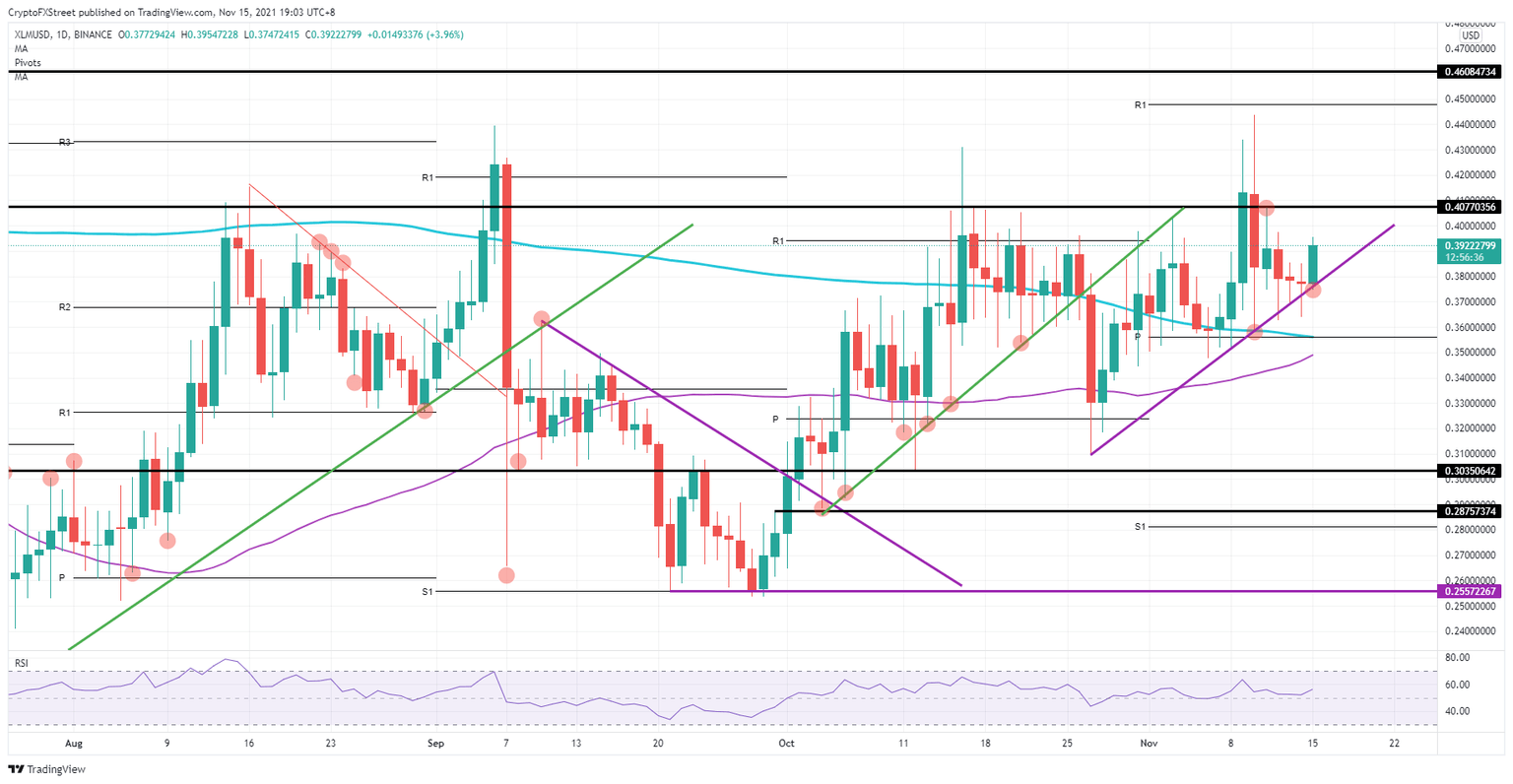

Stellar (XLM) price is experiencing a solid bounce off the purple ascending trend line that started the uptrend at the end of October. Bulls picked up XLM coins as some tailwinds are re-emerging in cryptocurrencies this Monday. Expect bulls to sit on their hands and ramp price up towards $0.40 in the first phase and follow for a retest at $0.44.

XLM price sees bulls re-embracing Stellar, gearing up for new all-time highs

Stellar price saw buy-side volume spiking higher this Monday as risk puts investors back to work. Bulls will want to first target the intermediary resistance level at $0.40, which saw the last time a clear rejection for the bulls on November 11. Expect to see the massive inflow, a quick pop above that level with a possible support test, before the next leg higher.

XLM price will, once beyond $0.40, see bulls going for a retest of $0.44. Around that level, bears started to flock in and made price action fade by almost 20%. If bulls play this right and refrain from taking too much profit, expect even a quick blip towards new all-time highs at $0.46.

XLM/USD daily chart

XLM price could see some pressure if the Relative Strength Index comes under pressure and gets into the overbought area. That would see some weaker inflow on the buy-side and see the equilibrium shift towards more sell-side volume. In that case, expect a short break of the purple trend line that will see bears eagerly getting in and running XLM price down towards $0.36 with the 200-day Simple Moving Average (SMA) and the monthly pivot for November as support.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.