XLM bulls harvest volume at $0.36 while Stellar price aims higher

- Stellar price saw bulls rejected from further upside at $0.40 historical level.

- XLM price bounced off two technical supports on the day before.

- Expect a retest of the trend line and see bulls squeezing prices higher to $0.45.

Stellar (XLM) price fluctuates a little further after the move in cryptocurrencies that rattled global markets on Wednesday. With the fade in XLM price action, bulls got a window of opportunity at around $0.36, with two technical elements supporting bulls and limiting bears in their tracks. Expect momentum to build further in favor of bullish action with a pop toward $0.45 by next week.

XLM price forms bullish signals with $0.45 as the price target

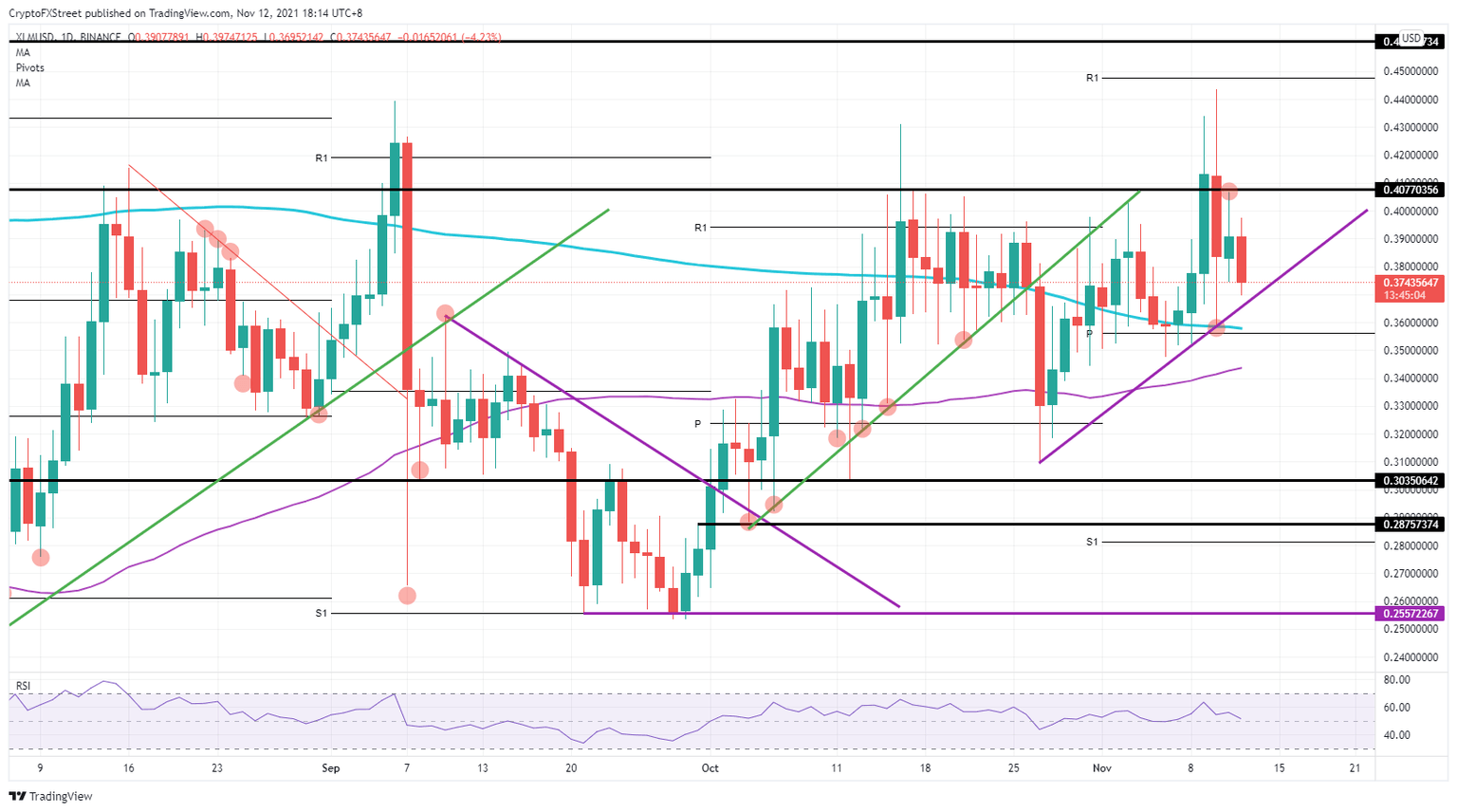

XLM price saw bulls picking up quite some volume at $0.36, with the monthly pivot providing support and the 200-day Simple Moving Average (SMA) backing it up and offering a buy-opportunity. With that, a bullish trend channel formed that should provide further support in the coming days and generate additional upside potential for Stellar price action. Expect a retest of $0.40 at first, which should easily break now after bulls regained new force in the dips at $0.36.

XLM/USD daily chart

XLM price will surely see bears retesting the purple ascending trend line, to test how strongly the conviction currently is amongst XLM bulls. Expect this purple ascending trend line to hold support and squeeze price action further upwards against $0.40 in a bullish triangle within the newly formed trend channel. Once through there, it is an open road towards the monthly R1 resistance level at $0.45. Bulls will get a little bit of help by then from the 55-day Simple Moving Average crossing the 200-day and forming a golden cross that should propel even more buy-side activity and further support bulls in their uptrend.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.